14 min read

On this page

- + The Virginia Problem: No Street Legal Conversions

- + Virginia DMV: “Application Denied”

- + The “No Connectivity” Nightmare

- + Virginia Property Tax on Off-Road Vehicles

- + The Montana Street Legal Solution

- + Virginia’s Best Trails: Where You Want to Ride

- • Shenandoah Valley Trails

- • Southwest Virginia Spearhead Trails

- + Military Surplus Vehicles & SF-97 Conversions

- + ATV-Friendly Coal Towns

- + The Zero Tax Tags Process

- + FAQ: Virginia Off-Road Restrictions

- + Break Free from Virginia Restrictions

It’s 6:00 AM in Fairfax County. You are standing in your driveway, loading your Polaris RZR onto a trailer. Again. You tighten the ratchet straps. You check the lights. You have to drive 90 minutes just to get to a legal riding area because Virginia off-road restrictions make it illegal to ride your UTV on public roads—even for the quarter-mile to the gas station or the trailhead parking lot.

You watch your neighbors drive golf carts down the street. You see dirt bikes registered for dual-sport use. But your $30,000 side-by-side? Illegal on Virginia roads. Completely illegal.

You tried to get it street legal. You installed DOT-compliant mirrors, turn signals, a horn, and brake lights. You spent $1,200 on a street legal kit. You filled out the DMV paperwork. And they rejected it.

Virginia DMV does not allow off-road vehicles—UTVs, side-by-sides, or ATVs—to be converted to street legal use. It doesn’t matter how many safety features you add. It doesn’t matter if 47 other states allow it. Virginia says no.

Meanwhile, states like Arizona, Texas, and South Dakota have thriving street legal UTV communities. Montana goes even further: they’ll register your UTV without inspections, emissions tests, or bureaucratic roadblocks. You get a license plate, registration, and the freedom to connect trails without breaking the law.

So how do Virginia off-road enthusiasts escape these restrictions? Let’s break down the problem—and the Montana solution that’s changing the game.

The Virginia Problem: No Street Legal Conversions

Virginia law is clear: off-highway vehicles (OHVs) are prohibited from operating on public roads, with limited exceptions. The Virginia DMV defines an OHV as any vehicle designed for off-road use, including:

- UTVs (Utility Terrain Vehicles) like Polaris RZR, Can-Am Defender, Honda Talon

- ATVs (All-Terrain Vehicles) like Yamaha Raptor, Honda Foreman

- Side-by-sides, ROVs (Recreational Off-Highway Vehicles)

- Military surplus vehicles like Humvees without proper SF-97 conversions

The only legal places to ride in Virginia are:

The “Farm Exemption” Loophole: Virginia Code § 46.2-915.1 allows OHVs to cross highways if you’re traveling between parcels of agricultural land you own or lease. But if you live in Fairfax, Loudoun, or Virginia Beach? You’re not crossing I-66 on a UTV to check on your “farm.”

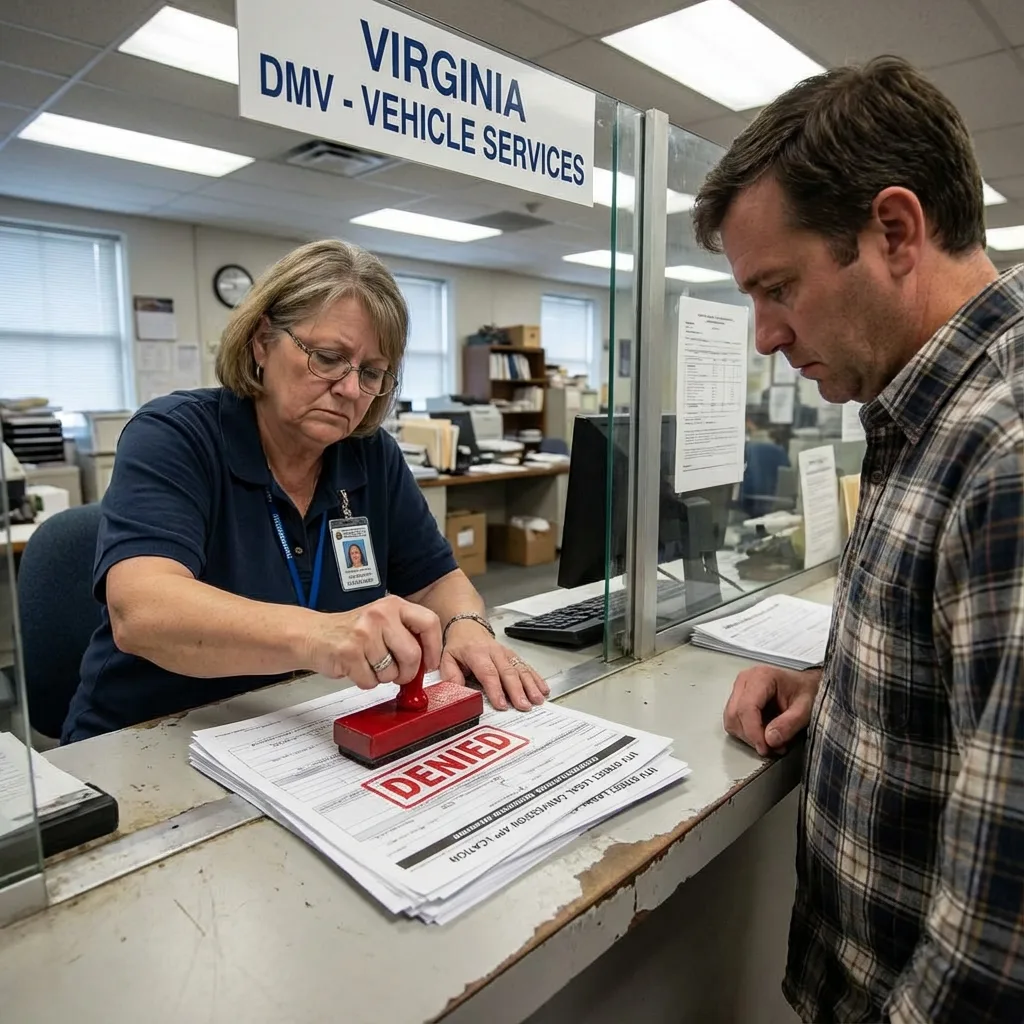

Virginia DMV: “Application Denied”

You walk into the DMV with confidence. You have receipts for the street legal conversion kit. You have photos of your UTV with mirrors, turn signals, a windshield, and a VIN-stamped frame. You filled out the Title and Registration Application (VSA 17A). You brought your insurance proof.

The clerk looks at the manufacturer’s certificate of origin. They see “Polaris RZR XP 1000” or “Can-Am X3 Turbo.”

“This is an off-highway vehicle. We can’t register it for on-road use.”

You try to explain:

- “It has all the DOT safety equipment.”

- “I saw someone in Arizona with plates on the same model.”

- “I spent over $1,000 making this street legal!”

The DMV clerk doesn’t care. Virginia Code § 46.2-100 defines motor vehicles eligible for highway use. If the manufacturer’s statement says “off-highway use only,” the Virginia DMV will not issue a title or registration for street use. Period.

Unlike states with independent inspection-based systems (where a state trooper verifies compliance and grants a plate), Virginia relies on the manufacturer’s designation. If Honda, Polaris, or Can-Am didn’t build it as a street-legal vehicle from the factory, Virginia won’t let you retrofit it.

See how other states handle vehicle taxes and registration:

- Arizona VLT: The Annual Tax Trap on Vehicles

- How to Transfer a Certificate of Origin for Off-Road Vehicles

The “No Connectivity” Nightmare

Imagine this scenario: You live in Charlottesville. You want to ride the trails at Walnut Creek Park, which is 8 miles from your house. The park has a parking lot where trailers are allowed. But to ride the actual trails, you have to unload your UTV in the parking lot and ride from there.

Now imagine the gas station is 0.3 miles from the parking lot entrance. Your UTV is out of gas. Do you:

- Option A: Load the UTV back onto the trailer, drive to the gas station, unload it, fill it up, reload it, drive back, and unload it again?

- Option B: Just drive the damn UTV 0.3 miles to the gas station on the shoulder of the road?

If you choose Option B, you are breaking Virginia law. If a sheriff’s deputy sees you, you can be cited for:

Your UTV is legally tethered to the trailer. You can only ride it in isolated pockets of designated land. You can’t connect trails. You can’t ride through town. You can’t even move it from your garage to your neighbor’s property without trailering it. This is the Virginia off-road cage.

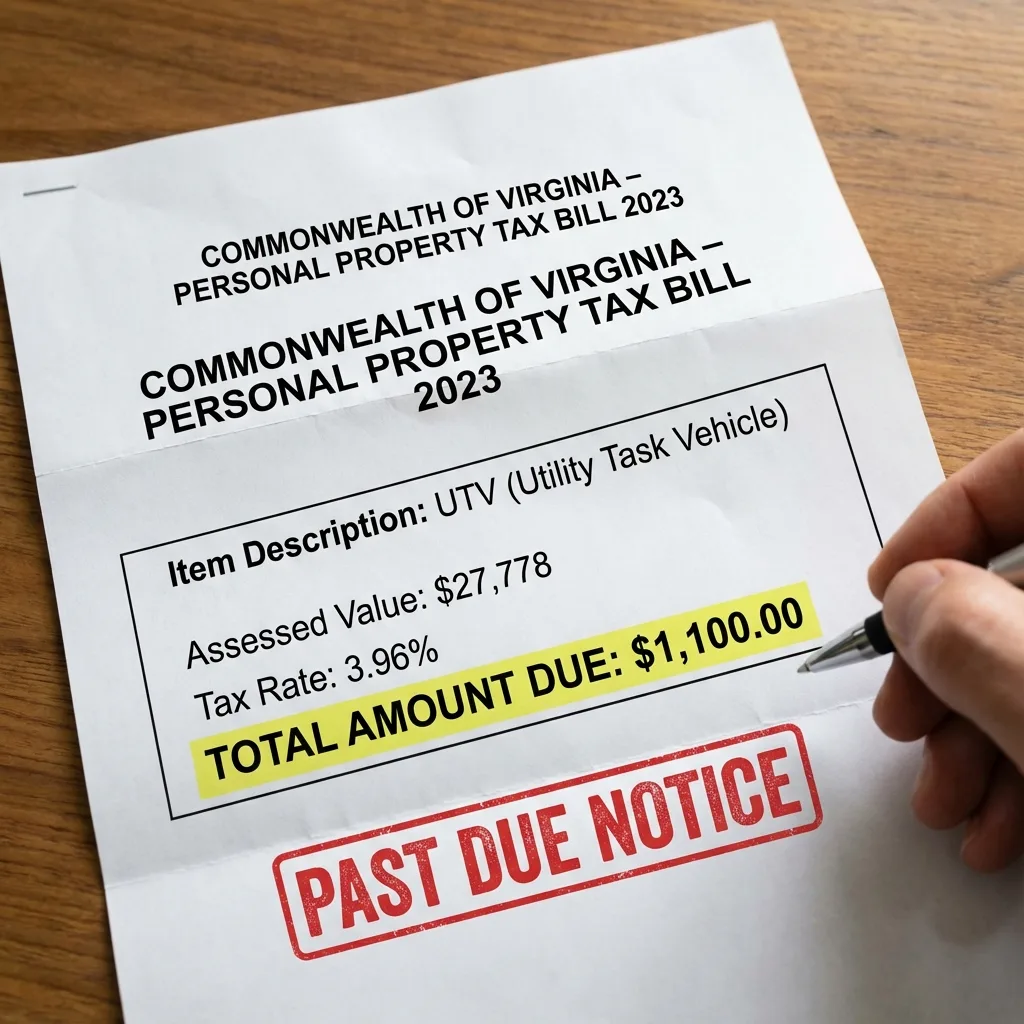

Virginia Property Tax on Off-Road Vehicles

Adding insult to injury, even though Virginia won’t let you drive your UTV on public roads, they’ll happily tax it as personal property. Virginia has the highest vehicle property tax rate in the nation—an average of 3.96% annually on the assessed value.

If you own a $30,000 Polaris RZR Pro XP in Fairfax County, you’re paying approximately $1,371 per year in personal property tax (4.57% rate). Over 5 years, that’s $6,855 in taxes for a vehicle you can’t even legally drive to the trailhead.

You’re paying thousands in annual taxes for a vehicle Virginia says you can’t drive on roads. That’s the definition of insult to injury. Learn more about Virginia’s brutal personal property tax system.

The Montana Street Legal Solution

Montana doesn’t care what Virginia thinks. Montana has a simple philosophy: if you own it, you can register it. If you register it, you can drive it.

Here’s what makes Montana the ultimate solution for Virginia off-road owners:

- $0 sales tax on vehicle purchases

- $0 annual vehicle property tax (no 3.96% wealth extraction)

- No safety inspections required for registration

- No emissions testing

- UTVs, ATVs, side-by-sides ALL eligible for on-road registration

- Permanent registration available for vehicles 11+ years old (one-time fee, lifetime plates)

How the Montana LLC Strategy Works

You don’t register the UTV in your personal name. You form a Montana Limited Liability Company (LLC). The LLC owns the vehicle. Since the LLC is a Montana resident, the vehicle is registered in Montana.

| Step 1: | Zero Tax Tags forms your Montana LLC within 24-48 hours |

| Step 2: | Your UTV is sold to your LLC (or purchased new by the LLC) |

| Step 3: | We handle Montana DMV registration—no inspections, no VIN verifications, no bureaucratic runaround |

| Step 4: | Montana license plates are shipped directly to your Virginia address. You mount them and ride. |

This is 100% legal. Forming a Montana LLC is legal. Owning vehicles through an LLC is legal. Montana registration is recognized by all 50 states under the Full Faith and Credit Clause of the U.S. Constitution. Thousands of UTV, RV, and exotic car owners nationwide use this strategy.

Virginia’s Best Trails: Where You Want to Ride

Virginia actually has incredible off-road terrain—if you can get to it legally. Let’s look at the two major riding regions where Montana plates unlock access.

Shenandoah Valley Trails

The Shenandoah Valley offers stunning mountain scenery and some of Virginia’s best legal OHV areas, including:

- Peters Mill Run Trail System — Over 30 miles of trails in George Washington National Forest

- Flagpole Knob/Little Fort Recreation Area — 14,000 acres of designated OHV trails

- Taskers Gap Trail — Technical rock crawling near Harrisonburg

The problem? These trail systems are often 10-20 miles apart. Without street legal registration, you have to load, drive, unload, ride, reload, drive to the next spot, and repeat. A Montana-plated UTV lets you connect these trails via Forest Service roads and state highways, turning a logistical nightmare into a full-day adventure.

Southwest Virginia Spearhead Trails

This is the crown jewel of Virginia off-roading: the Spearhead Trails system in coal country. Stretching over 350+ miles across five counties (Buchanan, Dickenson, Tazewell, Russell, and Wise), this system connects old mining roads, mountain passes, and scenic overlooks.

Key features:

- Trail Town Integration: Ride directly into towns like St. Paul, Haysi, and Pocahontas for gas, food, and lodging

- Connects to Kentucky’s trail systems: Cross state lines and access 1,000+ miles of riding

- Elevation changes from 1,400 to 4,000+ feet

- ATV-friendly businesses: Restaurants, hotels, and shops that encourage trail riders

With Montana plates, you can ride the Spearhead system AND connect to town amenities legally. Local law enforcement in these coal counties understand the economic value of UTV tourism. A Montana plate signals you’re a serious rider who invested in legal registration—not a weekend warrior breaking the law.

Military Surplus Vehicles & SF-97 Conversions

Virginia is home to massive military installations—Norfolk Naval Station, Fort Belvoir, Quantico, and the Pentagon. Military surplus auctions (GovPlanet, IronPlanet) frequently sell Humvees, M998s, and other tactical vehicles with SF-97 certificates.

The SF-97 is the military equivalent of a manufacturer’s certificate of origin. But here’s the problem: Virginia DMV often refuses to register military surplus vehicles for on-road use, especially if they were sold as “off-road only” by the Defense Logistics Agency.

Montana doesn’t care. Montana will register an SF-97 Humvee without requiring DOT certification, crash testing, or EPA compliance. You get a Montana title, Montana plates, and legal on-road operation.

Military members and veterans: If you bought a Humvee at auction with dreams of driving it legally, Montana LLC registration is often your ONLY path to street legal operation. Learn more about transferring certificates of origin for off-road vehicles.

ATV-Friendly Coal Towns

Southwest Virginia coal country has embraced UTV/ATV tourism as an economic lifeline. Towns like Pocahontas, St. Paul, Dante, and Haysi actively encourage trail riders to ride into town on their UTVs to eat, shop, and stay overnight.

These municipalities have ordinances allowing off-road vehicles on designated streets. Hotels have UTV parking. Gas stations have wide pumps for side-by-sides. Restaurants have signage saying “ATVs Welcome.”

But here’s the catch: to legally ride into town, you need valid registration. A Montana LLC plate gives you that legitimacy. Local sheriffs and town police recognize Montana plates as proof of out-of-state registration, similar to how they’d treat a North Carolina or Tennessee tourist.

Without a legal plate, you’re gambling. Even in UTV-friendly coal towns, if you get into an accident or cause property damage on an unregistered vehicle, your insurance won’t cover it. Montana registration solves this problem instantly.

The Zero Tax Tags Process

We make this process as simple as ordering a pizza. You don’t travel to Montana. You don’t deal with lawyers or accountants. We handle everything.

| Day 1: | You fill out our simple online form at ZeroTaxTags.com with your vehicle info and contact details |

| Day 2-3: | We form your Montana LLC, secure your Registered Agent, and obtain your LLC documents |

| Day 4-7: | We file the vehicle registration with Montana DMV (no inspections, no emissions, no VIN verification drama) |

| Day 8-10: | Montana license plates and registration are shipped to your Virginia address via USPS Priority Mail |

We act as your Registered Agent in Montana. We handle renewals. We provide a Montana mailing address for your LLC. You get the freedom without the bureaucratic hassle.

Total cost? A fraction of what you’d pay in Virginia property taxes over 5 years. And you get the added benefits of asset protection, privacy (your name isn’t on public registration databases), and nationwide legal compliance.

FAQ: Virginia Off-Road Restrictions

Q: Is it legal to drive a Montana-plated UTV on Virginia roads?

A: Montana registration is valid nationwide under the Full Faith and Credit Clause. However, Virginia law requires residents to register vehicles where they’re “garaged.” This strategy works best for recreational vehicles, trail riders, and those who can demonstrate the vehicle isn’t primarily garaged in Virginia (e.g., stored at a Virginia cabin you visit seasonally, or used for out-of-state trail riding).

Q: Will Virginia police ticket me for Montana plates?

A: If you’re pulled over for speeding or a moving violation, law enforcement checks your driver’s license and vehicle registration. As long as your Montana registration is valid and current, you’re legal to operate the vehicle. The issue of “garaging” is typically a civil tax matter handled by county tax assessors, not state police.

Q: Can I insure a Montana-registered UTV?

A: Yes. Major insurers like Progressive, Geico, and State Farm will insure vehicles owned by Montana LLCs. You must accurately disclose where the vehicle is physically kept (Virginia) to ensure valid coverage.

Q: What about Virginia’s “Farm Use” exemption?

A: Virginia Code § 46.2-915.1 allows OHVs to cross highways when traveling between parcels of agricultural land you own or lease. Unless you own farm property, this exemption doesn’t apply. Montana registration offers a more comprehensive solution for trail connectivity.

Q: Does this work for ATVs, dirt bikes, and military Humvees?

A: Yes. Montana will register UTVs, ATVs, side-by-sides, military surplus vehicles (with SF-97), and even custom-built off-road vehicles. If it has a VIN or can be assigned one, Montana will register it.

Break Free from Virginia Restrictions

You didn’t buy a $30,000 UTV to spend your weekends wrestling with ratchet straps and trailer ramps. You bought it to ride. Virginia off-road restrictions are killing the sport. They’re forcing you into isolated pockets of land with no connectivity. They’re charging you thousands in annual property taxes while denying you the right to drive on public roads.

Montana registration is the only legal path to street legal UTV operation for most Virginia residents. It’s not a loophole. It’s not a gray area. It’s a legitimate business structure that thousands of Americans use to protect assets and reduce tax burden.

Stop chaining your UTV to a trailer. Stop paying Virginia’s punishing 3.96% annual tax. Stop missing out on the Spearhead Trails, Shenandoah backcountry, and coal town hospitality because you can’t legally connect the dots.

Zero Tax Tags has helped thousands of off-road enthusiasts nationwide break free from restrictive state laws. We’ll do the same for you.

Ready to Escape Virginia Off-Road Restrictions?

Virginia UTV owners have saved thousands while gaining legal trail access. Join them.

Disclaimer: Zero Tax Tags provides vehicle registration services and LLC formation. We are not attorneys or tax advisors. Montana LLC registration is a legitimate business structure. Virginia residents should understand local “garaging” laws and consult with legal counsel if needed. This strategy is most effective for recreational vehicles, seasonal use, and asset protection scenarios.