15 min read

On this page

- + The Architecture of the Shake-Down

- • The Chicago Tax Stack

- • The Registration Nightmare

- + Tales from the Front Lines

- • The Contractor’s Dilemma ($92K Truck)

- • The Retirement Dream ($450K RV)

- • The Gearhead ($180K McLaren)

- + The Montana Solution

- + The Math of Freedom

- + Why Choose ZeroTaxTags?

- + Frequently Asked Questions

- + Conclusion

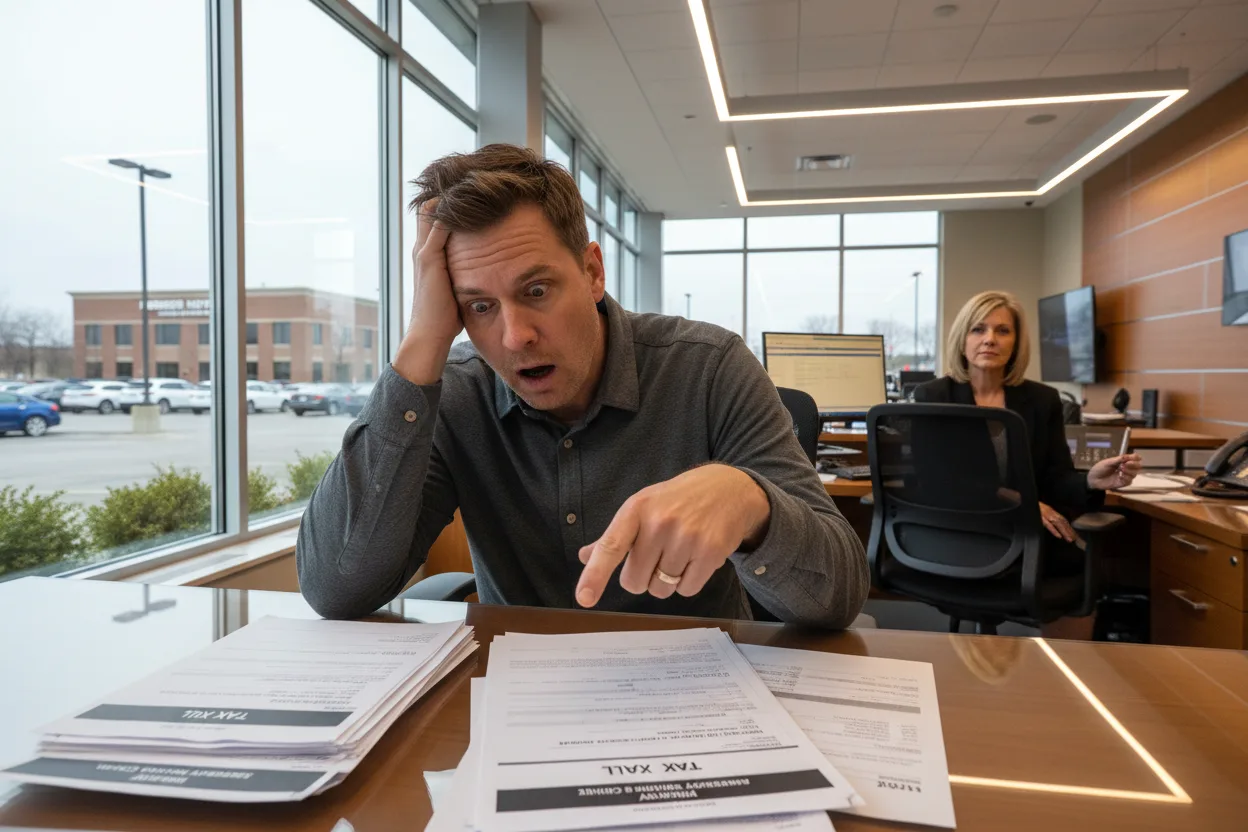

Illinois vehicle tax creates that specific mix of excitement and nausea when you hit the finance office of a car dealership.

You’ve spent weeks researching. You’ve test-driven the Ford F-350 Super Duty or the Porsche 911. You’ve negotiated the trade-in value of your old beater. You’ve argued over the interest rate. You are finally ready to sign the papers and take the keys.

Then, the finance manager slides the “out the door” cost sheet across the desk.

Your eyes scan past the vehicle price. They skip over the relentless “doc fees.” Ideally, they land on the total. But in Illinois—specifically in Cook County and the sprawling Chicago metro area—your eyes stop halfway down the page.

Tax.

It’s a number so large it looks like a typo. It’s four figures, maybe five. It is the price of a decent used car, all by itself. It is money that vanishes into the ether of the Illinois Department of Revenue, never to be seen again. It adds nothing to the value of your vehicle. It doesn’t make the engine run smoother. It doesn’t upgrade the leather.

It is simply the cost of permission. The price tag for the privilege of registering a vehicle in one of the most financially punitive states in the Union.

If you are a contractor in Naperville, a small business owner in Schaumburg, or a successful professional in the Gold Coast, you aren’t just buying a car. You are funding a broken system. You are paying a penalty for your own success.

But here is the secret that the wealthy have known for decades, and that the state of Illinois hopes you never figure out: You don’t have to pay it.

There is a legal, accessible, and financially brilliant escape hatch. It flows through the mountains of Montana, and it leads directly to your bank account.

At ZeroTaxTags.com, we specialize in liberation. We help Illinois residents legally bypass the skyrocketing sales taxes and punishing registration fees of the Land of Lincoln by establishing a Montana LLC.

This isn’t about evasion. It’s about strategy. Let’s talk about why Illinois is bleeding you dry, and how we can stop the bleeding today.

Part I: The Architecture of the Shake-Down

To understand the solution, you have to fully appreciate the problem. Most people look at “Sales Tax” as a singular annoyance. In Illinois, however, it is a multi-layered cake of financial misery.

If you live in a rural county, you might think you’re getting off easy with the state base rate of 6.25%. But if you are anywhere near the economic engine of the state—Chicago and its collar counties—the math changes violently.

The Chicago Tax Stack

Let’s look at the anatomy of a vehicle purchase in Chicago:

- State Tax: 6.25%

- Home Rule Municipal Tax: Municipalities can add their own percentage.

- RTA (Regional Transportation Authority) Tax: If you are in Cook, DuPage, Kane, Lake, McHenry, or Will counties, add another slice.

- Cook County Home Rule Tax: Another layer.

When you stack these up in the city of Chicago, the combined sales tax rate on a vehicle often exceeds 10.25%.

Think about that percentage. Over ten percent.

If you buy a heavy-duty work truck for your construction business for $85,000, you aren’t paying $85,000. You are paying approximately $8,712 just in sales tax. That is nearly nine grand that you have to finance, pay interest on, and never see again.

The “Lease” Loophole is Gone

For years, savvy Chicagoans leased cars to mitigate this. They paid tax only on the monthly usage. But Illinois, in its infinite hunger for revenue, closed that loophole years ago. For a long time, you paid tax on the full value of the car even if you only leased it for 3 years. While the laws shift back and forth, the intent is clear: they want the money upfront, and they want all of it.

The Registration Nightmare

It doesn’t end at the dealership. Illinois vehicle tax through the Illinois Secretary of State’s office has turned vehicle registration into a high-stakes game. Basic passenger vehicle fees have jumped significantly in recent years. But if you drive a truck, a trailer, or an RV? Prepare for pain.

For B-Truck plates (which many pickups require), the fees are higher. If you are registering a large RV or a luxury vehicle, the annual recurrence of these fees feels like a subscription service purely for the right to exist in the state.

And then there is the Chicago City Sticker. This is the infamous “Wheel Tax.” If you live in the city, you must buy a sticker for your windshield. The price varies by vehicle weight. For a large passenger vehicle or truck, it can be over $150 a year. If you utilize residential zone parking? Add more money. If you’re late? The tickets are predatory.

By the time you get your keys, get your plates, and get your sticker, you have been bled dry before you’ve even driven the first mile.

Part II: Tales from the Front Lines (Real Scenarios)

Statistics are sterile. Let’s look at the human cost. Let’s talk about the people we help every day at ZeroTaxTags.com. These are fictionalized composites of real clients, representing the very real struggles of Illinois residents.

Scenario A: The Contractor’s Dilemma

Meet Mike. Mike runs a general contracting business out of Orland Park. He works hard. He’s up at 4:30 AM, coordinating sub-contractors, hauling drywall, and meeting clients.

Mike’s business relies on his truck. His old 2012 Silverado finally gave up the ghost. He needs a new 2024 GMC Sierra 2500HD Denali. It’s not just a luxury; it’s his mobile office. He needs the towing capacity for his dump trailer and the reliability to get to job sites in the dead of winter.

The truck lists for $92,000.

Mike goes to the dealer. He has a trade-in, but the “trade-in credit” on taxes only goes so far in Illinois. Because he lives in Cook County, the tax rate hits him hard.

That $10,000 is his profit margin on two mid-sized bathroom remodels. That is two months of 60-hour work weeks, purely to pay the tax man. Mike isn’t rich; he’s solvent. Taking $10k out of his operating capital hurts. It means he can’t upgrade his saws this year. It means he can’t give his foreman that Christmas bonus he promised.

Mike represents the backbone of the Illinois economy, and the state is breaking his back.

Scenario B: The Retirement Dream

Meet Linda and Gary. They live in Evanston. They’ve worked corporate jobs in the Loop for thirty years. They saved, they invested, and they finally retired. Their dream? To buy a Class A Motorhome and tour the National Parks.

They find a beautiful Newmar diesel pusher. The price tag is significant: $450,000.

In the RV world, sales tax is the dream killer. Attempting to register this beast in Illinois is a financial tragedy.

Pause and look at that number. Forty-five thousand dollars.

That is a year of travel expenses. That is the cost of fuel for the next decade. That is a down payment on a condo in Florida. Illinois wants to take $45,000 from Linda and Gary simply because they bought a vehicle.

This doesn’t even account for the luxury tax implications or the insanely high annual registration fees for heavy recreational vehicles in Illinois.

Scenario C: The Gearhead

Meet Jason. Jason is a successful software developer living in the West Loop. He’s young, single, and has always wanted a McLaren. He finally gets a bonus that makes it possible. He finds a lightly used McLaren 570S for $180,000.

Jason knows he has to pay to play. But when he runs the numbers, the “Chicago premium” makes him sick. Between the sales tax and the Chicago “Use Tax” on non-titled personal property, he’s looking at nearly $19,000 in taxes.

Jason buys the car, but the joy is sucked out of it. Every time he hits a pothole on I-290—and there are thousands of them—he wonders where that $19,000 went. It certainly didn’t go to the roads.

Part III: The Montana Solution — Your Financial Escape Hatch

This is where the story changes. This is where Mike, Linda, Gary, and Jason take back control.

It’s called a Montana LLC.

You might be wondering: “Why Montana? I don’t live in Montana. I’ve never even been to Montana.”

Montana is unique among the 50 states because it has 0% sales tax on vehicles. Zero. Nothing. Nada. Furthermore, Montana has a legal framework that allows non-residents to form a Limited Liability Company (LLC) within the state.

Here is the strategy that ZeroTaxTags.com executes for you:

- We Form the Essential Structure: You don’t buy the car in your name (Mike Smith). You buy the car in the name of your company (Smith Holdings LLC), which happens to be domiciled in Montana.

- The Asset Transaction: Your Montana LLC purchases the GMC Sierra, the Newmar RV, or the McLaren.

- The Registration: Because the owner of the vehicle (the LLC) is a Montana resident, the vehicle is registered in Montana.

- The Result: The transaction occurs in a 0% sales tax jurisdiction. You pay $0 in sales tax.

Is this Legal?

This is the most common question we get. The answer is: Yes, it is a legal asset protection structure.

You are creating a legitimate business entity. That entity creates a legal nexus in Montana. That entity has the right to own property. In the US, a business can own vehicles, and businesses can operate in multiple states.

Unlike the “sham” methods of the past (like using a friend’s address in a different state, which is fraud), forming an LLC is a codified legal process. The LLC is a real legal person. It owns the car. You own the LLC.

The “Permanent” Benefit

This isn’t just about the upfront sales tax. It’s about the lifetime of the vehicle.

Montana offers Permanent Plates for light vehicles 11 years or older. But even for newer vehicles, the registration process is streamlined. No emissions testing (a huge headache in the Chicago metro area). No vehicle inspections.

The Illinois Secretary of State requires older vehicles to go through emissions testing every two years in affected counties (Cook, DuPage, Lake, etc.). It is a hassle. It wastes your time. Montana doesn’t care about your catalytic converter’s efficiency. They care about processing your paperwork efficiently and leaving you alone.

Part IV: The Math of Freedom (What You Save)

Let’s re-run the numbers for our scenarios using ZeroTaxTags.com.

Mike’s GMC Sierra Denali ($92,000)

What could $7,500 do for Mike’s business? That’s a new trailer. That’s marketing. That’s cash flow.

Linda and Gary’s RV ($450,000)

That savings literally pays for the first two years of their retirement travels.

The Exotic Car Difference

For Jason and his McLaren, the savings are equally stark. But there’s another hidden benefit: Privacy.

In Illinois, vehicle registrations are easily searchable. If you drive a high-profile car, people can find out where you live. A Montana LLC provides an unexpected layer of anonymity. The car belongs to the LLC. The trail stops there for the average snooper. For high-net-worth individuals in Chicago, this security is priceless.

Part V: Why Choose ZeroTaxTags?

You might think, “Can’t I just file this paperwork myself?”

Technically? Maybe. Practically? It’s a minefield.

Montana law is specific. The bureaucracy, while better than Illinois, still requires precision. One wrong checkbox, one missed filing date, or one error in the Registered Agent designation, and your registration is rejected. Or worse, your LLC is dissolved, leaving your vehicle in legal limbo.

At ZeroTaxTags.com, we are not just filing clerks. We are your blockade against bureaucracy.

1. Speed and Accuracy: We know the Montana MVD (Motor Vehicle Division) inside and out. We know which forms they need, how they need to be signed, and exactly what fee to attach. We turn weeks of confusion into days of resolution.

2. The Registered Agent Requirement: To have a Montana LLC, you must have a physical presence in the state—a Registered Agent. You cannot use a PO Box. We provide this commercial address and statutory representation for you. We are your anchor in Montana.

3. Full Service from A to Z: We handle the LLC formation. We obtain the EIN (Employer Identification Number) from the IRS. We handle the title work. We send you the plates. You never have to step foot in a DMV again.

Think about the Illinois DMV (Secretary of State) facilities. The one on Elston Ave in Chicago? The Thompson Center? The distinct misery of waiting in line for three hours only to be told you brought the wrong utility bill.

When you use ZeroTaxTags, your “DMV visit” happens from your couch. You upload documents. We do the fighting. You get the plates.

Part VI: Frequently Asked Questions

We know you have questions. Dealing with tax law and interstate registration can feel daunting. Let’s clear the air.

Q: Do I need a special driver’s license to drive my Montana-plated car in Illinois?

A: No. You drive with your standard Illinois driver’s license. You are simply driving a corporate vehicle. Millions of people drive company cars every day. This one just happens to be owned by your company.

Q: What about insurance?

A: This is crucial. You must insure the vehicle. Most major carriers (Progressive, Geico, State Farm, Hagerty) are familiar with this structure. You will insure the vehicle in the name of the LLC, but you must list the “garaging address” as your actual home in Illinois. Do not lie about where the car sleeps. Lying about location is insurance fraud. Owning it through an LLC is not. As long as the premium is paid based on the Chicago zip code risk profile, the carrier covers you.

Q: Can I finance the car?

A: Yes, but it requires a lender who understands commercial/LLC lending. Many credit unions and specialty lenders are fine with this. However, the easiest path is often purchasing outright or using a line of credit, then refinancing into the LLC. If you are financing at the dealer, tell them the buyer is the LLC.

Q: Is this only for exotic cars?

A: Absolutely not. While the savings are massive on Ferraris and Prevost busses, we help everyday contractors with Ford F-250s, families with Suburbans, and riders with Harleys. If the sales tax is over $2,000, the Montana LLC usually pays for itself in year one.

Q: What if I get pulled over in Chicago?

A: You provide your license, your insurance card (in the LLC’s name), and your registration (in the LLC’s name). You are driving a vehicle owned by a Montana company. It is a valid legal status.

Q: Does Illinois fight this?

A: States hate losing revenue. However, the US Constitution’s “Full Faith and Credit” clause generally requires states to recognize the legal acts (like business formation) of other states. The key is that the LLC is a legitimate entity. This is why having ZeroTaxTags manage the annual renewal of your LLC is vital. If your LLC lapses, you own a car illegally. If your LLC is active, you are compliant.

Conclusion: Escape Illinois Vehicle Tax

Illinois vehicle tax creates hurdles. ZeroTaxTags creates a ramp to jump over them.

Every time you hit a pothole on the Dan Ryan Expressway, ask yourself: Did I get my money’s worth for that 10.25% Illinois vehicle tax? Every time you open that envelope from the Secretary of State demanding another $150 or $300 for a sticker, ask yourself: Why am I paying this?

You work hard. Whether you are hauling gravel in a dump truck, commuting to the Loop in a Tesla, or touring the country in a retirement RV, you earned that money. The government didn’t earn it.

The exorbitant tax rates in Cook County and the surrounding suburbs are not a fact of life; they are a choice. You can choose to pay them, or you can choose the smart, legal alternative used by the financially savvy for generations.

Don’t let Illinois bleed your bank account dry. Keep your capital. Invest in your business. Enjoy your retirement.

The Solution is Quiet. The Savings are Loud.

Contact ZeroTaxTags.com today. Let’s get your LLC formed, your vehicle registered, and your money back in your pocket where it belongs.

Start Your Montana LLC Registration Now

(Disclaimer: ZeroTaxTags.com provides vehicle registration and LLC formation services. We are not tax attorneys or CPAs. We recommend consulting with your financial advisor regarding your specific tax situation.)