15 min read

On this page

- + The Hangover After the Handshake

- + Dissecting the Colorado Tax Scheme

- • The Sales Tax Avalanche

- • The Killer: Specific Ownership Tax

- + The Opportunity Cost of Compliance

- + The Solution: Montana LLC

- + Real World Scenarios

- + Privacy and Asset Protection

- + The “Is it Legal?” Question

- + The ZeroTaxTags Advantage

- + FAQs (Colorado Edition)

Colorado specific ownership tax isn’t just a registration fee. It’s an annual wealth tax on your assets. Here is why Denver’s high-net-worth professionals are moving their vehicle equity to Montana.

Part I: Understanding Colorado Specific Ownership Tax

You know the feeling. You’ve just closed a massive quarter. Maybe your equity vested, maybe the sale of that commercial property in LoDo finally cleared, or perhaps your dental practice had its best year yet.

You decide to reward yourself. Not with a weekend in Vegas, but with a tangible asset. Something German with twin turbos, or perhaps something American with enough towing capacity to haul a skid steer to your next job site.

You walk into the dealership off Arapahoe Road or in Cherry Creek. You negotiate the hard numbers. You agree on a price—let’s say $125,000 for a well-spec’d Range Rover or a high-performance Porsche. You sign the papers. You drive off the lot. The leather smells new; the engine hums with potential. You feel like you’ve won.

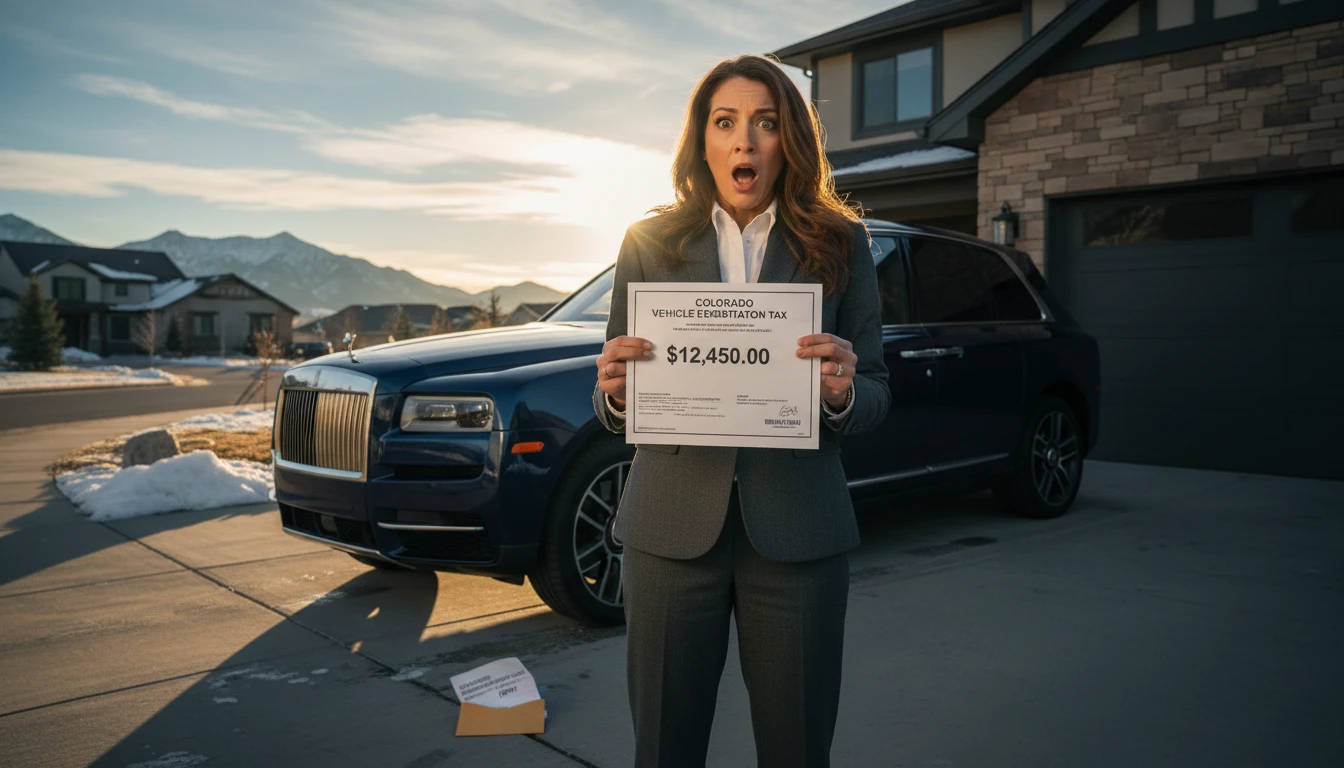

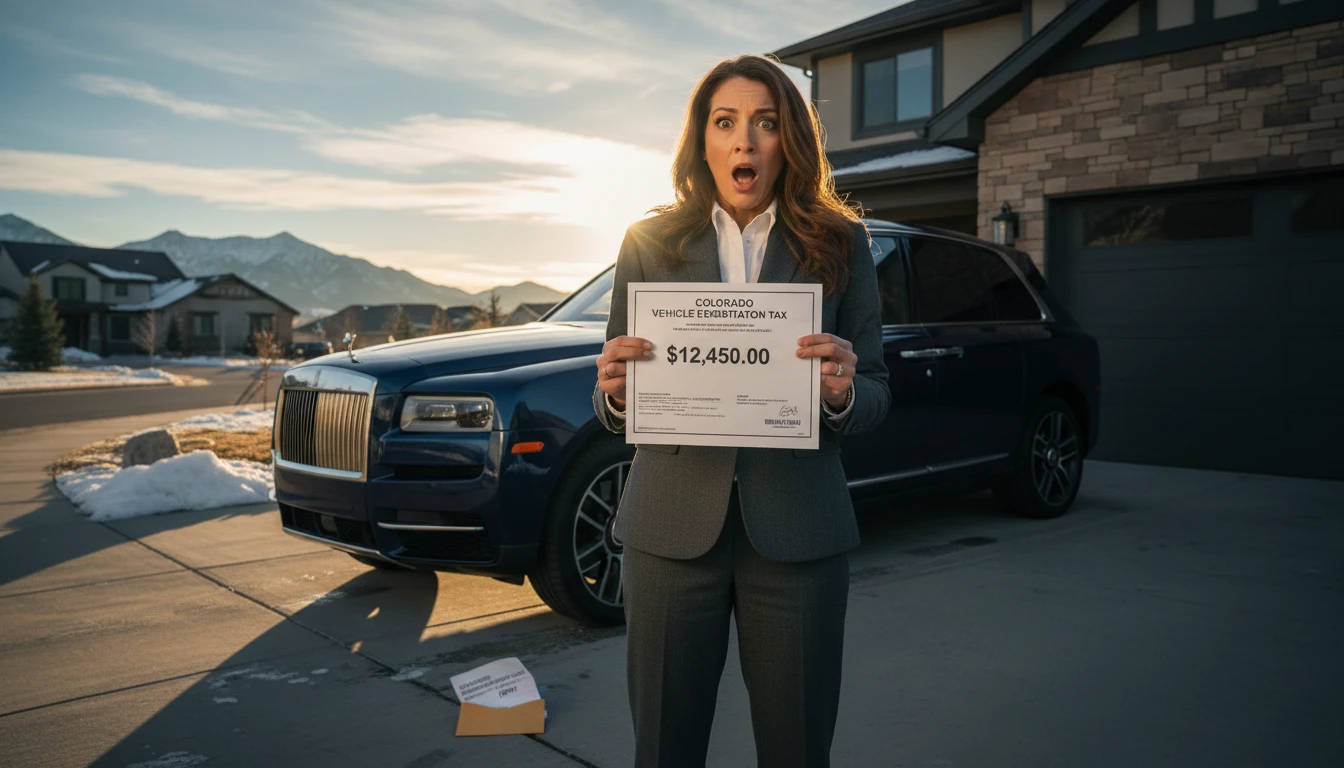

Then, the letter comes.

It’s the Colorado specific ownership tax bill from the Colorado DMV.

You open it, expecting a standard administrative fee. Maybe $200? $500?

Instead, you see a number that looks like a mortgage payment. Or two.

$3,800.

$4,200.And that’s just for this year.

Welcome to Colorado’s best-kept secret for draining the bank accounts of its successful residents: The Specific Ownership Tax (SOT).

If you live in Colorado and drive a vehicle worth more than a used Honda Civic, you aren’t just paying for plates. You are paying a personal property tax—an annual wealth tax—solely for the privilege of parking a car you already bought in your own garage.

Most people just sigh, write the check, and complain to their spouse. They treat it as a “cost of living” in a beautiful state.

But you aren’t “most people.” You understand ROI. You understand compound interest. You understand that bleeding thousands of dollars a year in regulatory friction is the enemy of wealth preservation.

There is a way out. It doesn’t involve moving to Wyoming. It doesn’t involve fraud. It involves leverage.

It’s time to talk about the Montana LLC.

Part II: Dissecting the Colorado Tax Scheme (It’s Worse Than You Think)

To understand why the Montana solution is necessary, you have to understand the mechanics of how Colorado extracts money from you. It is a two-pronged attack designed to penalize asset ownership.

1. The Sales Tax Avalanche

Colorado has a deceptively low “state” sales tax rate of 2.9%. If you just looked at that number, you’d think you were getting a deal.

But nobody pays 2.9%.

Colorado is a “Home Rule” state. That means every municipality, county, and special district piles on their own cut.

On a $120,000 vehicle, an 8.81% sales tax is $10,572. That is ten grand vanished the moment the ink dries. That money buys you nothing. It adds no value to the car. It is pure loss—capital that can no longer work for you.

2. The Killer: Specific Ownership Tax (SOT)

This is where Colorado truly differentiates itself as a predator of high-net-worth individuals.

In most states, registration is a flat fee based on weight. A 5,000-lb truck pays a little more than a 3,000-lb sedan. It covers the cost of printing the aluminum plate and paying the DMV clerk.

In Colorado, registration is based on the taxable value of the car.

They calculate the “Taxable Value” as 85% of the MSRP. Then, they apply a tax rating based on the age of the vehicle.

Let’s run the math on that $120,000 vehicle.

Taxable Value: $102,000 (85% of MSRP).

And remember, that is in addition to the $10,572 sales tax you paid upfront.

Total Government “Friction” Cost over 4 years: $16,386.

You are paying over 13% of the vehicle’s value in taxes and fees within the first 48 months of ownership.

If your financial advisor charged you 13% to manage your portfolio, you would fire them immediately and report them to the SEC. Yet, when the state does it, you pull out your checkbook.

Why?

Part III: Beyond Taxes — The Opportunity Cost of Compliance

We need to reframe how you look at vehicles.

For a tech worker in Boulder with RSUs (Restricted Stock Units) or a real estate developer in Fort Collins, cash flow is everything. Every dollar allocated to a sinking cost (taxes) is a dollar that cannot be allocated to an appreciating asset (market equities, property improvements, business expansion).

Let’s look at the “Scenario of Compliance.”

You buy a luxury SUV for the family. You pay the $16,386 in total taxes over four years. That money is gone.

Now, let’s look at the “Scenario of Strategy.”

You use a tax-neutral structure (Montana LLC) to eliminate the sales tax and reduce the registration to a nominal flat fee. You save roughly $15,000 of that $16,386.

If you took that $15,000 and invested it in an S&P 500 index fund (averaging 8% returns) or put it as a down payment on a rental property, what is that worth in 20 years?

At 8% interest, that $15,000 grows to over $70,000.

By paying Colorado’s exorbitant vehicle taxes, you aren’t just losing the face value of the tax. You are losing the future wealth potential of that capital.

When you operate multiple vehicles—a daily driver, a spouse’s car, a business truck—the numbers multiply. A two-car household with high-end vehicles could be bleeding $150,000+ in lost future wealth every decade simply by registering cars in Denver County.

This isn’t about “getting away” with something. It is about stopping a leak in your financial ship.

Part IV: The Solution — The Montana LLC

You’ve seen the license plates. You’ve seen them on McLarens in Aspen, on G-Wagons in Cherry Creek, and on heavy-duty Ford King Ranches at construction sites in Loveland.

The Montana Plate.

Why are they everywhere? Is everyone moving to Big Sky Country? No. They are utilizing a legal, established vehicle ownership structure to protect their assets.

Here is the mechanics of how it works:

- The Formation: You don’t register the car in your name. You form a Limited Liability Company (LLC) in Montana.

- The Transaction: Your Montana LLC buys the vehicle. The title is made out to “Granite Peak Holdings LLC” (or whatever you name it), not “John Smith.”

- The Law: Montana has 0% Sales Tax. Montana has no “Specific Ownership Tax” based on value for light vehicles. They charge a flat registration fee.

- The Result: You pay a few hundred dollars to register a $200,000 car. You renew it annually for a flat fee (often under $150 depending on age/weight).

Because the LLC is a resident of Montana, and the vehicle is owned by the LLC, it is legally registered in Montana.

Why Montana?

Montana has created a cottage industry around this. They consciously decided not to punish vehicle ownership. They want your registration fees, and in exchange, they don’t ask for a percentage of the car’s value. It is a transactional relationship, not a predatory one.

Part V: Real World Scenarios — Who is This For?

This solution isn’t for the struggling student with a 2015 Camry. This is a tool for those building and preserving wealth. Let’s look at three specific avatars based on our actual client base in Colorado.

1. The Boulder Tech Executive (“Miles”)

Profile: Miles is a Senior Director at a SaaS company. He lives in Boulder. He just had a liquidity event and wants to buy his dream car: a Porsche 911 Turbo S.

MSRP: $230,000.

The Colorado Route (The Pain):

- Sales Tax (Approx 9%): $20,700.

- SOT Year 1: ~$4,100.

- SOT Year 2: ~$2,900.

- Total 2-Year Burn: $27,700.

The Montana Route (The Win):

- LLC Setup: Small one-time fee.

- Montana Registration: ~$800 (Luxury surcharge included).

- Sales Tax: $0.

- Total 2-Year Cost: ~$1,500.

Savings: $26,200.

Miles takes that $26k and puts it into his brokerage account. He has effectively received a 10% discount on the Porsche just by changing the paperwork.

2. The Denver Business Owner (“Sarah”)

Profile: Sarah owns a boutique consulting firm. She buys a new BMW 750i annually for client meetings and professional positioning.

MSRP: $110,000.

The Colorado Problem:

Sarah is constantly fighting margin compression. Salaries cost more; office overhead is expensive. Writing a check for $9,700 in sales tax plus $2,300 in Year 1 SOT hurts her cash flow. That’s over $12k she could use for payroll or marketing.

The Montana Solution:

She registers the car under a Montana LLC. She saves the initial $12,000+ immediately. Furthermore, since she trades vehicles in annually, she avoids being caught in the depreciation spiral of Colorado’s SOT schedule every single time. Over a decade of business, she saves nearly $80,000 in taxes. That is the cost of a full-time employee’s salary package.

3. The Multi-State Wealth Builder (“The Greenwoods”)

Profile: The Greenwoods live in Texas but own a luxury condo in Aspen and spend summers in Boulder. They keep vehicles in Colorado year-round.

Vehicles: A Tesla Model S Plaid ($120,000) and a Range Rover Sport ($110,000).

The Colorado Problem:

Because the cars are garaged in Colorado, the state wants them registered there. But paying SOT on cars that are driven 6-8 weeks a year feels like theft. The Colorado Department of Revenue is extracting $4,000+ annually from vehicles used intermittently.

The Montana Solution:

The Montana LLC is perfect for vacation/secondary vehicles. The LLC owns the cars. The cars live in Colorado. The Greenwoods pay zero sales tax and negligible registration fees. Over the 10-year ownership span of these vehicles, they save nearly $40,000 in SOT alone. That capital is reinvested into acquisitions or investment portfolios.

Part VI: Beyond Taxes — Privacy and Asset Protection

There is another reason the wealthy use Montana LLCs, and it has nothing to do with saving money. It has to do with anonymity and legal separation.

We live in a litigious society. If you are a high-net-worth individual—a doctor, a CEO, a business owner—you are a target.

When you drive a car registered in your personal name, anyone with a specialized database (or a friend in the right department) can run your plate and find your home address.

In an era of road rage and targeted lawsuits, this is a vulnerability.

When you register your vehicle to a Montana LLC:

- The Plate Scan: The license plate returns to “Summit Alpha Logistics LLC” (or your chosen name).

- The Address: The address on file is a registered agent in Montana, not your driveway in Cherry Hills Village.

- The Barrier: If someone wants to sue you because of a minor fender bender, they have to sue the LLC. This creates a legal layer of separation between your personal assets (your home, your savings) and the liability of the vehicle.

For many of our clients, the tax savings are just a bonus. The peace of mind of not having their personal name attached to their license plate is the real product.

Part VII: The “But is it Legal?” Question

This relies on the “Supremacy Clause” and the recognition of corporate personhood.

An LLC is a legal entity. It has the right to own property. It has the right to be domiciled in the state of its formation. A Montana LLC resides in Montana. Therefore, its property (the car) is registered in Montana.

However, we must address the Elephant in the Room: Colorado Residency.

Colorado law states that if you (the human) are a resident, you must register your vehicles here. They have cracked down on this in the past.

However, this is where the nuance of the LLC comes in. You are not registering the car. The LLC is.

The Golden Rules of Montana Tags in Colorado:

- Don’t be flashy with the law. If you get pulled over, you are driving a company car owned by a Montana entity.

- The Second Home Advantage: This strategy is ironclad for vehicles kept at vacation properties or for people with split residency.

- The Business Use: If the vehicle is used for business, the argument for an out-of-state LLC holding company becomes much stronger.

Disclaimer: We are not tax attorneys. ZeroTaxTags.com provides the service of forming the LLC and processing the registration. You must evaluate your own risk tolerance regarding local ordinances.

But ask yourself this: Why do thousands of exotic cars in Denver bear Montana plates? Because for many, the risk of a “fix-it ticket” or a conversation with a code enforcement officer is statistically far cheaper than the 100% guaranteed loss of $15,000 in taxes.

It is a calculated risk. And wealth is built on calculated risks.

Part VIII: The ZeroTaxTags Advantage

You can try to do this yourself. You can try to navigate the Montana Secretary of State’s website, find a registered agent, fill out the title applications, calculate the GVW fees, and mail checks into the void.

Or, you can let us handle the bureaucracy while you focus on your business.

At ZeroTaxTags.com, we specialize in this specific transaction. We aren’t a general legal zoom clone. We do Montana vehicle LLCs. That’s it.

What we do for you:

- 24-Hour LLC Setup: We form your Montana company immediately.

- DMV Handling: We stand in line (figuratively) so you don’t have to. We process the title work, the plating, and the registration.

- Privacy: We act as your registered agent. Our address is on the paperwork, not yours.

- Renewal Management: When next year rolls around, we handle the renewal. No more SOT shock. Just a small flat fee.

Your time is worth hundreds of dollars an hour. Do not waste it fighting DMV forms.

Our Process Timeline

| Day 1: | You contact us. We form your Montana LLC within 24 hours. |

| Day 2-3: | You purchase the vehicle in the LLC’s name (or transfer title). |

| Day 4-7: | We process title and registration with Montana DMV. |

| Day 8-10: | Montana plates arrive at your door. Drive legally. |

Part IX: Frequently Asked Questions (Colorado Edition)

Q: Do I need a Montana Driver’s License?

A: No. You keep your Colorado license. You are simply driving a vehicle owned by a Montana company. It is no different than renting a car from Hertz (which has out-of-state plates) or driving a company truck owned by a multi-national corporation.

Q: How do I insure it?

A: This is critical. You must tell your insurance carrier the truth. You tell them the vehicle is owned by an LLC, registered in Montana, but garaged in Colorado (at your zip code). Most major carriers (Progressive, Geico, State Farm, Hagerty) can write a policy for this. Do not lie about where the car sleeps—that is insurance fraud. As long as they know the garaging address, they will write the policy. It creates a robust paper trail.

Q: Does this work for leased vehicles?

A: Generally, no. Leasing companies (BMW Financial, etc.) own the title, not you. They will not release the title to a Montana LLC. This strategy is for cash buyers or those financing through banks that allow retitling to an LLC (many credit unions and commercial lenders do this).

Q: What about emissions testing?

A: Montana does not have emissions testing. However, if you live in the Denver Metro/Northern Front Range ozone non-attainment area, you are technically subject to air quality standards. The benefit? You don’t have to go through the hassle of the state testing centers to get your tags renewal. You bypass the administrative hurdle.

Q: Can I put my existing car into the LLC?

A: Yes. If you already own a car in Colorado and are tired of the annual SOT renewal, you can sell it to your Montana LLC. You will pay a title transfer fee in Montana (cheap), and your annual renewals will drop from thousands to pennies. Note: You already paid the sales tax, so you won’t get that back, but you will stop the annual SOT bleeding.

Q: Is this just for “Supercars”?

A: No. While we do many Ferraris and Lamborghinis, our volume comes from $70k – $100k pickup trucks, Suburbans, and Teslas. The “SOT” hits middle-class luxury just as hard as it hits the ultra-wealthy. If your SOT bill is over $500/year, this service pays for itself.

Conclusion: Escape Colorado Specific Ownership Tax

Colorado specific ownership tax is fundamentally flawed. You worked for the money. You paid income tax on the money. You bought the asset.

Why should you have to pay the state a percentage of that asset’s value every single year just to possess it?

It creates a drag on your net worth. It penalizes you for buying newer, safer, more reliable vehicles. It punishes success.

In Colorado, you have two choices:

- The Default Path: Accept the SOT as a fact of life. Complain about it. Pay the $5,000, $10,000, or $20,000 over the life of the car. Watch that money vanish into the general fund.

- The Strategic Path: Leverage the laws of the United States. Open a Montana LLC. Keep your capital. Invest it in your family, your business, or your portfolio.

The wealthy don’t get wealthy by writing unnecessary checks to the government. They get wealthy by optimizing every line item on their balance sheet.

Your vehicle plays a massive role in that balance sheet. Optimize it.

Ready to stop the bleeding?

Click here to start your Montana LLC with ZeroTaxTags.com today.

Don’t let another registration renewal season steal your hard-earned equity. Take control of your assets.

(Note: ZeroTaxTags.com services are for vehicle registration and LLC formation purposes. We recommend consulting with a tax professional regarding your specific financial situation.)