11 min read

You’ve done the math. You see the massive savings on sales tax and registration fees by registering your vehicle in Montana through a Limited Liability Company (LLC). You are ready to pull the trigger with Zero Tax Tags. But there is one heavy, steel anchor dragging behind your shiny new truck or UTV: The Bank.

When you finance a vehicle, you don’t technically own it yet—the lienholder does. This adds a layer of complexity to the Montana registration process. Title transfer with lienholder involvement turns a simple paperwork shuffle into a three-way dance between you, the state of Montana, and a bank that is likely very confused about why a company in Bozeman is registering “their” truck.

Whether you are dealing with a transfer from Colorado, California, or any other high-tax state, the presence of a lienholder changes the game. Here is everything you need to know about navigating a title transfer with lienholder when you owe money on the ride.

On this page

- + The MCO: The Birth Certificate of Your Loan

- + Dealer Perfection: The Critical Handoff

- + Electronic Lien Titles (ELT): The Invisible Record

- + Paper Title with Lien Notation

- + Buyer Never Sees the Title

- + The “Wrong Address” Nightmare

- + The Montana LLC with Financing Complications

- + Lienholder Release Requirements

- + Common Lender Rejections

- + Troubleshooting: When the Bank Won’t Budge

1. The MCO: The Birth Certificate of Your Loan

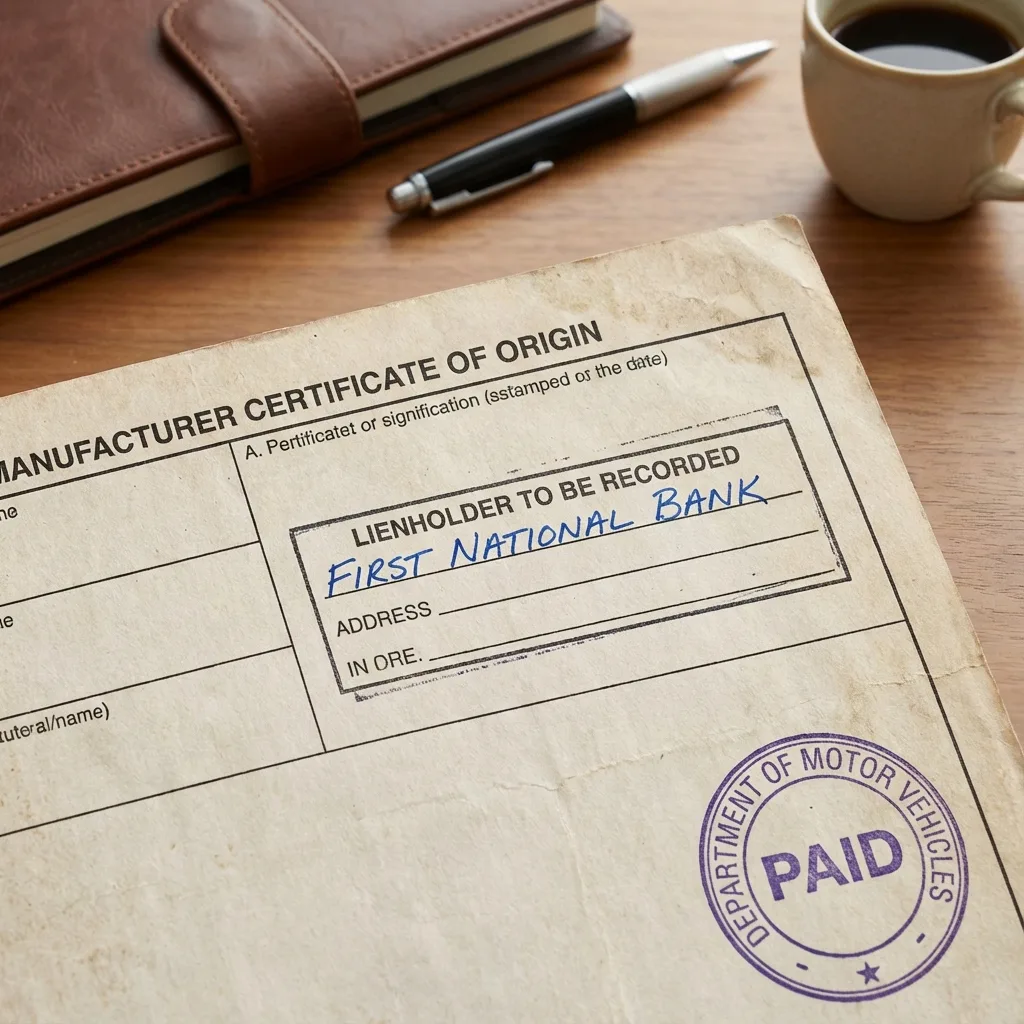

If you are buying a brand-new vehicle, the most critical document is the Manufacturer’s Certificate of Origin (MCO), sometimes called the MSO. This is the vehicle’s birth certificate.

When you finance a vehicle, the dealer is legally obligated to list the lienholder (your bank or credit union) on the back of the MCO before it is submitted to the state. This isn’t just a suggestion; it is how the lender protects their asset.

The Montana Requirement

A security interest (lien) must be perfected to be enforceable against third parties. On a new vehicle, this perfection happens when the MCO is submitted with the lienholder’s information clearly typed on the back or on the application for title.

If the dealer hands you an MCO that looks blank on the back, but you signed a loan agreement, stop. Do not leave the dealership. If that MCO gets sent to Montana without the lien recorded, the state issues a “clean” title. While that sounds nice, your bank will eventually audit the file, realize they aren’t on the title, and potentially call your loan due immediately for breach of contract.

2. Dealer Perfection: The Critical Handoff

In a standard transaction, the dealer handles the title work. They collect your taxes, send the paperwork to your local DMV, and you get plates in the mail.

When you use a Montana LLC, you are throwing a wrench in their automated gears. You are asking the dealer to perfect a lien for a Montana entity while you (likely) live in another state.

The Disconnect

Most dealers know how to perfect a lien in their home state. They do not know how to perfect a lien in Montana. They often mess this up by:

- Listing you personally as the owner on the title application, but the LLC as the registrant (Montana won’t allow this mismatch).

- Failing to include the specific filing fee required by Montana. The fee to file a lien is $8. If this $8 isn’t included, the state rejects the paperwork.

The Fix: You must instruct the dealer that the “Purchaser” on the MCO is your Montana LLC. The lienholder remains the same. If the loan is in your personal name, the bank must provide a letter authorizing the vehicle to be titled in the LLC’s name, or the loan must be refinanced into the LLC’s name (commercial lending).

3. Electronic Lien Titles (ELT): The Invisible Record

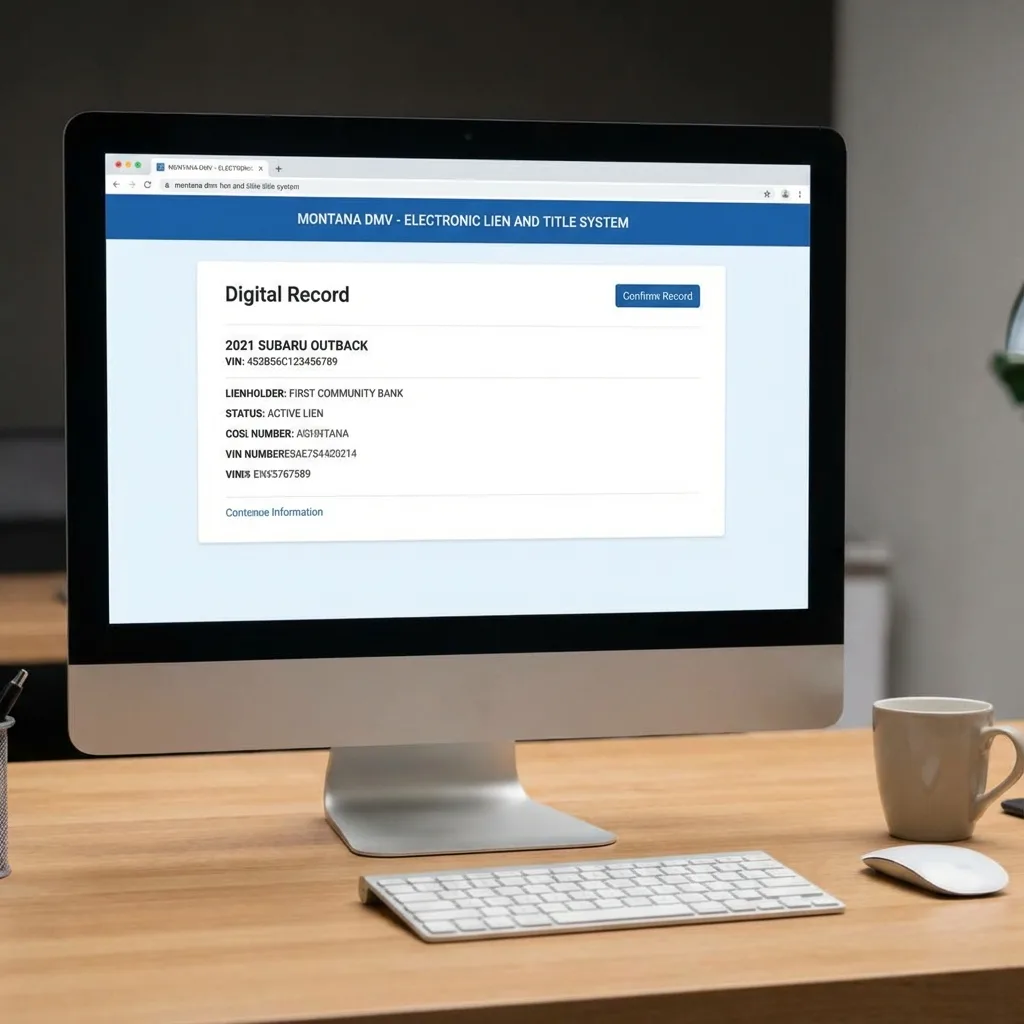

We live in a digital world, and paper titles are becoming endangered species. Montana, like many states, utilizes an Electronic Lien and Title (ELT) system.

When a security interest is entered, it is often recorded against the electronic record of the title.

What this means for you:

If your lender participates in Montana’s ELT program, no paper title is printed. The state simply marks the record in their database as “Lien Perfected.” The title remains in digital limbo until the loan is paid off.

The Complication:

If you are transferring a vehicle from another state to Montana, the existing state likely holds an electronic title. You cannot simply walk into a tag agency with a piece of paper. You have to request the current jurisdiction to “print” or “release” the paper title to Montana so the transfer can happen.

4. Paper Title with Lien Notation

If your lender is a small credit union or does not participate in Montana’s ELT system, the state will print a physical title.

However, you will not receive it.

Montana is a “title-holding” state regarding liens. When a physical title is issued with a lien, it is mailed directly to the bank. The face of the title will have a section stamped or printed with the lender’s name and address.

5. Buyer Never Sees the Title

This is the most common point of confusion for our clients.

“I registered my car three weeks ago, where is my title?”

If you owe money on it, you don’t get the title.

- ELT: The title exists as data on a server in Helena.

- Paper: The title is sitting in a fireproof filing cabinet in your bank’s collateral department.

You will receive a Registration Receipt. This is your proof of ownership for driving purposes. It shows the vehicle is registered to your LLC and lists the lienholder. Do not panic when the title doesn’t show up in your mailbox—it isn’t supposed to.

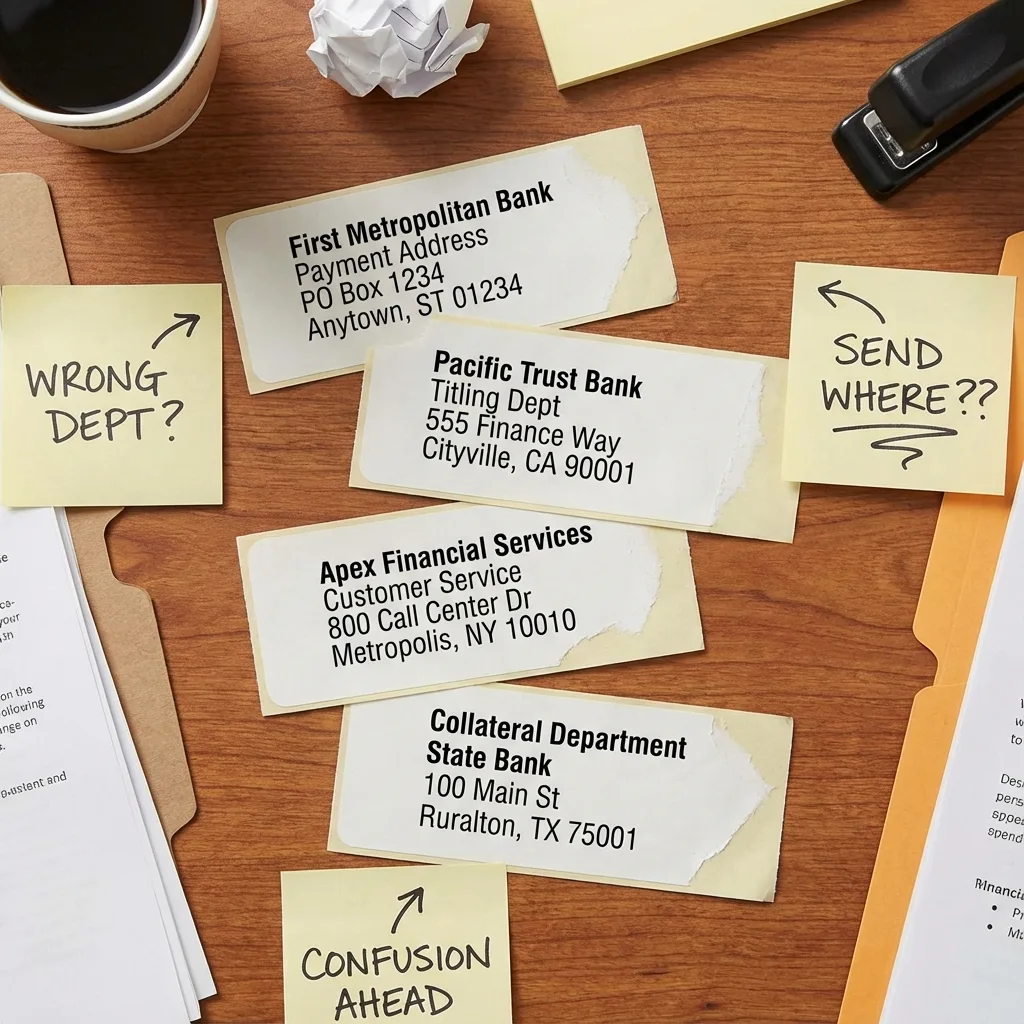

6. The “Wrong Address” Nightmare

Lienholders are notorious for having multiple addresses. They have a payment address, a customer service address, a payoff address, and a specific Titling/Collateral address.

If the dealer or the applicant lists the payment address on the title work, the title (if printed) might get mailed to a lockbox center where a machine opens it, scans a check that isn’t there, and shreds the “non-conforming document” (your title).

The Fix:

If an error occurs regarding the lienholder’s address or name, a Statement of Correction or Statement of Fact may be required to fix the record. It is vital to get the exact titling address from your lender before submitting paperwork.

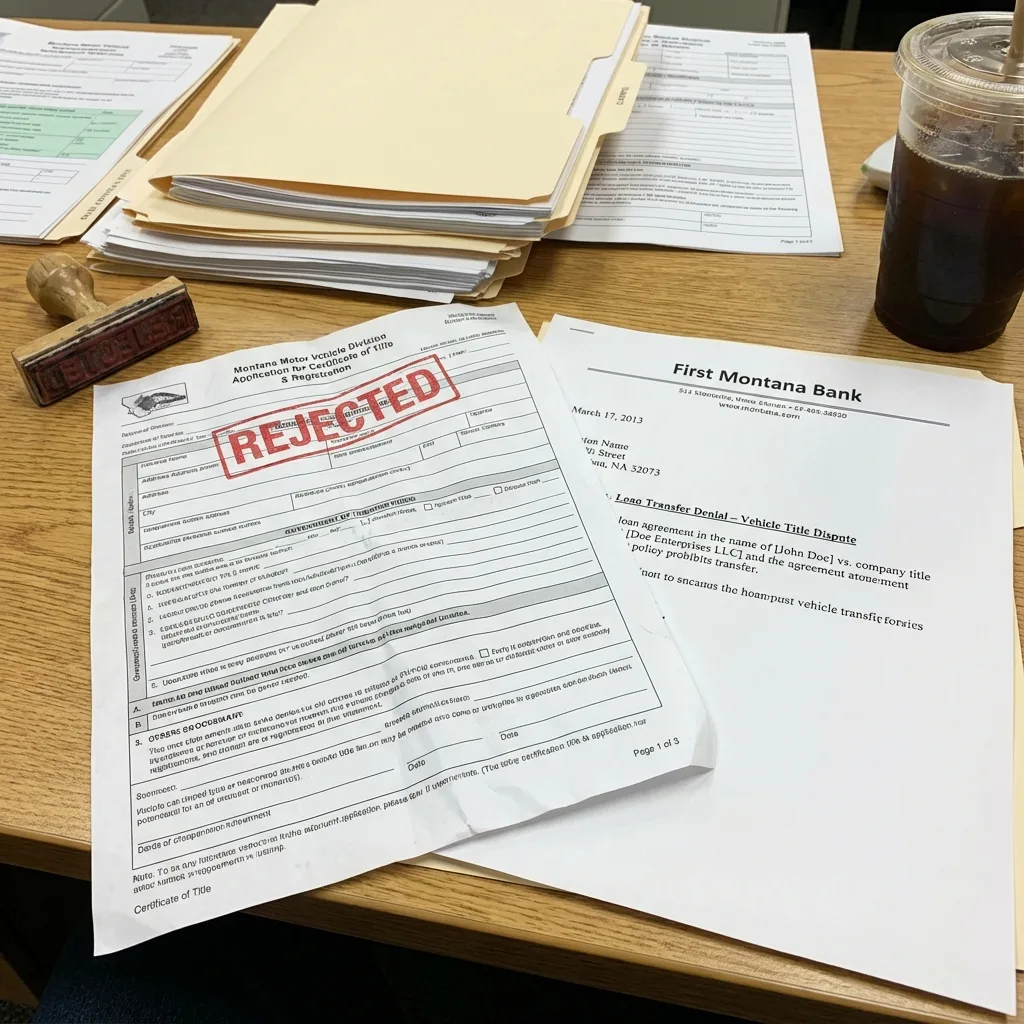

7. The Montana LLC with Financing Complications

This is the big one. This is why you are reading this blog.

You have a loan in your name (John Doe).

You want the truck titled to your company (Doe Holdings LLC).

The Rejection:

The Montana DMV generally requires the name on the title to match the name on the loan. If John Doe borrows the money, the bank expects John Doe to be on the title. If the title comes back reading “Doe Holdings LLC,” the bank may reject it because their collateral is now owned by a corporate entity they didn’t underwrite.

The Solutions:

- Refinance: The cleanest way is to get a commercial loan in the LLC’s name.

- The Permission Letter: Some lenders will sign a “Letter of Instruction” allowing you to title the vehicle in the LLC’s name as long as you (the guarantor) remain liable for the payments.

- Co-Titling: In some cases, you can title the vehicle as “John Doe AND/OR Doe Holdings LLC.” However, this can muddy the waters regarding asset protection and liability.

Related Reading: If you’re dealing with a Certificate of Origin transfer, check out our guide on How to Transfer a Certificate of Origin for complete instructions.

8. Lienholder Release Requirements

Congratulations! You paid off the truck. Now, how do you get the title into your hands?

Because Montana holds the electronic record or the bank holds the paper, the release process requires specific forms. You cannot just call the DMV and say “I paid it.”

The lender must complete a Release of Security Interest or Lien.

- The form must list the year, make, VIN, and owner name.

- It must be signed by the secured party.

- The Penalty: Montana law is strict. A secured party who fails to file a satisfaction of the lien within 21 days after receiving final payment is required to pay the department $25 for each day they are late.

Once the state receives the release (or the electronic equivalent from the lender), the lien is removed. You can then request a clean title be mailed to you (for a nominal fee).

9. Common Lender Rejections

Why would a lender stop your Montana registration?

- “Straw Purchase” Accusations: If you buy a car in Florida and immediately try to title it to a Montana LLC, the bank might flag it as a straw purchase (buying for someone else).

- Insurance Issues: The bank requires full coverage listing them as loss payee. If your insurance is in the LLC name but the loan is personal, their systems might flag a gap in coverage.

- Policy: Some major banks simply have a blanket policy: “We do not title vehicles in Montana unless the borrower lives in Montana.”

Troubleshooting: When the Bank Won’t Budge

Here are three common scenarios we see at Zero Tax Tags and how to handle them.

Scenario A: Bank Refuses to Release MCO/Title

You are trying to transfer a car you already own (but financed) from Texas to Montana. The Texas title is held by the bank. The bank says, “We won’t release the title until the loan is paid.”

The Solution:

You need to file a Request for Foreign Title Transfer.

This form acts as a formal request from the state of Montana to your lender. It tells them: “We aren’t trying to steal your collateral; we just want to register it here. Please send the title to the County Treasurer, we will record your lien, and send the new Montana title back to you.”

Scenario B: Dealer Never Sent MCO to Lender

You bought the car, drove it home, and 90 days later, you still have no plates. The dealer says “We sent the paperwork.” The Montana DMV says “We have nothing.”

The Reality:

The dealer likely messed up the “perfection” fee or the address. They might be sitting on the MCO because they don’t know how to fill out the Montana forms.

The Solution:

Demand proof of mailing. If they haven’t sent it, instruct them to send the MCO directly to the Vehicle Services Bureau in Helena with the required $8 lien filing fee. If they refused to pay the $8, the state threw the application in the trash.

Scenario C: Lender Lost the MCO

It happens more than you think. The dealer sent it, the bank got it, and then… it vanished.

The Solution:

This enters the territory of a Bonded Title.

If the MCO is gone, you cannot prove ownership. You may have to apply for a Break/Bond Title.

- You will need a VIN inspection.

- You will need to buy a surety bond for 1.5x the value of the vehicle.

- Montana holds this bond for 3 years to protect against claims that the vehicle was stolen.

More MCO Solutions: For additional help with dealer-related MCO issues, see our guide on What to Do When the Dealer Won’t Release Your MCO and Out-of-State MCO Requirements.

Summary

Transferring a title with a lienholder isn’t impossible, but it is bureaucratic warfare. The bank wants to protect their money. The state wants their $8 filing fee. You want your Zero Tax Tag.

If you miss one signature, one fee, or one address line, your application enters the void. Don’t fight the banks and the DMV alone.

Ready to Navigate Your Title Transfer with Lienholder?

Montana LLC registration with a lienholder is complex. Let Zero Tax Tags handle the three-way dance between you, the state, and your bank. We’ve perfected thousands of liens—yours is next.