14 min read

On this page

- + I. Understanding Arkansas Vehicle Tax: The Deceptive “Low Fee” Trap

- + II. The May 31 Assessment Deadline Minefield

- + III. Dual Taxation System

- + IV. The Weight Reclassification Scam

- + V. The Montana LLC Solution

- + VI. Cost Comparison: Arkansas vs. Montana

- + VII. Legal Considerations

- + VIII. FAQ: Arkansas Data & Deadlines

- + IX. Real-World Case Studies

- + X. Exit the Arkansas Assessment Trap

Arkansas vehicle tax is a trap designed to look cheap while bleeding you dry. If you define “low cost” by looking solely at a $25 annual renewal sticker, Arkansas seems like a paradise. This is exactly what the Department of Finance and Administration (DFA) wants you to think. It is a calculated optical illusion designed to distract high-net-worth individuals from the reality: Arkansas runs one of the most aggressive, bureaucratic, and mathematically punishing vehicle taxation schemes in the mid-South.

For the enthusiast buying a Porsche GT3, the contractor purchasing a fleet of heavy-duty trucks, or the luxury SUV owner, Arkansas is a fiscal trap. The state utilizes a dual-system of taxation—upfront sales tax combined with a recurring, unavoidable personal property tax assessment—that bleeds equity from your assets year after year.

Here is the breakdown of how Arkansas penalizes vehicle ownership, and why the smart money never plates their assets in Little Rock.

I. Understanding Arkansas Vehicle Tax: The Deceptive “Low Fee” Trap

The greatest trick Arkansas lawmakers ever pulled was convincing residents that vehicle registration costs “peanuts.”

If you look at the official DFA fee schedule, the numbers look innocuous. A standard passenger vehicle between 3,001 and 4,500 lbs costs roughly $25.00 to renew. A heavier vehicle is slightly more. They even tack on a mandatory $2.50 decal fee, just to squeeze a few more pennies out of the transaction.

But focusing on the $25 fee is financial suicide. It is the bait.

The trap is the 6.5% Sales Tax levied on the gross purchase price of any vehicle over $4,000. Unlike states that cap sales tax on vehicles or offer flat-rate structures, Arkansas demands a percentage of the total value at the time of registration.

The Math of the Trap

Let’s run the numbers on a 2025 Cadillac Escalade V-Series, with a sticker price of roughly $155,000.

When you walk into the DMV (or “Revenue Office” as they euphemistically call it), you aren’t paying $40. You are writing a check for over ten thousand dollars.

Compare this to a Montana LLC:

Montana Sales Tax: $0

Montana Personal Property Tax: $0By registering that single Escalade in Arkansas, you have voluntarily incinerated over $10,000 in capital that offers zero return on investment.

The deceptive “low annual fee” is nothing more than a rounding error compared to the sales tax acquisition cost the state forces you to pay to get that license plate.

II. The May 31 Assessment Deadline Minefield – The 10% Penalty

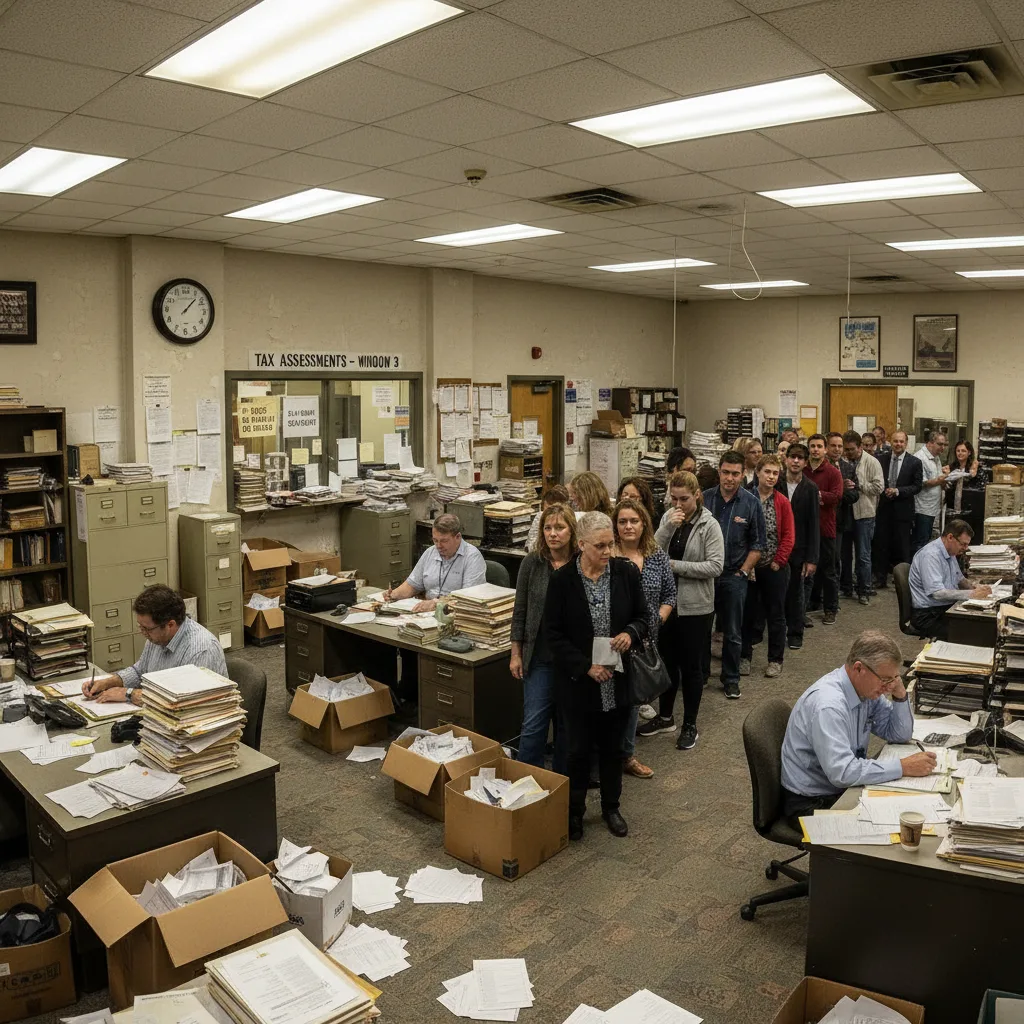

Arkansas operates on a draconian “assess or pay” model that treats vehicle owners less like customers and more like suspects. Before you can even renew that cheap $25 tag, you must prove you have “assessed” your personal property with the county.

This is where the bureaucracy weaponizes the calendar.

According to the DFA, every individual must report their personal property to the county assessor between January 1 and May 31 of every year.

The Penalty Mechanism

If you are busy running a business, traveling, or simply forget to file this paperwork by May 31, the state automatically applies a 10% penalty to your upcoming tax bill.

- This is not a 10% penalty on the registration fee.

- This is a 10% penalty on the assessed tax liability of the vehicle.

If your annual property tax bill on a luxury fleet is $3,000, missing that arbitrary May 31 date costs you an instant $300 penalty. There is no grace period for “I didn’t know.”

The New Resident Trap

The trap is even sharper for new residents. If you move to Arkansas or buy a new vehicle, you generally have a roughly 30-day window to assess the vehicle without penalty. However, because the tax is collected in arrears, the paperwork confusion leads thousands of owners to miss the deadline, triggering the 10% penalty immediately upon entry into the system.

The state explicitly warns that “All personal property should be reported to the county assessor every year… to avoid a late assessment penalty of 10%.”

They are banking on your non-compliance. It is a revenue stream built on administrative friction.

III. Dual Taxation System – Registration Fees + Annual Personal Property Tax

In civilized jurisdictions, you pay a registration fee to cover the administrative cost of the license plate and road maintenance. In Arkansas, you pay “rent” to the government for the privilege of keeping your own property in your own garage.

Arkansas forces you into an Ad Valorem tax system. This means your tax is based on the value of the vehicle, not its usage.

The “Arrears” Nightmare

Arkansas collects personal property taxes one year in arrears.

- Taxes assessed in 2024 are billed and paid in 2025.

- The Trap: If you assess your McLaren in May 2024 and sell it in June 2024, you still owe the taxes for 2024, which you won’t even receive a bill for until 2025.

This creates a “zombie debt” that follows you. We regularly see clients who move out of Arkansas or sell their cars, only to legally owe thousands of dollars a year later for a vehicle they no longer own or a state they no longer live in.

The Cost of Ownership Calculation

Let’s look at the 5-year ownership cost of an $80,000 Ford F-250 Platinum, assuming a conservative 60% residual value retention and an average county millage rate (approx 1% effective tax rate per year).

Total 5-Year Cost via Montana LLC:

Sales Tax: $0

Property Tax: $0

LLC Setup + Annual Fees: ~$1,500 – $2,000Net Savings: Over $6,000 simply by changing the jurisdiction.

Under Arkansas law, your vehicle is valued at the “usual selling price… at the time of listing.” This means as long as the market stays high, your taxes stay high.

IV. The Weight Reclassification Scam – How Trucks Cost More

Arkansas claims to have a simple registration system, but they penalize capability. The state uses a tiered weight system that ensures heavy-duty vehicle owners—often business owners and farmers—pay the highest premiums.

According to the DFA fee schedule, the “Class” system is broken down by unladen weight:

The “Luxury Truck” Strategy

While a $20 difference in registration fees seems negligent, it signals the intent of the state. If you drive a modern 3/4 ton or 1-ton pickup truck (F-250, Ram 2500, Chevy 2500), your curb weight is well over 6,000 lbs. You are forced into higher brackets.

Furthermore, these vehicles are the primary targets for the Personal Property Tax. Because trucks and large SUVs retain value better than luxury sedans, the “market value” assessment stays higher for longer.

A 5-year-old BMW 7-series depreciates like a rock, lowering your tax bill. A 5-year-old diesel truck barely depreciates, meaning the Arkansas assessor keeps hammering you with maximum tax rates year after year.

They punish you for buying assets that hold value.

V. The Montana LLC Solution: Escape the Arkansas Assessment Hell

You are currently trapped in a system designed to penalize you for owning assets. The Arkansas vehicle tax system treats your high-end vehicle not as personal property, but as a recurring revenue stream for the state. They hit you with a massive sales tax upfront (up to 9-10% with local levies), and then the county assessor bleeds you annually with personal property taxes based on a value they determine.

The Exit Strategy: The Montana Limited Liability Company (LLC).

Montana has established itself as the premier tax haven for vehicle owners across the United States. Unlike Arkansas, Montana operates on a philosophy of flat fees and zero taxes on vehicle value.

By forming a Montana LLC, you create a separate legal entity that resides in a tax-free jurisdiction. Your vehicle is sold to and owned by this LLC. Since the LLC is a Montana resident, the vehicle is titled and registered in Montana. You, as the driver and LLC member, maintain control and use of the vehicle, but you sever the tax link to the Arkansas Department of Finance and Administration (DFA).

The Montana Advantage Structure:

- 0% Sales Tax: Buy a $100,000 car in Arkansas? You pay ~$9,000 in sales tax. Buy it through your Montana LLC? You pay $0.

- No Personal Property Tax: Arkansas assessors demand roughly 1% of your vehicle’s market value every single year. Montana demands $0.

- Permanent Registration: For vehicles 11 years or older, Montana offers permanent registration, meaning you pay once and never renew again. Arkansas forces you to assess and renew annually until the car is scrapped.

- Privacy: Montana allows for a layer of anonymity. Your name isn’t on the public registration database; your LLC’s name is.

VI. Cost Comparison: Arkansas Personal vs. Montana LLC

Let’s run the numbers. The data exposes just how much equity Arkansas strips from you over ownership cycles.

Scenario A: The High-Trim Truck

Vehicle: 2024 Ford F-250 Platinum

Sticker Price: $90,000

Location: Pulaski County, AR (Combined Sales Tax ~9%)

Total Savings: $10,750 — That is a 740% ROI on your registration setup.

Scenario B: The Family Fleet (3 Vehicles)

Vehicles: 2024 Porsche Macan ($75k), 2023 GMC Sierra 1500 ($65k), 2020 BMW X5 ($50k)

Total Value: $190,000

- Arkansas 5-Year Burden: Approx. $17,100 in sales tax (if bought new) plus roughly $8,000 in personal property taxes. Total bleed: ~$25,000+

- Montana LLC 5-Year Cost: Setup fees for the LLC and registrations for three vehicles: ~$3,500

Total Wealth Preserved: $21,500+

The math is undeniable. Staying in the Arkansas system is a voluntary donation of five figures to the state government.

VII. Legal Considerations for Arkansas Residents

The state of Arkansas relies on fear and ambiguity to keep residents paying into the system. Here is the reality of the legal landscape.

Residency vs. Ownership

Arkansas law requires “residents” to register their vehicles within 30 days. However, the Montana LLC is not an Arkansas resident. It is a Montana entity. The vehicle is owned by the LLC, not you personally. You are driving a company car owned by an out-of-state company. This is a common practice for businesses; you are simply structuring your personal assets like a business.

Insurance: The “Garaging” Rule

Here is where you must be absolutely transparent. Do not lie to your insurance provider.

- The Policy: Insure the vehicle in the name of the Montana LLC.

- The Location: Tell the insurer explicitly that the vehicle is garaged in Arkansas.

- The Result: Your premium is based on Arkansas risk (Little Rock traffic, local hail storms, etc.), which is legal and accurate. If you tell them it’s garaged in Montana to get lower rates, that is insurance fraud. Do not do it.

The “Arrears” Reality

Arkansas property taxes are paid in “arrears” (you pay this year for what you owned last year).

- The Transition: When you move a car to a Montana LLC, you will still owe Arkansas tax for the months you personally owned it in the previous year. You cannot escape the taxes you already accrued.

- The Future: Once the title transfers to the LLC, the assessment clock stops. You stop accruing new taxes immediately.

VIII. FAQ: Arkansas Data & Deadlines

Q: I missed the May 31 Assessment Deadline in Arkansas. Now what?

A: You are now subject to a mandatory 10% penalty on your personal property taxes. The local assessor offers no grace period. Montana has no assessment deadline because they don’t assess value.

Q: Will Arkansas police pull me over for Montana plates?

A: Out-of-state plates are ubiquitous in Arkansas. Unless you are committing a moving violation, police generally do not pull vehicles over solely for license plates. You are driving a vehicle legally registered to a US corporation.

Q: Can I register my heavy duty truck (over 1 ton) in Montana?

A: Yes, and you should. Arkansas charges significantly higher registration fees based on Gross Vehicle Weight Rating (GVWR) for heavy trucks. Montana fees are flat and significantly cheaper for commercial-grade vehicles.

Q: Does Montana require a vehicle inspection?

A: No. Arkansas generally doesn’t either, but Montana guarantees no emissions testing or safety inspections, even if you are in a county in Arkansas that might implement stricter rules in the future.

Q: What if I have a loan on my car?

A: This is the only hurdle. Most lenders will not allow you to title the vehicle to an LLC while they hold the lien. You generally need to pay off the vehicle or refinance with a lender who accepts commercial/LLC titles to make the switch.

Q: Is the Montana plate permanent?

A: If your vehicle is 11 years or older, yes. Montana Code allows for permanent registration for older vehicles. You pay the fee once, and you never talk to the DMV again.

IX. Real-World Case Studies

1. The Little Rock Surgeon

Profile: Dr. S lives in Chenal Valley. He buys a new Range Rover Autobiography every 3 years ($160,000).

Arkansas Trap: He was paying ~$15,000 in sales tax every 3 years, plus $2,400/year in property taxes.

Montana Solution: Dr. S established a Montana LLC. He now buys the vehicle tax-free. He saves $22,000 per vehicle cycle. He uses those savings to lease a winter condo in Aspen.

2. The Jonesboro Contractor

Profile: Runs a construction firm, personally owns a Ford F-450 Limited for towing his fifth-wheel.

Arkansas Trap: Arkansas categorized his truck by weight, charging high commercial-style fees, and the tax assessor laid claim to 1% of the $100k value annually.

Montana Solution: Registered the F-450 and the Fifth Wheel in Montana. The Fifth Wheel received a Permanent Plate (no inspection, no renewal). The F-450 is on a flat commercial rate. He eliminated the yearly “assessment day” paperwork entirely.

3. The Bentonville Collector

Profile: Tech executive with a collection of four air-cooled Porsches and two vintage Land Cruisers.

Arkansas Trap: Even though the cars are rarely driven, Arkansas demands they be assessed annually. If he misses the May 31 deadline, he gets hit with penalties on six cars.

Montana Solution: He transferred the entire collection to a single Montana LLC. All six vehicles were eligible for Permanent Registration. He paid a one-time fee. He now pays $0/year to maintain legal registration on a collection worth over $800,000.

X. Exit the Arkansas Assessment Trap

The Arkansas vehicle tax trap is real, and the Department of Finance and Administration (DFA) relies on a specific sleight of hand: they dangle a cheap $17–$30 registration fee in front of you while hiding a sledgehammer behind their back. If you are reading this and still hold an Arkansas title for a high-value asset, you are voluntarily subjecting yourself to a confiscatory system designed to penalize ownership.

We have exposed the Four-Layer Trap that extracts wealth from Arkansas residents:

- The Low-Fee Illusion: The state promotes low weight-based registration fees ($17 to $30) to distract you from the actual costs.

- Dual Taxation: You pay a 6.5% sales tax (plus local surcharges) upon purchase and an annual personal property tax just for the privilege of parking the car in your garage.

- The May 31 Assessment Deadline: Miss the arbitrary assessment deadline? You are hit with a 10% penalty on your taxes.

- Weight-Based Exploitation: The property tax assessment scales aggressively with the value of heavier, luxury SUVs and trucks.

The May 31 assessment deadline is always approaching. Every day you wait is a day you risk hitting the 60-day registration penalty window or facing a 10% late tax fine.

Do not let Little Rock dictate the terms of your vehicle ownership. The cost of our service is frequently covered by the tax savings on a single year of ownership.

Secure your assets. Zero out your tax liability.

See how Montana LLC registration helps owners in other high-tax states:

- North Carolina Vehicle Tax: The Tag Tax Trap and Mandatory Inspection Dragnet

- South Carolina Vehicle Tax: The “No Inspection” Lie and Property Tax Wealth Trap

Contact Us for Your Montana LLC Consultation

Stop the bleed. Call us now before the next May 31 deadline arrives.