12 min read

On this page

- + Executive Summary

- + The Manufacturer’s Certificate of Origin

- • Characteristics & Chain of Assignment

- + The Certificate of Title

- • Legal Function & Ownership Proof

- + Key Differences: MCO vs. Title

- + The Legal Exchange Mechanism

- • Surrender Principle & Fraud Prevention

- + The Montana LLC Connection

- + Common Legal Mistakes and Pitfalls

- + Real-World Scenarios

- + Decision Matrix

- + Conclusion

In the complex landscape of vehicle acquisition and registration, few concepts cause as much confusion as the distinction between a certificate of origin vs title. While both documents are fundamental to establishing ownership, they serve distinct legal functions at different stages of a vehicle’s lifecycle.

For the uninitiated, these documents may appear interchangeable. Legally, they are not. Just as a human birth certificate differs from a state-issued identification card, the MCO and the Title represent different phases of a vehicle’s legal existence. Understanding this distinction is paramount for anyone purchasing a new vehicle, transferring ownership, or seeking to register a high-value asset through a Montana LLC for tax optimization purposes.

This guide provides an authoritative comparison of these two critical documents, explaining the legal mechanics of the exchange process and how Zero Tax Tags navigates these complexities to secure your property rights.

Executive Summary: The “Birth Certificate” vs. The “State ID”

To navigate vehicle registration law, one must first master the terminology.

A Manufacturer’s Certificate of Origin (MCO)—often referred to as a Manufacturer’s Statement of Origin (MSO)—is the initial proof of existence for a motor vehicle. It is issued by the factory and certifies that a specific vehicle has been produced and transferred to a licensed dealer.

A Certificate of Title is a state-issued legal document that establishes the current owner of the vehicle within a specific jurisdiction.

The relationship between the two is linear: The MCO is surrendered to a state Department of Motor Vehicles (DMV) or Motor Vehicle Division (MVD) to generate the first Certificate of Title. You generally cannot hold a valid MCO and a Title for the same vehicle simultaneously; the issuance of the Title legally replaces and voids the active status of the MCO.

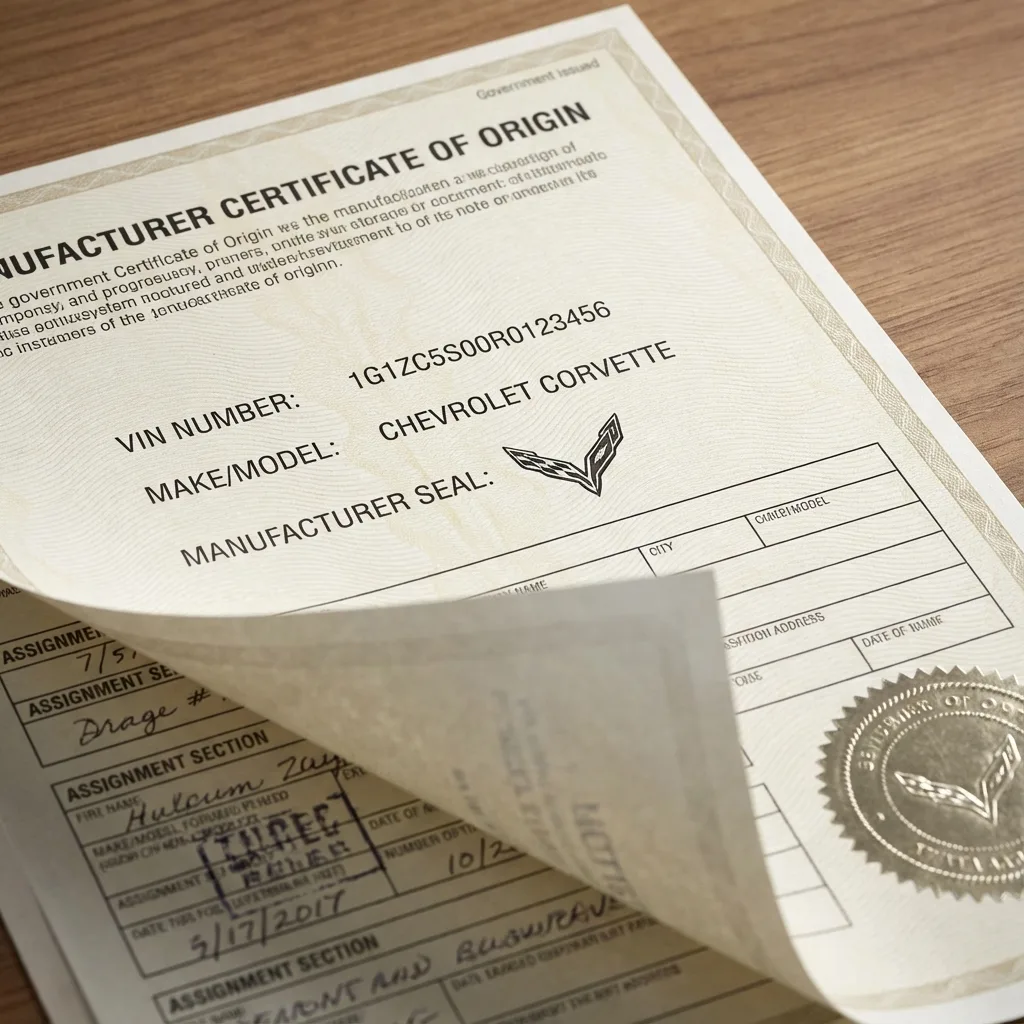

1. The Manufacturer’s Certificate of Origin (MCO/MSO) Defined

The Manufacturer’s Certificate of Origin is the source document for all subsequent vehicle documentation. Under legal definitions found in state statutes, including Montana’s, a “new motor vehicle” is one whose legal title has never been transferred to a person for purposes other than resale. The MCO is the document that substantiates this status.

Characteristics of the MCO

The MCO contains vital data fixed at the time of manufacture:

- Vehicle Identification Number (VIN): The unique 17-digit serial number.

- Year, Make, and Model.

- Engine specifications and Horsepower.

- Gross Vehicle Weight (GVW).

The Chain of Assignment

The back of an MCO contains assignment spaces. These are strictly regulated. When a manufacturer sells a vehicle to a dealer, they assign the MCO to that dealer. If that dealer trades the vehicle to another dealer, the MCO is reassigned.

Crucially, when the vehicle is sold to the first retail purchaser—whether an individual or a business entity like a Montana LLC—the dealer assigns the MCO to that purchaser. This assignment is the legal trigger that changes the vehicle’s status from “inventory” to “property.”

According to Montana MVD regulations, a new vehicle cannot be titled without the submission of this document. It serves as the absolute proof of ownership required to apply for the initial Montana title.

2. The Certificate of Title Defined

The Certificate of Title is the definitive proof of ownership recognized by the state. Unlike the MCO, which is a manufacturer’s document, the Title is a government-issued document.

The Legal Function of a Title

A Title serves three primary legal purposes:

- Establishes Ownership: It names the specific individual or entity (such as a Montana LLC) that owns the asset.

- Records Liens: It serves as the public record for any security interests. If a vehicle is financed, the lender’s interest is perfected by being recorded on the face of the Title.

- Tracks History: Through “branding,” a Title discloses if a vehicle has been salvaged, rebuilt, or subjected to flood damage.

Once a Title is issued, the vehicle is no longer considered “new” in the eyes of registration law, regardless of mileage. It is now a titled asset. Future transfers of ownership must be conducted by assigning the Title, not an MCO.

3. Key Differences: MCO vs. Title

To clarify the distinction between certificate of origin vs title, we have compiled a direct comparison of legal attributes.

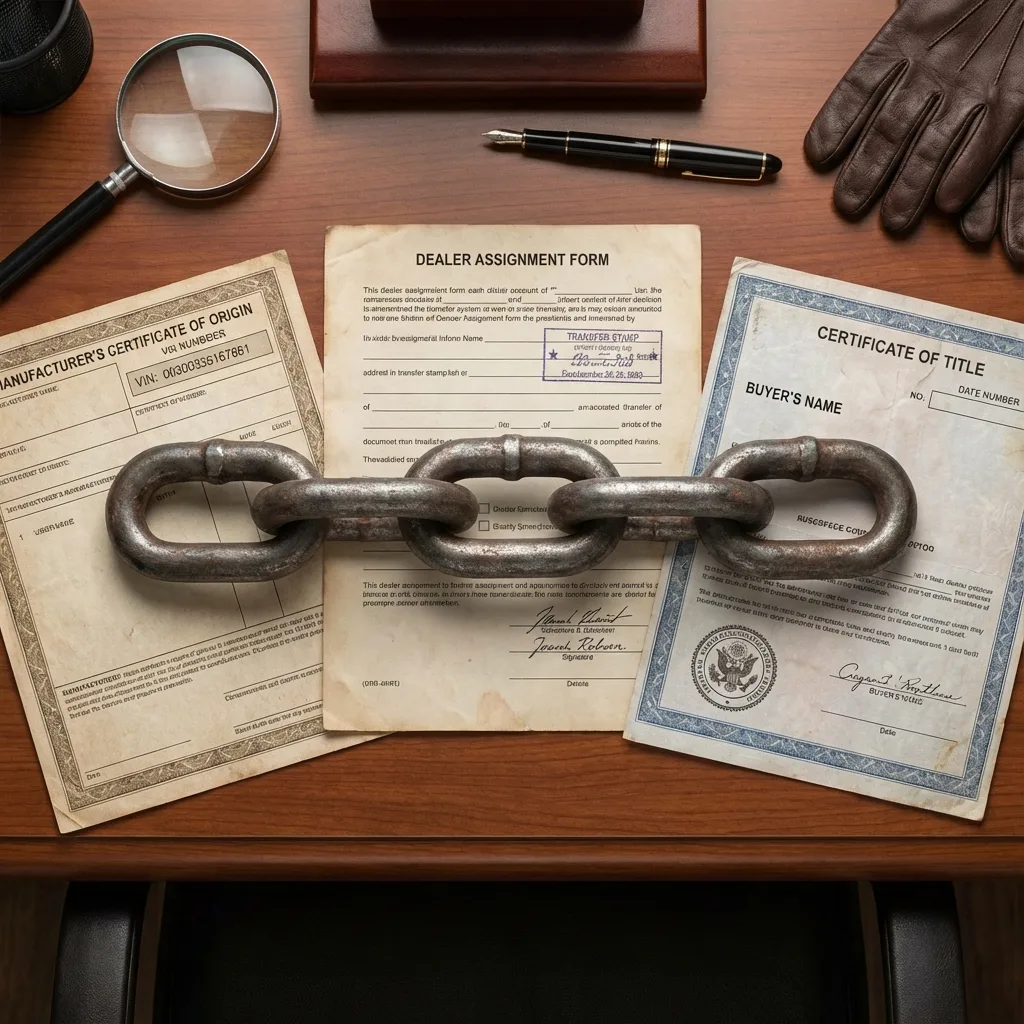

4. The Legal Exchange Mechanism

The transition from MCO to Title is a critical legal event known as “titling.” This process creates the state record for the vehicle.

The Surrender Principle

You cannot maintain an active MCO and a Title simultaneously. To obtain a Title, the MCO must be physically surrendered to the state licensing agency.

In Montana, for example, when Zero Tax Tags processes a registration for a client, we must submit the original MCO to the Montana Motor Vehicle Division. The state reviews the assignment on the back of the MCO to ensure the chain of ownership flows correctly from the dealer to the Montana LLC.

Once verified, the state archives or destroys the MCO and issues a Montana Certificate of Title. This new Title is the legal proof that the Montana LLC owns the vehicle.

Why You Cannot Keep the MCO

Clients often ask if they can keep the MCO as a souvenir or for their records. The answer is legally no. The state requires the MCO as evidence to prevent fraud and theft. If a state issued a Title without collecting the MCO, a fraudster could theoretically use the MCO to title the same vehicle in a different state, creating conflicting ownership records (a practice known as “title washing” or “cloning”).

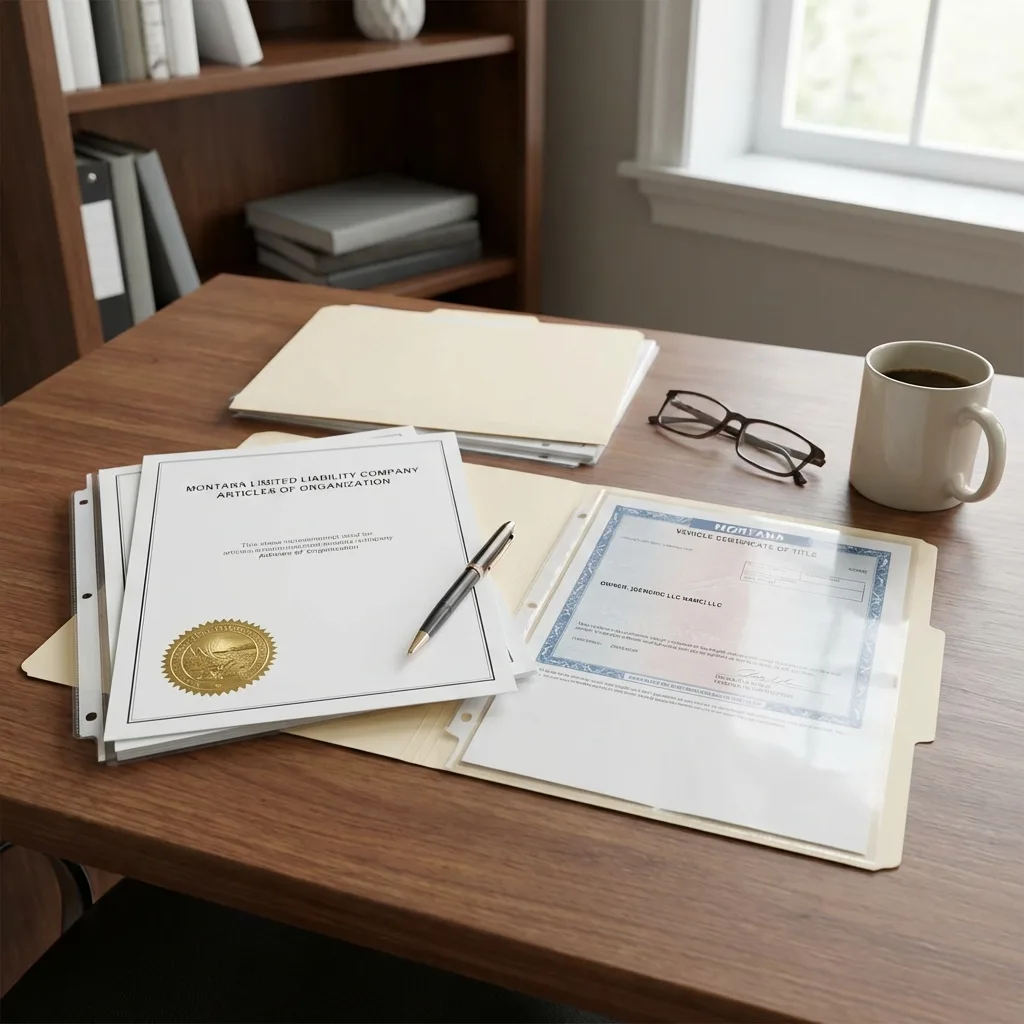

5. The Montana LLC Connection

For clients of Zero Tax Tags, understanding the MCO is vital because it is the key to unlocking tax savings on new vehicle purchases.

The Process for New Vehicles

When you purchase a new vehicle through a Montana LLC to avoid sales tax, the dealership must assign the MCO directly to your LLC, not to you personally.

- Purchase: You buy the vehicle. The “Purchaser” listed on the MCO must be the name of your Montana LLC.

- Submission: The original MCO is sent to Zero Tax Tags.

- Exchange: Zero Tax Tags submits the MCO, along with the Application for Certificate of Title, to the county treasurer or MVD.

- Issuance: Montana issues a Title in the name of the LLC and provides the license plates.

Why the MCO is Critical for the LLC

If the dealer assigns the MCO to you personally, you have technically taken ownership as an individual. Transferring it subsequently to the LLC may trigger tax liabilities in your home state or complicate the Montana titling process. It is imperative that the MCO assignment is executed correctly at the point of sale.

Zero Tax Tags acts as your authorized agent in this transaction, ensuring that the surrender of the MCO and the issuance of the Montana Title are handled in strict accordance with Montana MVD regulations.

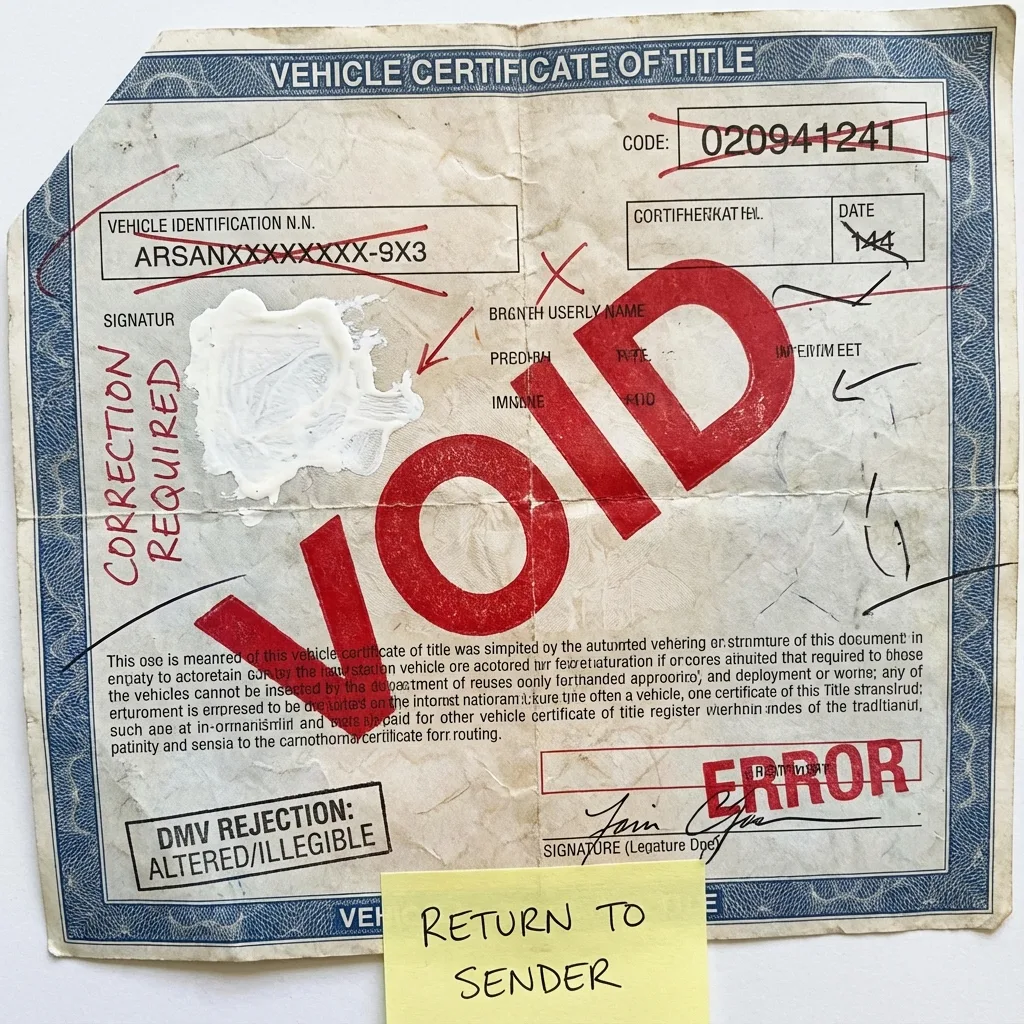

6. Common Legal Mistakes and Pitfalls

The documentation process is unforgiving. Small errors on an MCO or Title can result in rejection by the state, delaying registration and potentially causing tax exposure.

Mistake 1: Breaking the Chain of Ownership

The “Chain of Ownership” must be unbroken.

- Correct: Manufacturer → Dealer → Your LLC.

- Incorrect: Manufacturer → Dealer → You (Personal Name) → Your LLC.

If the MCO is assigned to you personally, you generally must title it in your name first (paying applicable taxes) before you can transfer it to the LLC. Zero Tax Tags advises clients on how to instruct dealers to avoid this costly error.

Mistake 2: Losing the MCO

Because the MCO is a bearer instrument of sorts, losing it is a significant legal hurdle. You cannot simply apply for a “duplicate” at the DMV because the DMV never issued it. You must go back to the selling dealer, who must petition the manufacturer for a replacement. This is a time-consuming and difficult administrative process.

Mistake 3: Alterations and Erasures

State agencies, including the Montana MVD, have a zero-tolerance policy for alterations on title documents. If a name is written on the MCO assignment line and then crossed out or covered with white-out, the document is typically voided. This requires the issuance of a statement of fact or, in severe cases, a replacement MCO from the manufacturer.

Mistake 4: Confusing the Documents

Attempting to register a vehicle with an MCO that has already been titled, or attempting to export a vehicle using a Title when an MCO is required (or vice versa), leads to immediate rejection.

Warning: Never alter, erase, or white-out information on an MCO or Title. The document will be voided and rejected by the state.

Explore related guides:

7. Real-World Scenarios

To further clarify when each document is applicable in the certificate of origin vs title decision, consider the following common scenarios handled by Zero Tax Tags.

Scenario A: Buying a Brand New RV from a Dealer

- The Situation: You are purchasing a $300,000 Class A Motorhome.

- The Document: The dealer holds the Manufacturer’s Certificate of Origin (MCO).

- The Action: The dealer assigns the MCO to your Montana LLC. Zero Tax Tags takes possession of the MCO and surrenders it to Montana to generate the first Title.

- The Result: You receive a Montana Title and plates. The MCO is archived by the state.

Scenario B: Buying a Classic Car from a Private Seller

- The Situation: You are buying a 1969 Mustang from a private collector.

- The Document: The seller holds a Certificate of Title (likely from their home state).

- The Action: The seller signs the back of the Title as the “Seller.” Your Montana LLC is entered as the “Buyer.” Zero Tax Tags submits this Title to Montana.

- The Result: Montana cancels the old state title and issues a new Montana Title in your LLC’s name. An MCO is not involved because the vehicle has been titled previously.

Scenario C: The “Title Only” Dealer Transaction

- The Situation: A dealer sells a used vehicle that was traded in.

- The Document: The dealer holds the previous owner’s Certificate of Title.

- The Action: The dealer uses a “Dealer Reassignment” form or the back of the Title to transfer ownership to your LLC.

- The Result: Even though you are buying from a dealer, you get a Title, not an MCO, because the vehicle is used.

8. Decision Matrix: When is Each Document Required?

When preparing to register your vehicle through Zero Tax Tags, use this matrix to determine which document you must obtain from the seller.

When to Require a Manufacturer’s Certificate of Origin (MCO):

- New Vehicles: The vehicle has never been titled in any state.

- Kit Vehicles: You have purchased a chassis and body kit that has not yet been assembled or titled as a road-legal vehicle.

- Direct Imports: In some cases of grey market vehicles where no US title exists yet (though this requires additional Customs documentation).

When to Require a Certificate of Title:

- Used Vehicles: Any vehicle that has been registered previously.

- Dealer Demos: Often, “demonstrator” vehicles have been titled to the dealership. If so, you need the Title, not the MCO.

- Auction Purchases: Unless it is a factory sale of new units, auction vehicles are transferred via Title.

- Transfers from Personal Name: If you already own the vehicle personally and are transferring it to your LLC, you will use your existing Title.

Conclusion: Professional Handling of Legal Documentation

The distinction between a certificate of origin vs title is more than semantics; it is the legal foundation of your vehicle ownership. Mismanaging these documents can lead to rejected registrations, tax liabilities, and breaks in the chain of legal ownership.

At Zero Tax Tags, we specialize in the precise execution of these documents. Whether you are surrendering an MCO for a new luxury coach or transferring a Title for a classic Ferrari, our team ensures the exchange process satisfies all Montana MVD statutes. We handle the paperwork so you can enjoy the road.

Ready to Navigate MCO to Title Conversion?

Whether you have a Manufacturer’s Certificate of Origin or a Certificate of Title, we handle Montana registration with legal precision.