9 min read

On this page

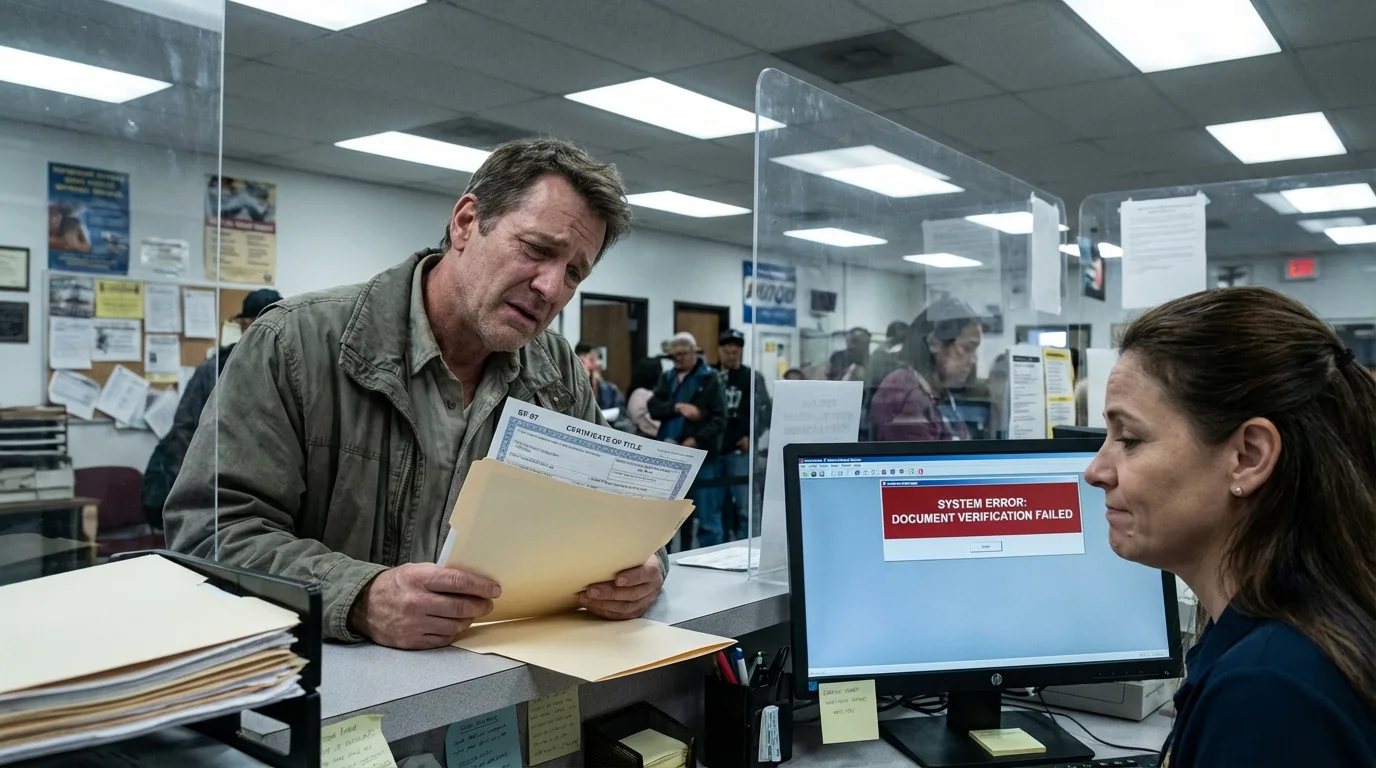

It is the moment every surplus auction winner dreads. You stand at the DMV counter, clutching your folder of documents, watching the clerk’s face turn from boredom to confusion. You’ve just spent $18,500 on an LMTV to build the ultimate overland rig. You have the bill of sale. You have the insurance binder. And you have the government form.

The clerk types the VIN. A frown. She types it again. Then she slides the paperwork back under the plexiglass.

“We can’t title this. The system says ‘Off-Road Use Only.’ Next in line.”

In that second, your asset became a liability. You are now the owner of a 15,000-pound paperweight that you cannot legally drive on public roads. This isn’t a clerical error; it is a systemic regulatory wall designed to keep military hardware off civilian highways.

WARNING: Driving a military vehicle with improper registration or “tag applied for” cardboard plates can result in immediate impoundment. In states like California and Colorado, this often leads to a mandatory court appearance and the potential destruction of the vehicle if deemed non-compliant.

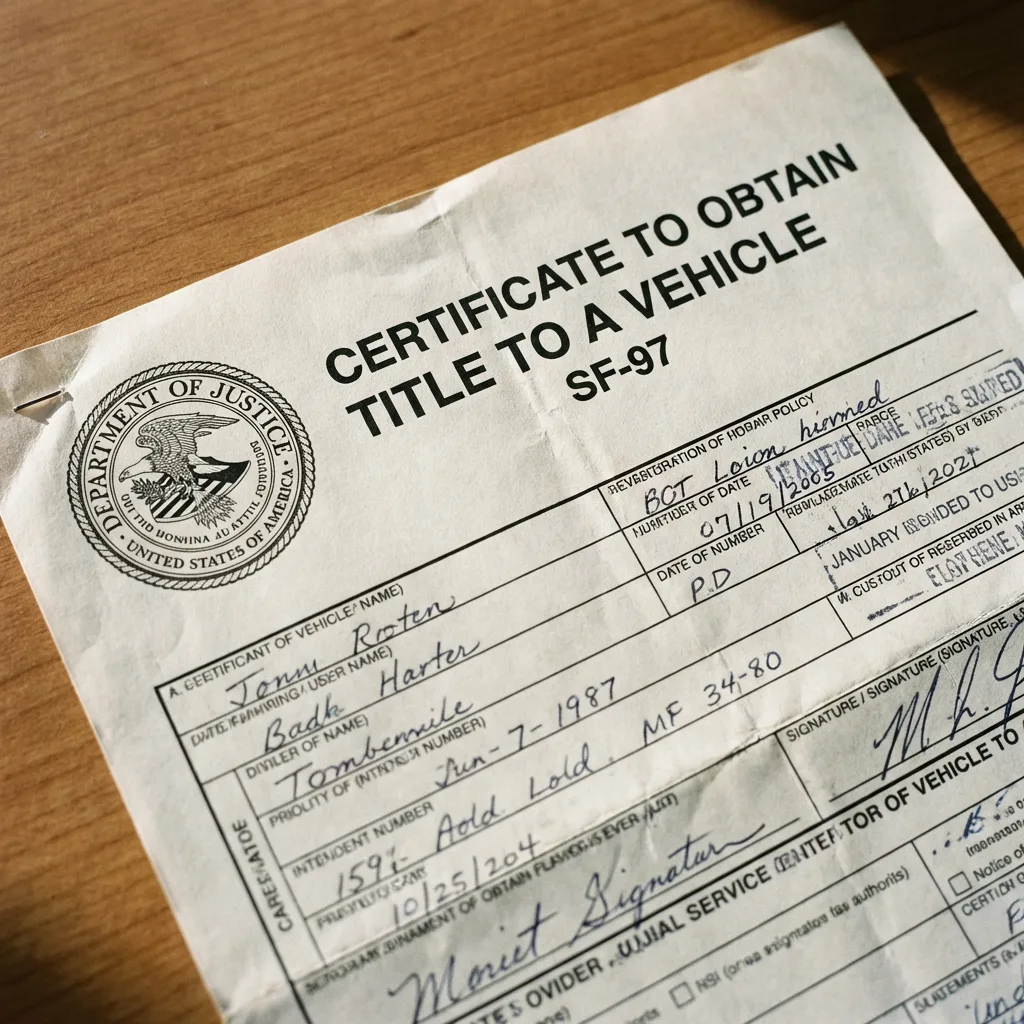

What Is The SF-97?

The Standard Form 97 (SF-97) is the “Certificate to Obtain Title to a Vehicle.” It is issued by the U.S. government (specifically agencies like the Defense Logistics Agency) to transfer ownership of a vehicle from the Department of Defense to a civilian buyer.

It is not a title.

This is the single most expensive misconception in the surplus community. The SF-97 is merely evidence of transfer. It functions similarly to a Manufacturer’s Certificate of Origin (MCO) for a new car. To drive legally, you must exchange this certificate for a state-issued title and registration.

However, unlike a Ford or Toyota MCO, the SF-97 lacks the standard 17-digit VIN and emissions compliance data that state DMV computers require. When the computer rejects the input, the clerk rejects you.

The Real Cost of The “Waiting Game”

Many buyers attempt to “wait out” the DMV or try different branches hoping for a lenient clerk. This strategy is financially ruinous. While you wait for a solution, your vehicle is racking up storage fees, insurance costs on a non-drivable asset, and potential fines if parked on the street.

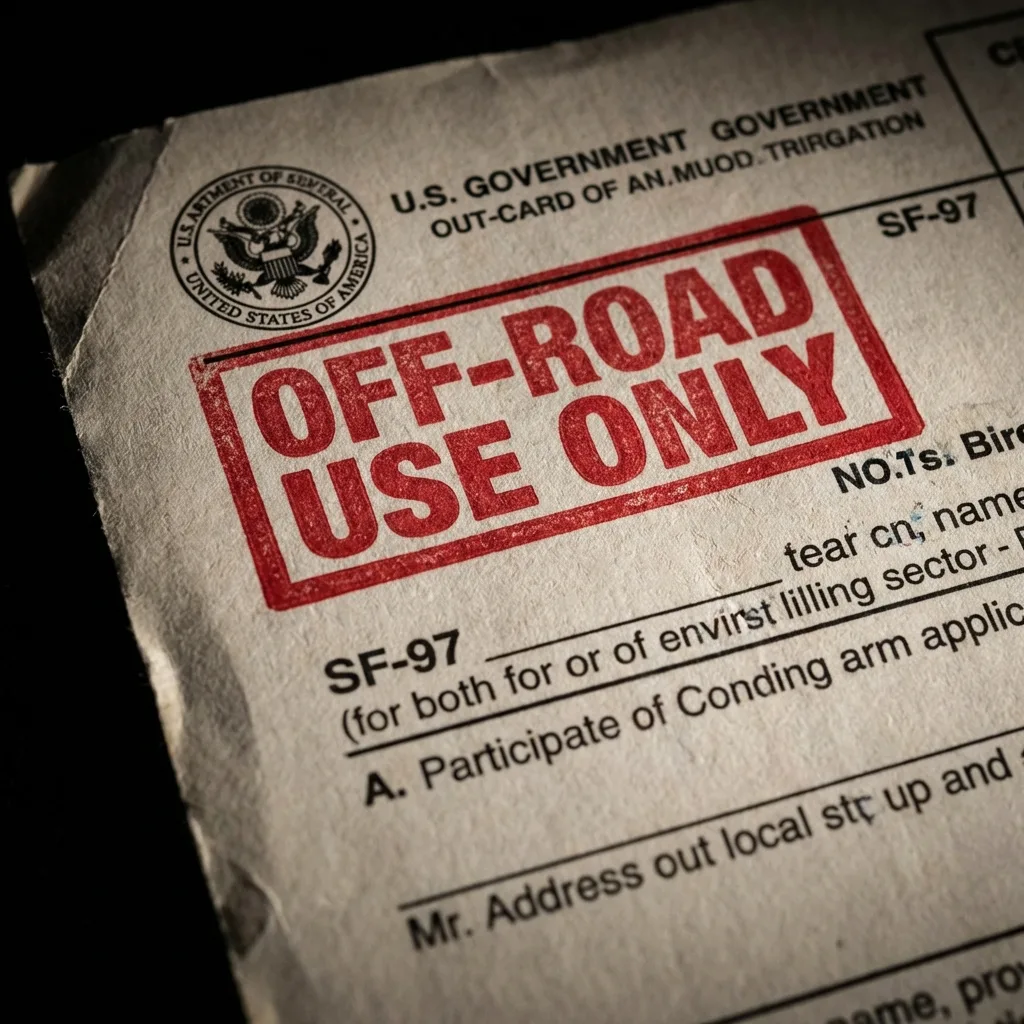

Why It Hurts: The “Off-Road” Designation

The government covers its liability by stamping many SF-97s with “OFF-ROAD USE ONLY.”

State DMVs interpret this literally. If you bring an SF-97 with this stamp to a window in New Jersey, New York, or Colorado, you are flagging your vehicle as non-highway compliant. They will issue an Off-Highway Vehicle (OHV) sticker.

This restricts you to trail use only. You cannot drive to the gas station. You cannot drive to a parade. You cannot drive to a car show. If a police officer catches you on pavement with an OHV sticker, the fines start at $500 and escalate to vehicle forfeiture.

Who Is At Risk? (Target Audiences)

This issue affects specific profiles of collectors and enthusiasts. If you fit one of these descriptions, you are in the danger zone for registration denial.

The Phoenix Off-Road Enthusiast

Vehicle: 1992 AM General M998 Humvee

Situation: You bought it on GovPlanet for rock crawling in Sedona. You need to drive it on I-17 to get to the trailheads. Arizona requires highway-legal registration for this, but the 6-digit VIN is flagging as “invalid” in the MVD system.

The Austin Military Collector

Vehicle: M923A2 5-Ton Cargo Truck

Situation: You want to use this for parades and local heavy hauling. Texas requires a specific weight inspection that the military tires and lighting systems often fail, leaving you with a massive lawn ornament.

The Denver Overlander

Vehicle: Stewart & Stevenson LMTV (M1078)

Situation: You are converting the box into a camper for cross-country travel. Colorado has recently revoked titles for military vehicles, retroactively mailing letters demanding plates be returned. You are currently building a camper on a chassis that cannot legally leave your driveway.

The Seattle Heavy Equipment Contractor

Vehicle: M35A2 “Deuce and a Half”

Situation: You purchased this for moving equipment to muddy job sites. Washington State’s emissions requirements for diesel vehicles of this vintage are nearly impossible to pass with the original multi-fuel engine.

The Montana Solution

There is a legal avenue to bypass your state’s restrictive DMV policies. It involves leveraging the specific vehicle codes of Montana, a state that does not require vehicle inspections and allows for the street-legal registration of military surplus vehicles.

You do not need to move to Montana. You need to establish a Montana Limited Liability Company (LLC).

INFO: A Montana LLC is a legal entity that has the rights of a resident. By forming this LLC, the company (a Montana resident) purchases and registers the vehicle. You, as the owner of the LLC, have the authority to drive the company vehicle anywhere in the United States.

Is This Legal?

Yes. This is a matter of jurisdiction and property law.

When you form a Montana LLC, that entity is a distinct legal person domiciled in Montana. The Constitution’s Full Faith and Credit Clause requires other states to recognize the public acts, records, and judicial proceedings of every other state. This includes vehicle registrations.

Your local state may want your tax money, but they cannot legally force a non-resident entity (your Montana LLC) to register its property in your home state, provided the vehicle is not being used for commercial transport within that state (intrastate commerce).

Who Benefits? The Tax Math

Beyond the ability to simply get a license plate, the financial incentives are massive. Most states charge sales tax on the vehicle purchase price (or book value) upon registration. Montana charges 0% sales tax.

The Process

The 0taxtags workflow is designed to eliminate the SF-97 friction points.

- Entity Formation: We file your Articles of Organization with the Montana Secretary of State. You receive a Tax ID (EIN) immediately.

- Asset Transfer: You sign the vehicle over to your LLC.

- Bureaucratic Handling: We take your SF-97, Bill of Sale, and LLC documents and physically walk them into the Montana DMV.

- Plate Issuance: Montana issues the title and permanent license plates to your LLC.

- Delivery: We overnight the plates and registration to your door.

Timeline Expectations

Attempting this yourself involves mailing documents to a black hole. Using a specialized service creates a predictable timeline.

- Self-Filing in Home State: 3–9 Months (High risk of rejection)

- 0taxtags Montana Process: 2–4 Weeks (depending on current DMV volume)

SUCCESS: Once registered in Montana, many military vehicles qualify for Permanent Registration. You pay once, and you never have to renew the tags again as long as you own the LLC.

When is This NOT a Good Fit?

We are in the business of solutions, not false promises. The Montana LLC route is not for everyone.

If you are a California resident intending to use a Humvee as your daily commuter to an office in downtown Los Angeles, you will attract attention. The California Highway Patrol (CHP) has a dedicated “CHEATERS” program targeting out-of-state plates on resident vehicles. While the LLC structure is legal, the hassle of roadside stops may not be worth it for a daily driver. This solution is best for secondary vehicles, collectors, overlanders, and heavy equipment.

Frequently Asked Questions

Do I need a CDL to drive a 5-ton truck?

Generally, no. If the vehicle is registered as a private vehicle (not commercial) and is used for personal use (like an RV or collector item), a standard driver’s license usually suffices, provided the vehicle is under 26,000 lbs GVWR or equipped with air brakes (check your local endorsements). Montana registration helps clarify the “private use” status.

Does Montana require a vehicle inspection?

No. Montana does not require emissions testing or safety inspections for registration. This is critical for military diesels that lack modern emissions equipment.

Can I insure a vehicle owned by an LLC?

Yes. Major specialty insurers (Hagerty, Progressive Commercial, etc.) write policies for LLC-owned vehicles every day. You simply list the LLC as the “Named Insured” and yourself as the “Driver.”

Final CTA

The SF-97 is not a permission slip; it is a barrier to entry. The government has sold you a vehicle that your local DMV does not want on the road.

You have two choices:

- Fight a losing battle with local bureaucrats, risking impound fees and months of delay.

- Leverage the Montana legal code to secure a title, license plates, and permanent registration within weeks.

Your military vehicle was built to conquer any terrain. Don’t let a piece of paper stop it.

Ready to Get Your SF-97 Titled Legally?

Military vehicle owners across the country trust Zero Tax Tags for fast, legal Montana LLC registration. Your SF-97 is waiting to become a real title.