11 min read

You found the perfect vehicle. Maybe it’s a specialized truck in Texas, a rare bike in Nevada, or a custom trailer in Georgia. The price was right, the dealer took your money, and they handed you a crisp, fancy piece of paper called a Certificate of Origin (CO) or Manufacturer’s Certificate of Origin (MCO).

You drove home feeling like a champion. Then, you walked into your local DMV.

That’s when the dream died. You were met with a blank stare, a demand for sales tax you thought you’d avoided, and a laundry list of inspections requiring you to physically move a vehicle that isn’t legally registered yet.

If you are holding an out of state MCO and staring down the barrel of your home state’s bureaucracy, you are in the “Red Tape Zone.” Here is exactly what the DMV is going to ask for, why they make it so hard, and how to bypass the headache entirely through Montana LLC registration with Montana MVD.

On this page

- + The Dealer Won’t Register It For You

- + The VIN Inspection Gauntlet

- + The Emissions Trap (California/Nevada)

- + Sales Tax Complications

- + Strict Bill of Sale Requirements

- + Proof of Insurance (Right State)

- + Temporary Transit Permits

- + State-Specific Variations

- + Common Rejections

- + The Montana LLC Advantage

1. The Dealer Won’t Register It For You (And Why That’s Your Problem)

When you buy a car locally, the dealer has a direct line to the local DMV. They print the temporary tag, they file the title application, and you get your metal plates in the mail.

When you buy out of state, that convenience evaporates.

Most dealers are not equipped to handle registration in all 50 states. They don’t know the specific tax rates of your county in Ohio, nor do they have access to the California DMV database. Legally, many are only required to hand you the MCO and a Bill of Sale. Once you drive off the lot, the registration burden is 100% on you.

This leaves you holding an MCO—which is not a title. It is the vehicle’s “birth certificate.” To get a title, you have to convince your state to “naturalize” the vehicle. If you mess up the paperwork, the dealer is hundreds of miles away and has very little incentive to help you fix it.

2. The VIN Inspection Gauntlet

This is the most common hurdle for out of state MCO registrations. Because the vehicle has never been titled in your state (or anywhere else), your local DMV wants proof that the vehicle actually exists and isn’t a collection of stolen parts.

They will demand a VIN Verification or Physical Inspection.

Here is the catch-22: You cannot legally drive the vehicle to the inspection station because you don’t have plates. But you can’t get plates until you get the inspection.

- Florida: Requires the HSMV 82042 form. You usually have to drag the vehicle to a police station, a DMV office, or a tax collector’s office.

- California: You need a verification of the vehicle (REG 31) completed by an authorized DMV employee or peace officer.

- Texas: Requires a specific “Safety Inspection” (VI-30) at a state-certified station before you can even approach the tax office.

If you bought a trailer or an off-road vehicle, hauling it there is annoying. If you bought a car, you risk a ticket driving it there on an expired dealer temp tag (or no tag at all).

3. The Emissions Trap (The California/Nevada Scenario)

If you live in a CARB (California Air Resources Board) state and you bought a vehicle in a non-CARB state, you might be holding a very expensive paperweight.

Scenario: A California resident buys a new car in Nevada to save a few bucks or because stock was available.

California has a strict “7,500-mile rule.” If you are a California resident and you acquire a new vehicle (defined as having less than 7,500 miles) from another state, it must be 50-state certified.

Many vehicles sold in Nevada or Arizona are “49-state” vehicles. They meet federal standards but not California’s stricter smog laws. If you walk into the CA DMV with a Nevada MCO for a 49-state car with 500 miles on it, they will refuse to register it. There is no fix for this at the CA DMV level. You cannot just “pay a fine.” You essentially cannot register that car in California until it has 7,500 miles on it.

Warning: This is why many California residents use Montana LLC registration to bypass California’s CARB restrictions entirely. Montana doesn’t enforce California’s emissions laws.

4. Sales Tax Complications (Home State Wants Their Cut)

This is the one that hurts your wallet the most. Many buyers assume that if they buy in a state with lower sales tax, they save money.

False.

Your home state DMV doesn’t care what you paid (or didn’t pay) to the dealer. They care about where the vehicle is domiciled.

- If you buy a car in Montana (0% tax) and bring it to Florida, Florida will demand their 6% sales tax (plus discretionary surtax) the moment you try to swap that MCO for a Florida title.

- If you paid 3% tax to the dealer in North Carolina and move it to a state with 8% tax, your home state will usually demand you pay the difference (the remaining 5%).

The DMV will ask for a Bill of Sale that clearly breaks down exactly how much tax was collected. If that number is zero, or lower than your home state’s rate, get your checkbook ready. You aren’t getting plates until the difference is paid.

5. Strict Bill of Sale Requirements

An MCO proves the vehicle exists, but a Bill of Sale proves you own it. When dealing with out-of-state transactions, a handwritten napkin won’t cut it.

DMVs are notoriously picky about the Bill of Sale when an MCO is involved. They typically require:

- Odometer Disclosure Statement: Federal law requires this for vehicles under a certain age. If it’s missing or not on the specific state form your DMV likes, you get rejected.

- Notarization: Some states require the seller’s signature to be notarized. If you bought from a dealer, this is usually fine. If it was a private party sale involving an un-titled vehicle (rare but happens with off-road toys), a missing stamp means a rejected application.

- Purchase Price Verification: If the price looks “too low,” the DMV may reject the Bill of Sale and charge you tax based on the “Book Value” (NADA/KBB) instead of what you actually paid.

6. Proof of Insurance (From the Right State)

You have insurance. Great. But is it the right insurance?

Scenario: A New York resident buys a car in Pennsylvania.

New York is incredibly strict. You cannot register a vehicle in NY without an NY-specific insurance ID card with a barcode scannable by the DMV. A binder or a policy declaration page from a PA agent often won’t work.

When you walk into the DMV with an out of state MCO, they will scrutinize your insurance to ensure it meets the minimum liability standards of the state you are registering in, not the state you bought it in. If your policy hasn’t been updated to reflect the new jurisdiction, you’re walking out empty-handed.

7. Temporary Transit Permits

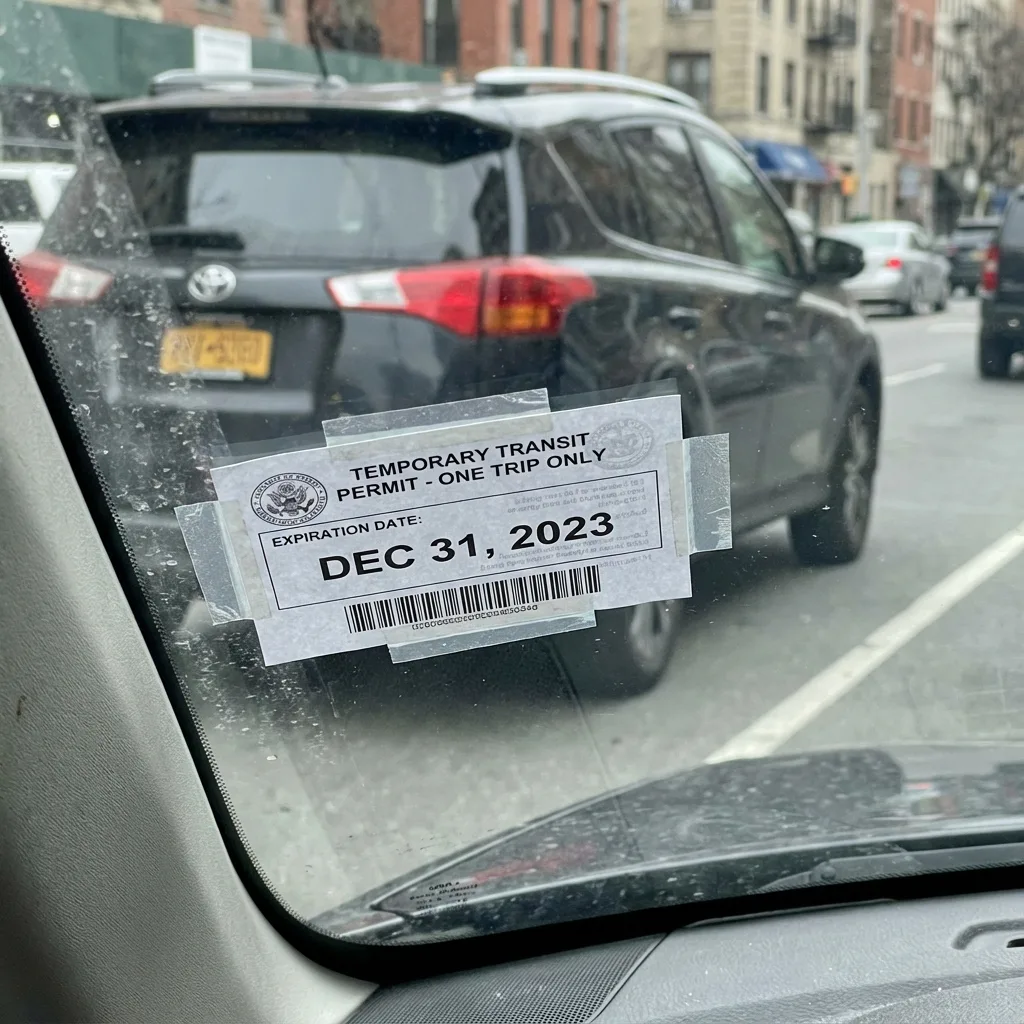

How do you legally get the vehicle from the seller to your home state?

If the dealer didn’t give you a temp tag (common with private sales or trailer/powersports MCOs), you are in a bind. You cannot drive a vehicle without plates.

You must apply for a Transit Permit or One-Trip Permit from the state where you purchased the vehicle. This allows you to drive the vehicle only to the border or your destination.

- These permits are often valid for only a few days.

- If you get pulled over in a third state along the way with an expired transit permit, expect an impound.

8. State-Specific Variations: The “Gotchas”

Every state handles out of state MCO registrations differently. Here is a quick look at the headaches in popular states:

- California: As mentioned, the 7,500-mile smog rule is the killer. Plus, you have 20 days to register before penalties kick in.

- Florida: High initial registration fees. If you are new to the state, the “New Wheels on the Road” fee is $225 on top of title and tag fees.

- Texas: You must pass a Texas vehicle safety inspection before you go to the county tax office. No inspection, no registration. This applies even if the car is brand new with an MCO.

- New York: Requires a specific “Sales Tax Clearance” (Form DTF-802 usually) claiming you paid tax, or you pay it right there. They are aggressive about out-of-state purchases.

- Pennsylvania: Requires a tracing of the VIN plate (pencil rubbing) or verification by a mechanic/notary.

9. Common Rejections

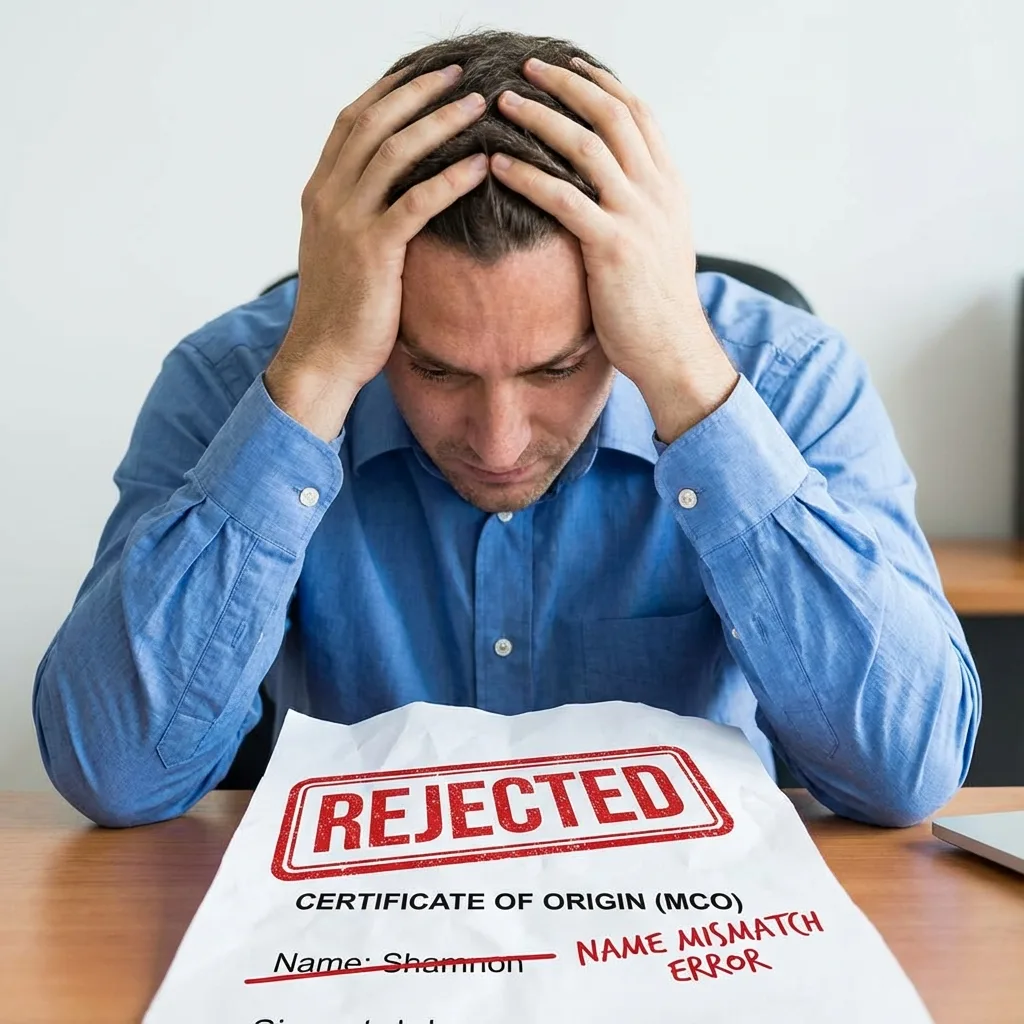

Why do people fail when trying to register an out of state MCO themselves?

- Name Mismatch: The name on the MCO (assignment block) must match the name on the application exactly. If the dealer wrote “Jon Smith” but your license says “Jonathan Smith,” some DMVs will reject it.

- Alterations: If there is any cross-out, white-out, or scribbling on the MCO, the DMV will void it. You will have to go back to the manufacturer for a duplicate MCO, which can take weeks.

- Chain of Ownership: If the MCO was assigned from the Manufacturer → Dealer A → Dealer B → You, you need proof of all those transfers. If a link is missing, the chain is broken, and the DMV won’t title it.

Pro Tip: Document everything. Keep copies of your purchase agreement, wire transfer confirmations, and any emails or texts with the dealer. This paperwork is critical if you need to file a complaint or lawsuit.

See how others have successfully handled MCO issues:

- How to Transfer a Certificate of Origin 2026: Step-by-Step Guide

- Dealer Won’t Release Your MCO 2026: How to Recover a Stuck Certificate of Origin

10. The Montana LLC Advantage (The Ultimate Fix)

If reading the above made you tired, there is a shortcut.

You can skip the local DMV, skip the inspections, and often skip the sales tax by using a Montana LLC.

Scenario: A Florida resident buys a UTV or luxury car in Montana (or anywhere else).

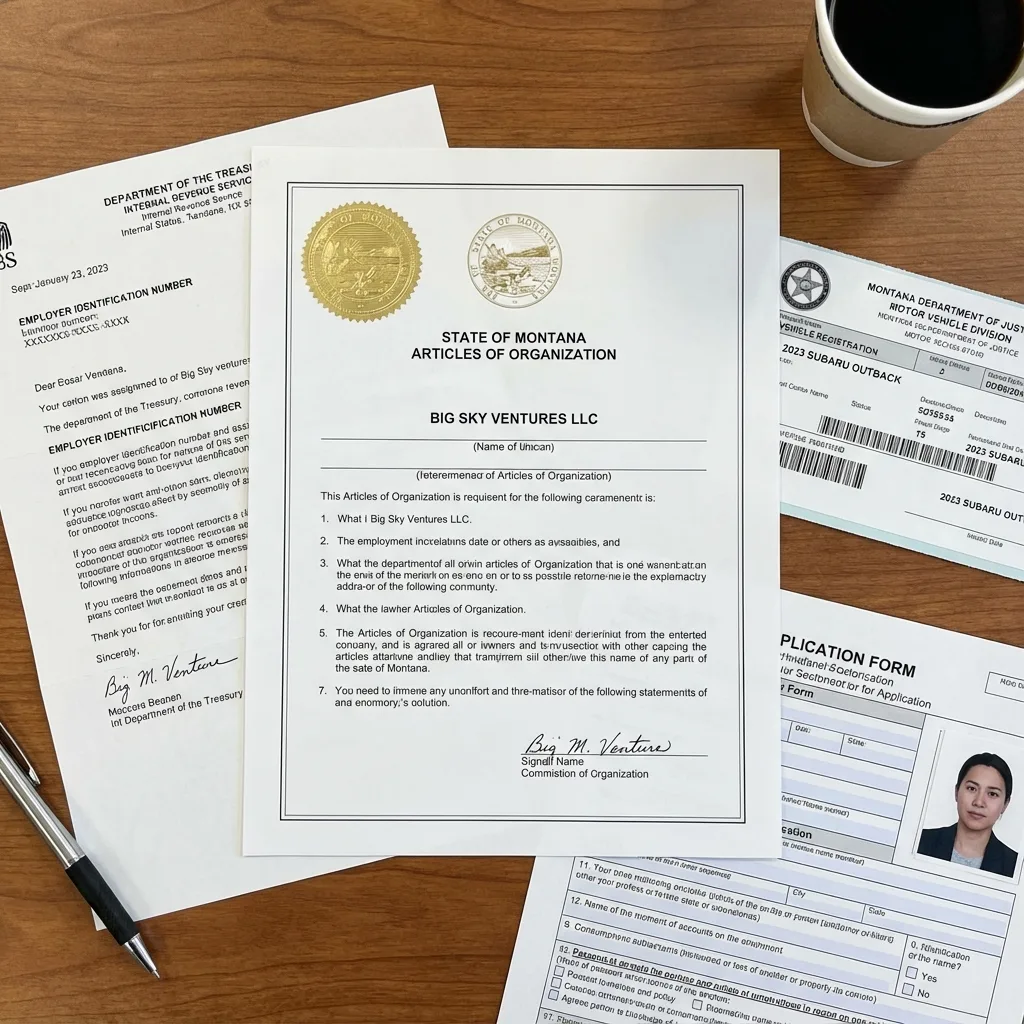

Instead of transferring that MCO to Florida (paying 6% tax, doing a VIN check, and paying high fees), you transfer the MCO to a Limited Liability Company (LLC) based in Montana.

- No Physical Presence: You do not need to live in Montana. The LLC lives there.

- No Sales Tax: Montana has 0% sales tax on vehicles.

- Easy MCO Handling: Montana is accustomed to handling MCOs from all over the country. They don’t require you to bring the vehicle to Montana for a VIN inspection.

- Permanent Plates: For older vehicles, Montana offers permanent registration. Pay once, and never visit the DMV again.

This is not a loophole; it is a legal asset-holding structure. Your LLC owns the vehicle, and you own the LLC. You get a legal title, registration, and license plate mailed to your door.

Example: A Texas resident with an Oklahoma trailer MCO can send it to Zero Tax Tags. We form a Montana LLC, title the trailer to the LLC, and the owner receives a license plate by mail. No Texas inspection. No 6.25% sales tax.

Zero Tax Tags: We Handle Out-of-State MCO Complications

An MCO should be a ticket to freedom, not an invitation for the state to audit your wallet and waste your time.

If you have an out of state MCO and the DMV is giving you the runaround—or if you simply want to avoid the taxes and inspections from day one—Zero Tax Tags is your solution. We deal with the bureaucracy so you can just drive.

Don’t let a piece of paper park your ride.

Ready to Skip the Out of State MCO Nightmare?

Vehicle owners across America have saved thousands by registering through Montana LLCs instead of fighting their home state’s bureaucracy. No VIN inspections, no emissions tests, no sales tax.