15 min read

On this page

- + The Empire State is Bleeding You Dry

- + The New York Vehicle Tax Shakedown

- • The Property Tax Double Whammy

- • The Bureaucratic Nightmare

- + Real Stories of Financial Pain

- + Why Montana? The Legal Strategy

- + The ZeroTaxTags Advantage

- + The Math Don’t Lie

- + Frequently Asked Questions

- + Step-by-Step Guide to Freedom

- + Stop Waiting

The Empire State is Bleeding You Dry

You can feel it the moment you cross the bridge or exit the tunnel. It’s in the air. It’s in the crumbling pavement of the BQE, the endless construction on the LIE, and the sheer, frantic pace of the city. New York. The center of the universe. The city that never sleeps. But if you live here—whether you’re in a high-rise in Manhattan, a sprawling estate in Westchester, or a family home in Nassau County—you know there’s something else that never sleeps: The New York vehicle tax collector.

Living in New York requires a level of financial stamina that most of the country can’t even comprehend. You pay some of the highest income taxes in the nation. Your property taxes in the suburbs are literally the highest in America. You pay a premium for milk, for gas, for insurance, and for the privilege of breathing the air.

And then, you decide to reward yourself. You’ve worked hard. You’ve ground through the corporate ladder or built your own business from scratch. You want to buy that Porsche 911 you’ve dreamed of. You want to pick up a Class A motorhome to escape the city on weekends. You need a heavy-duty truck for your contracting business.

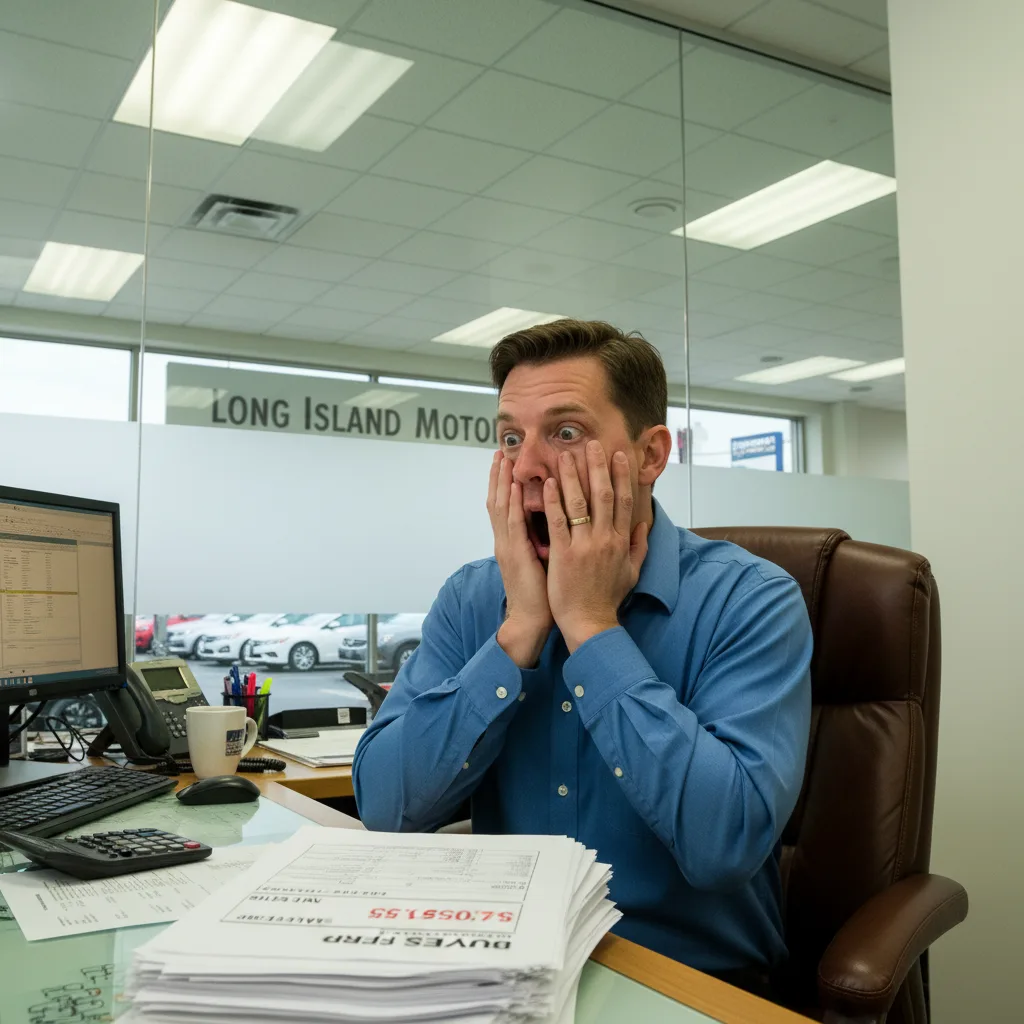

You walk into the dealership. You negotiate the price. You feel good. Then the finance manager slides the paper across the desk.

Sales Tax: $14,650.

Your stomach drops. That isn’t the price of the car. That’s just the fee for the privilege of buying it. That is money that vanishes into the abyss of Albany’s general fund, never to be seen again.

If you are tired of being treated like an ATM by the State of New York, you are not alone. There is a reason people are fleeing the state in droves. But you don’t have to move your family to keep your money. You just need to change where your vehicle lives on paper.

Welcome to the Montana Strategy. Welcome to ZeroTaxTags.com.

Part 1: The New York Vehicle Tax Shakedown—Doing the Math

Let’s be brutally honest about the numbers, because the state relies on you not doing the math until it’s too late.

In New York, “sales tax” is a deceptive term. The state base rate is 4%. If that were the end of the story, it would be manageable. But in New York, nothing is ever that simple. Every layer of government wants a slice of your pie.

By the time you add in mandatory county taxes and the Metropolitan Commuter Transportation District (MCTD) surcharges, the real number skyrockets:

Let’s put that into perspective. If you live in Manhattan and you buy a $150,000 Range Rover, you aren’t just paying $150,000. You are writing a check to the New York DMV for $13,312.

Thirteen. Thousand. Dollars.

That is the cost of a luxury vacation. That is a year of college tuition at a state school. That is a substantial investment into a retirement account. Instead, it is handed over to a bureaucracy that forces you to drive on pothole-ridden roads and wait in line for hours to renew a registration.

The Double Whammy: Property Taxes

The sales tax stings the most because it is an upfront lump sum. But it hurts even more because your wallet is already empty. If you live in Westchester County, you are paying the highest property taxes in the United States. It is not uncommon for a modest home to have a $25,000 annual tax bill. In parts of Long Island, $15,000 to $20,000 is the norm.

The state government treats its residents as an infinite resource. They assume you will just keep paying because “it’s New York.” They assume you are trapped.

But when you combine the highest property taxes, oppressive income taxes, and nearly 9% sales tax on vehicles, you reach a breaking point. It stops being about “civic duty” and starts feeling like financial abuse.

The Bureaucratic Nightmare: Inspections and Registration

It doesn’t end when you drive off the lot. New York’s vehicle inspection program is harsh, mandatory, and annoying:

- Annual Safety Inspections: Missed it by a week? Ticket.

- Emissions Testing: Buying a high-performance car? Good luck. The check engine light comes on for a minor sensor issue? You fail. You can’t renew your registration. You are grounded.

- Registration Fees: Based on weight. The heavier the car (like that SUV or electric vehicle), the more you pay, every two years, forever.

The DMV Experience: You take a half-day off work. You stand in a line that wraps around the block. You deal with surly clerks who look at you like you’re an inconvenience. It is a soul-sucking experience designed to make you submit.

Part 2: Real Stories of Financial Pain (And Relief)

To understand why thousands of New Yorkers are turning to ZeroTaxTags.com, you have to look at the real-world scenarios. These aren’t hypothetical numbers; these represent the daily reality of residents in the Tri-State area.

Scenario A: Mike the Long Island Contractor

Meet Mike. Mike owns a construction company based in Nassau County. He works 60 hours a week. He needs a new heavy-duty truck to haul equipment—a fully loaded Ford F-450 Platinum.

Mike operates on thin margins. Material costs are up. Labor costs are up. Handing over $9,000 to the state for a work truck feels like a punch in the gut. That’s the cost of a new hydraulic lift or bonuses for his crew.

The Solution: Mike calls ZeroTaxTags. He forms a Montana LLC for his business assets. Montana Tax Rate: 0%. Savings: $9,056 immediately kept in his pocket. Bonus: Permanent registration. No annual commercial weight fee hikes.

Scenario B: Elena the Wall Street Reward

Meet Elena. She’s a trader in Manhattan. She’s had a banner year and wants to treat herself to a McLaren GT. She lives in a condo in Chelsea and pays an exorbitant amount for a parking spot.

Nearly twenty thousand dollars in tax. Elena is savvy; she understands compound interest. She knows that $19,000 invested today is worth hundreds of thousands in twenty years. Throwing it away on sales tax is bad business.

The Solution: Elena uses ZeroTaxTags to set up a holding company in Montana. The LLC buys the McLaren. Montana Tax Rate: 0%. Savings: $19,081. Privacy: The car is registered to the LLC, keeping her personal name off the public database.

Scenario C: Roberts and Linda’s Retirement Dream

Meet Roberts and Linda. They live in Westchester. They just retired and sold their family home to downsize, and they want to buy a Class A Diesel Pusher RV to tour the country. This is their life savings.

Thirty-seven thousand dollars. That is literally the fuel budget for three years of touring the country. If they register this RV in New York, they are burning that money before the engine even turns over.

The Solution: ZeroTaxTags handles the transaction. Montana Tax Rate: 0%. Savings: $37,687. Bonus: No inspections. Dealing with inspections on a 40-foot bus in New York is a logistical nightmare. In Montana? It doesn’t exist.

Part 3: Why Montana? The Legal Loophole That Isn’t a Loophole

So, how is this possible? Is it magic? Is it evasion? No. It is a matter of sovereignty and property law.

Montana has a unique philosophy compared to New York. Montana has no general sales tax. Montana believes that if you own property, you shouldn’t be penalized for it annually with inspections and excessive fees.

But you don’t live in Montana. You live in Queens, or Buffalo, or Montauk. This is where the Montana Limited Liability Company (LLC) comes into play.

Here is the legal structure:

- You do not buy the car personally.

- You form a Montana LLC. This LLC is a legal entity, a “person” in the eyes of the law, that resides in Montana.

- The LLC buys the car. Because the owner of the vehicle (the LLC) is a Montana resident, the vehicle is subject to Montana tax laws.

- Montana Tax Law says: 0% Sales Tax.

- You own the LLC. You control the company that owns the car.

This is asset protection 101. The wealthy have used structures like this for real estate and jets for decades. It is not “hiding” money; it is structuring your assets in the most tax-efficient jurisdiction available.

The Inspection Liberation

For New Yorkers, the tax savings are the headline, but the lack of inspections is the unsung hero.

If you modify your car—tinted windows, aftermarket exhaust, engine tunes—New York hates you. They will fail your inspection, fine you, and force you to reverse the modifications.

Montana does not care. There are no vehicle inspections in Montana. No emissions testing. No safety stickering. You are treated like an adult who is responsible for their own vehicle. For car enthusiasts in the tri-state area, this is absolute liberation. Similar strategies work for residents facing the Arizona VLT, Virginia Car Tax, and Nevada’s 8.25% Tax.

Part 4: The ZeroTaxTags Advantage

You might be thinking, “Can’t I just file some paperwork myself?” Technically, yes. You could also perform your own dental work, but we wouldn’t recommend it.

Navigating the Montana Secretary of State, the Montana Department of Justice (DMV), and the various county treasurer offices requires precision. One wrong form, one missed signature, or an incorrect registered agent designation, and your application gets rejected. Or worse, the LLC is formed incorrectly, piercing the corporate veil and leaving you exposed.

ZeroTaxTags.com is your concierge service. We cut through the red tape so you don’t have to.

What We Handle for You:

| 1. | Same-Day LLC Formation: We file the articles of organization immediately. We provide the Registered Agent service (a physical requirement in Montana). |

| 2. | DMV Liaison: We physically go to the county treasurer’s office. We stand in line so you don’t have to. |

| 3. | Plate Procurement: We handle the title work and mail the plates and registration directly to your doorstep in New York. |

| 4. | Luxury & Exotic Expertise: We know how to handle titles for Ferraris, McLarens, Classics, and heavy RVs. |

Part 5: The Math Don’t Lie—Look at What You Save

Let’s break down the savings across different vehicle categories. We will use an average sales tax rate of 8.6% (a blend of NYC, Long Island, and Westchester).

Look at that column on the right. $51,600 on an RV. That isn’t savings; that is an entire annual salary for some people. That is life-changing money.

The “Luxury” Tax Trap

New York doesn’t just stop at sales tax. For vehicles over $100,000, additional fees and assessments can apply during registration.

With a Montana LLC, the registration fees are flat and predictable. For vehicles 11+ years old, you can get a Permanent Registration. You pay once, and you never renew again. No annual sticker. No annual check to the DMV. Done forever.

Part 6: Frequently Asked Questions (FAQ)

We know you have questions. This sounds too good to be true, but it is simply a matter of understanding jurisdiction.

Q: Is this legal for a New York resident?

A: Owning a Montana LLC is 100% legal. It is your right as an American citizen to form a business entity in any state you choose. A Montana LLC can legally own property, including vehicles. The vehicle is registered to the LLC, not to you personally. However, you must be aware of New York’s specific laws regarding “garaging” and “residency.” Many of our clients use this for second cars, show cars, RVs that travel, or vehicles stored partly out of state.

Q: What about insurance?

A: You simply insure the vehicle in the name of the LLC. Most major carriers (Progressive, Geico, Hagerty, State Farm) can write a commercial or business policy for an LLC. You must be honest with your insurer about where the vehicle is garaged.

Q: Do I need a special driver’s license?

A: No. You drive the vehicle with your standard New York driver’s license. You are authorized to drive a corporate vehicle (which is what this is).

Q: How does this work for financing?

A: It is easiest if you own the vehicle outright. However, many lenders will finance a vehicle under an LLC, provided you (the individual) sign as a personal guarantor.

Q: What if I get pulled over?

A: You show your valid NY driver’s license and the valid Montana registration and insurance card (in the LLC’s name). Driving a car owned by a business is a daily occurrence.

Q: Can I do this for a car I already own?

A: Yes, but the main benefit is avoiding sales tax at the point of purchase. If you already paid NY tax, you won’t get a refund. However, you can transfer it to MT to stop paying annual inspections, emissions testing, and expensive renewal fees.

Part 7: Step-by-Step Guide to Freedom

Ready to opt out of the New York vehicle tax system? Here is the roadmap:

| Step 1: | Don’t Sign the Title Yet. If you are at the dealership, tell them you are registering the vehicle to a Montana business. Do not let them calculate NY sales tax. |

| Step 2: | Go to ZeroTaxTags.com. Select our “New LLC & Registration” package. It takes about 5 minutes to fill out the form. |

| Step 3: | Upload Your Documents. We need the Bill of Sale or Title (signed over to the LLC) and a copy of your ID. |

| Step 4: | We Go to Work. We file the LLC with the state using expedited processing. We obtain the tax ID. We take the paperwork to the county treasurer. |

| Step 5: | Receive Your Plates. A package arrives at your door with your shiny new Montana plates and official registration. |

| Step 6: | Drive. Mount the plates. Cancel your NY registration (if applicable). Enjoy the road. |

Conclusion: The Cost of Waiting

Every day you wait is a risk:

- The risk of buying that car and realizing you are $10,000 over budget because of taxes.

- The risk of failing an inspection because of a tint violation.

- The risk of handing your hard-earned wealth over to a state government that squanders it.

New York relies on your compliance. They rely on you thinking there is no other way. They rely on the “status quo.”

But the wealthy have always played by different rules. They use entities, structures, and different jurisdictions to protect their wealth. Now, ZeroTaxTags.com brings that same power to you.

You can love New York—the pizza, the culture, the energy—without loving its New York vehicle tax policy. You can live in the city without letting the city rob your bank account.

Stop paying for the privilege of owning property.

Don’t write that check to Albany.

Ready to Keep Your Money in Your Pocket?

New Yorkers have saved millions with Montana LLC registration. You’re next.

Why Choose ZeroTaxTags?

- Speed: We are the fastest in the industry.

- Transparency: No hidden fees. Our pricing is flat and clear.

- Support: Real humans answering your questions.

- Experience: We have registered thousands of vehicles for clients just like you—New Yorkers who decided enough was enough.

(Disclaimer: ZeroTaxTags.com provides vehicle registration services. We are not tax attorneys or financial advisors. You should consult with your own tax professional regarding your specific tax liabilities and compliance with your local state laws.)