11 min read

On this page

- + The MCO Trap

- + Part 1: The Notarization Nightmare

- • Why the Confusion Exists

- • State-by-State Variations

- • How to Verify Safely

- + Part 2: Buying with Only an MCO

- • Normal vs. Red Flag Scenarios

- • The Title Jumping Trap

- • Fraud Risks & Counterfeits

- • Red Flags to Spot

- • Verification Checklist

- + Montana LLC Specific Issues

- + Conclusion

The MCO Trap: Is Your “New” Car Legit?

You’ve found the perfect vehicle. Maybe it’s a brand-new side-by-side, a trailer, or a low-mileage luxury SUV. But instead of a standard state title, the seller hands you a piece of paper that looks like a stock certificate. It says Manufacturer’s Certificate of Origin (MCO) or Manufacturer’s Statement of Origin (MSO).

They tell you, “It’s basically the same as a title. You just take this to the DMV, and you’re good to go.”

Stop right there.

While an MCO notarization is indeed the “birth certificate” of a vehicle, handling one incorrectly—or buying a vehicle from a private party who has one—can lead to a DMV nightmare, tax evasion charges, or the realization that you just bought a stolen car.

At Zero Tax Tags, we handle thousands of vehicle registrations for our Montana LLC clients. We see everything from pristine, dealer-direct MCOs to forged documents that would land you in handcuffs. We are going to walk you through the two biggest hurdles regarding MCOs: Notarization requirements and Fraud detection.

If you are holding an MCO, or about to buy a vehicle with one, this is the most important article you will read today.

Part 1: The Notarization Nightmare

One of the most common questions we get at Zero Tax Tags is: “My MCO has a spot for a notary public to sign. Do I actually need to get this notarized?”

The answer is the most frustrating answer in the automotive world: It depends.

Manufacturers print MCOs on standardized security paper. Because some states require MCO notarization, the manufacturers include a “Notary Public” section on the back of every MCO just to be safe. However, just because the blank space exists doesn’t mean your specific situation requires a stamp.

If you mess this up, the DMV (or the Montana Motor Vehicle Division) will reject your paperwork, sending you back to square one.

Why the Confusion Exists

The confusion stems from the conflict between manufacturer templates and state laws.

- The Form: The MCO is a generic document used in all 50 states. It has spaces for odometer readings, lienholder info, and notarization.

- The Dealer: A dealer in a state that doesn’t require notarization might leave that section blank.

- The Destination: If you take that non-notarized MCO to a state that does require it, you are stuck in limbo.

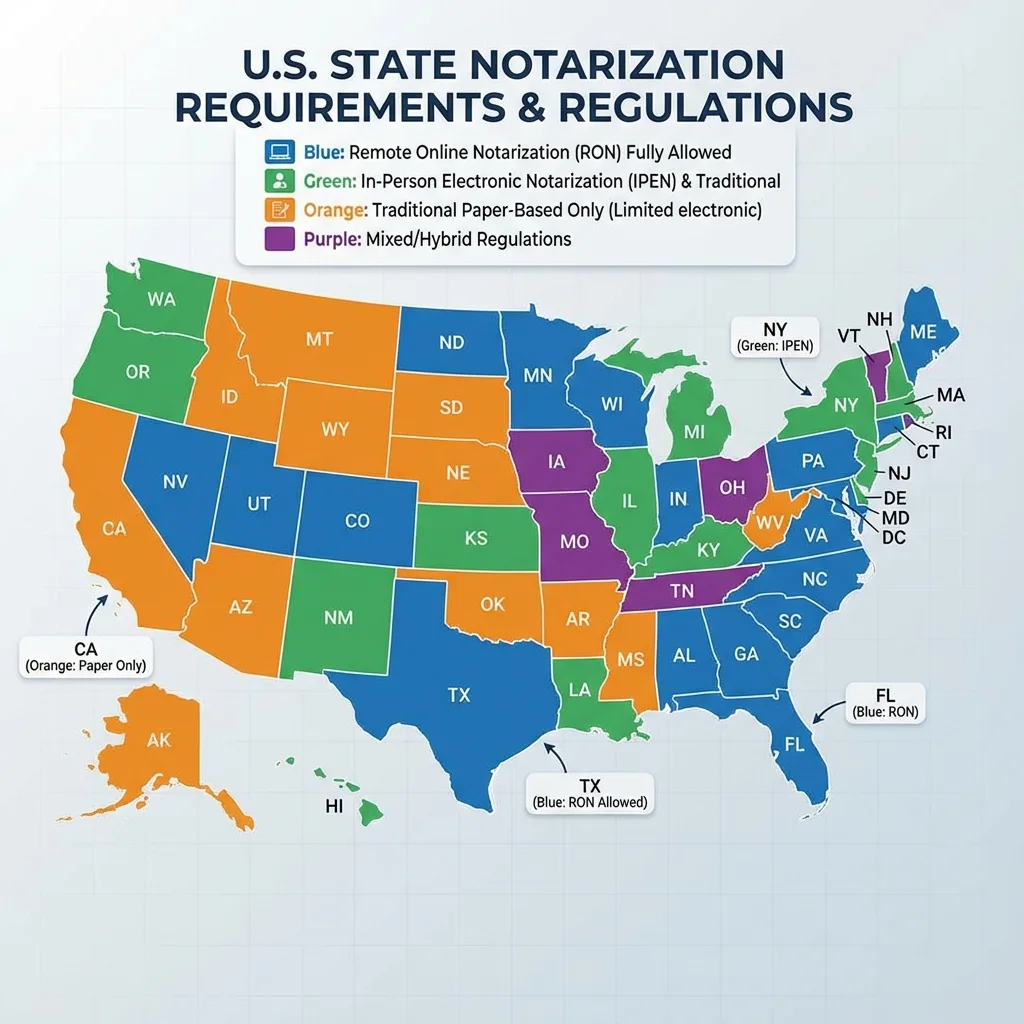

State-by-State Variations

Here is a breakdown of how different states handle the MCO notarization requirement. This is critical if you are an out-of-state buyer or setting up a Montana LLC.

The Golden Rule: When registering a vehicle through a Montana LLC, more proof is always better.

How to Verify Safely

If you are holding an MCO and aren’t sure if you need a notary:

- Check the Destination State: It doesn’t matter what the state selling the car requires; it matters what the state titling the car requires.

- When in Doubt, Notarize: If you have access to the seller/dealer, ask them to notarize it. It costs a few dollars and prevents weeks of rejection delays.

- Get a Notarized Bill of Sale: Even if the MCO isn’t notarized, having a separate Bill of Sale that is notarized often solves the problem. It proves to the DMV clerk that the signature isn’t a forgery.

Montana LLC Specific Consideration: If you are using Zero Tax Tags to register your vehicle, we review your paperwork before it goes to the state. We know exactly what the Montana DMV looks for. If your MCO is missing a critical stamp, we catch it before it results in a rejection letter.

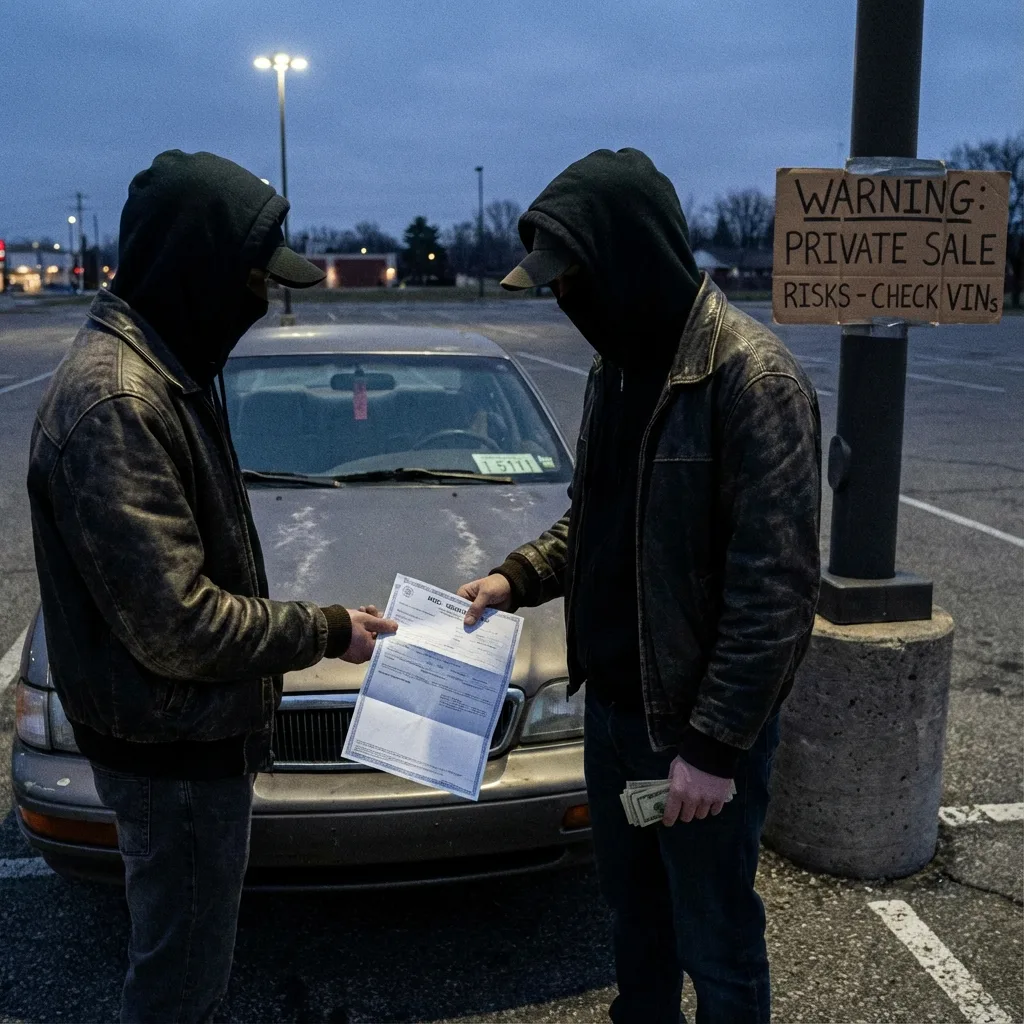

Part 2: Buying a Vehicle with Only an MCO (The Danger Zone)

Now let’s talk about the much scarier side of MCOs: Buying a vehicle from a private seller who hands you an MCO instead of a title.

In the world of vehicle titling, an MCO is usually only seen by the dealer and the first owner. Once that first owner goes to the DMV, the MCO is surrendered, and a Title is issued.

If you are meeting a guy in a parking lot to buy a “barely used” Hellcat or a “brand new” trailer, and he hands you an MCO, you need to be on high alert.

When It’s Normal vs. Red Flag

Normal Scenario:

- You are buying a brand-new vehicle from a licensed franchise dealership.

- You are buying a custom-built trailer or kit car directly from the manufacturer.

- You are buying a grey-market import that has never been titled in the US (requires specific import docs).

Red Flag Scenario:

- Private Party Sale: “I bought it, but I never got around to titling it.”

- “New” Used Car: The vehicle has 2,000 miles on it, but the seller claims it’s “still on the MCO.”

- Temp Tag Abuse: The vehicle is 6+ months old but still has expired temporary tags.

The Private Party Trap: “Title Jumping”

Why would a private seller have an MCO? Usually, it’s because they are Title Jumping.

This happens when Person A buys a vehicle from a dealer but wants to avoid paying sales tax and registration fees. They take the MCO home and stick it in a drawer. They drive the car for six months (often illegally or on fake temp tags), and then decide to sell it to you (Person B).

They hand you the MCO and say, “Just sign your name as the first owner. You’ll be the first owner on the title!”

The Risks:

- It is Illegal: This is tax evasion. The seller is skipping their tax liability and passing the paperwork headache to you.

- Broken Chain of Custody: The MCO might already be signed over to Person A on the back. If you try to scratch that out or write over it, you have voided the document. The DMV will reject it.

- No Verify: You have no way of knowing if Person A actually paid off the dealer. The dealer could still hold a lien on that MCO.

Warning: Title jumping is illegal and can result in you losing both the vehicle and your money. Never participate in a transaction where you’re asked to “sign as the first owner” when the vehicle has clearly been used.

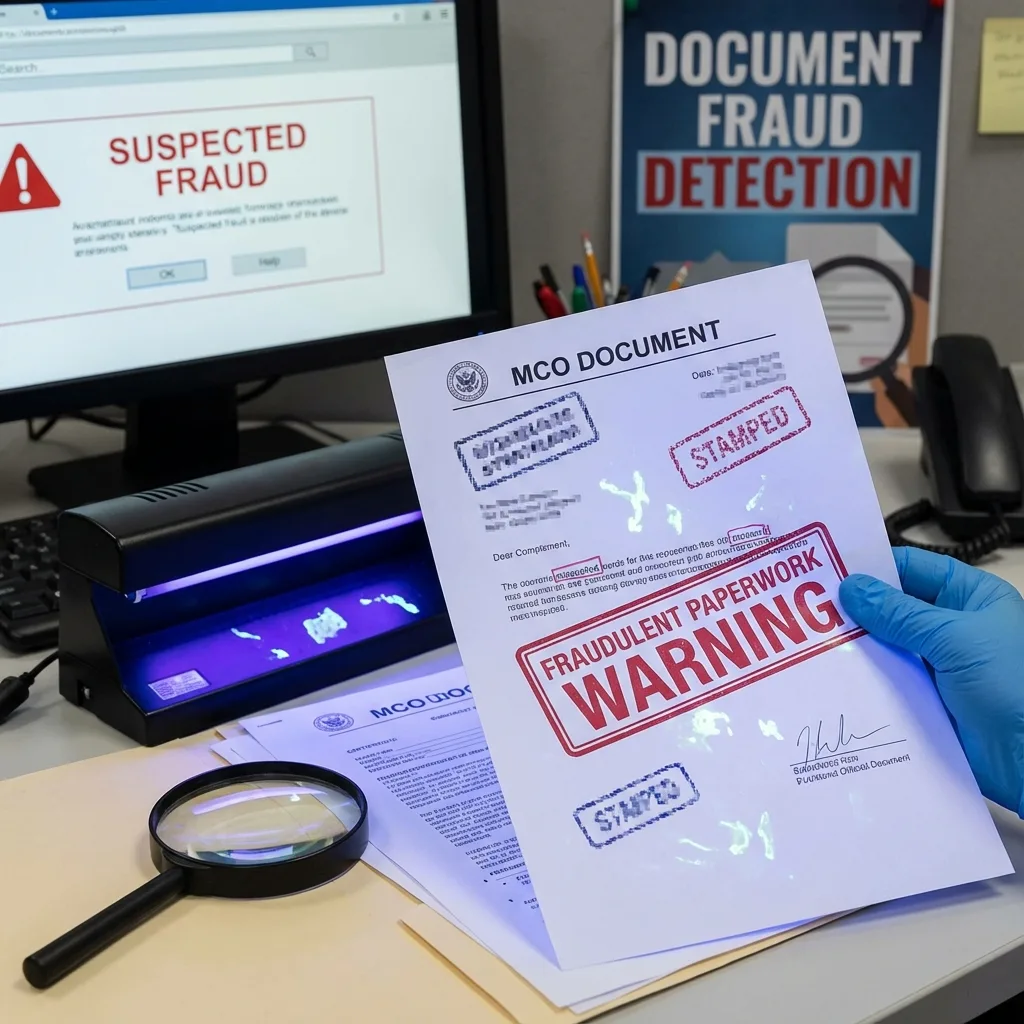

Fraud Risks: The Counterfeit Market

The bigger risk is that the MCO is fake.

Florida DMV Fraud Alert: Florida has seen a massive spike in counterfeit MCOs associated with high-end luxury vehicles (Bentleys, Mercedes G-Wagons) and muscle cars (Hellcats, Corvettes). Scammers steal these vehicles, create a high-quality fake MCO using a template found online, and sell the car to an unsuspecting buyer for cash.

Oregon DMV Warning: Oregon reported rings of thieves attaching fake VIN plates to stolen vehicles and fabricating MCOs to match. The paperwork looks real, the VIN on the dash matches the paperwork, but the car is stolen property.

The “Internet Template” Scam: You can find blank MCO templates online. Scammers print these on heavy bond paper, fill in the vehicle details, and pass them off as legitimate. If you buy a vehicle with a fake MCO, you do not own the vehicle. The police will seize it, and you will lose your money.

Red Flags to Spot

If you are looking at an MCO, look for these immediate warning signs:

- Purchase Date Discrepancy: The MCO date (when the manufacturer printed it) is 2022, but the seller claims it’s “brand new” in 2025.

- Price is Too Good: A $90,000 TRX truck listed for $60,000? It’s a scam.

- No Lien on High-End Metal: It is very rare for a private individual to own a brand-new $100k+ vehicle outright with zero financing. If there’s no lienholder listed on the MCO, be suspicious.

- The “Out-of-State Dealer”: The MCO is stamped by a dealer in a different state than the seller.

- Typos: Manufacturers rarely make typos. If “Chrysler” is spelled “Chryslar,” walk away.

Verification Checklist BEFORE Buying

Do not hand over cash until you have done this homework.

- 1. Verify the VIN: Check the VIN on the MCO against the VIN plate on the dashboard AND the sticker in the door jamb. They must match exactly.

- 2. Google the Dealer: Look at the back of the MCO. Who is the dealer listed as the first assignee? Google them. Do they exist? Call them.

- 3. Call the Dealer: This is the most effective step. Call the dealership listed on the MCO. Ask for the finance or titling department. Say: “I am looking at a vehicle that originated from your store. VIN ending in 1234. Can you verify if this vehicle was sold and if there are any holds on the MCO?”

- 4. NHTSA VIN Lookup: Run the VIN through the NHTSA database to ensure it hasn’t been reported stolen or salvaged.

- 5. Check Security Features: Real MCOs have watermarks, embedded fibers, and UV ink. If the paper feels like standard printer paper, it’s fake.

- 6. Get a Bill of Sale: Require a notarized Bill of Sale from the seller. If they refuse to go to a notary with you, walk away.

Pro Tip: If the seller gets defensive or refuses to allow you to verify the MCO with the dealer, that’s your sign to walk away. Legitimate sellers have nothing to hide.

Montana LLC Specific Issues

At Zero Tax Tags, we specialize in helping clients register vehicles tax-free in Montana. Because of this, we deal with MCOs daily.

The Dealer Panic: Many dealers are terrified of exporting vehicles or dealing with Montana LLCs because they fear manufacturers will penalize them. They often refuse to hand the MCO to the buyer, insisting on sending it directly to the DMV.

The Custody Issue: If a dealer sends an MCO to your local DMV, but you are trying to register it in Montana, you have a problem. The document is in the wrong place.

How Zero Tax Tags Protects You:

- We Verify Authenticity: When you use our service, we inspect the MCO. We know what a real Ferrari, Ford, or Polaris MCO looks like. We catch fakes before they get to the state, saving you from potential legal jeopardy.

- Dealer Coordination: We provide instructions to dealers on exactly where to send the MCO so it arrives safely at our processing center, ensuring your Montana registration goes smoothly.

- Notarization Checks: We know which states require what. If your paperwork is missing a signature, we flag it immediately.

See how we help vehicle owners with MCO documents and other registration challenges:

- Certificate of Origin vs Title: The Definitive Legal Guide

- Unsigned MCO: What to Do & What NOT to Do

- Who Holds the Certificate of Origin & How to Get It Back

Conclusion: Don’t Let Paperwork Ruin Your Ride

An MCO is a powerful document—it is the key to the first title of a vehicle. But in the wrong hands, it is a tool for fraud.

If you are a private buyer, be extremely wary of MCOs. If you are buying from a dealer, ensure the MCO notarization matches the destination state’s requirements.

Don’t navigate this minefield alone. Whether you have a legitimate MCO that needs a Montana plate, or you’re trying to verify if a transaction is safe, Zero Tax Tags is your protective barrier against DMV bureaucracy and title fraud. We handle the paperwork so you can handle the driving.

Ready to Register Your Vehicle Safely?

Thousands of vehicle owners trust Zero Tax Tags with their MCO documents and Montana LLC registrations. Let us handle the complexity.