12 min read

Certificate of origin transfer is the most critical step in registering a brand-new vehicle. You just bought a brand-new vehicle, trailer, or UTV. You expect a title, but instead, the dealer hands you a fancy piece of paper that looks like a stock certificate. It says “Manufacturer’s Certificate of Origin” or “Manufacturer’s Statement of Origin” (MSO).

Now you’re standing there thinking, “What am I supposed to do with this? Can I put a license plate on a piece of paper?”

The short answer is no. The long answer is that you are holding your vehicle’s birth certificate, and until you “transfer” it, that vehicle doesn’t legally exist in the eyes of the Montana MVD.

On this page

- + What MCO Transfer Actually Means

- + Step 1: Verify You Have the Right Document

- + Step 2: Complete the Assignment Section

- + Step 3: Gather Supporting Documents

- + Step 4: State-Specific Requirements

- + Step 5: Submit to the DMV

- + The Montana LLC Specific Process

- + Common Mistakes That Cause Rejections

- + What Happens After Submission?

If you are registering a vehicle through a Montana LLC to save on sales tax, or if you are just a DIYer trying to navigate your local DMV without a dealer’s help, mishandling the MCO is the fastest way to get your registration denied. One typo, one wrong signature, or one missing odometer reading, and you are looking at months of delays and requests for duplicate documents.

At Zero Tax Tags, we process thousands of these documents. We know exactly what the DMV looks for and exactly what makes them stamp “REJECTED” on your application.

Here is the no-nonsense, step-by-step guide on how to transfer a certificate of origin correctly the first time.

What MCO Transfer Actually Means

Before you pick up a pen, you need to understand the lifecycle of this document.

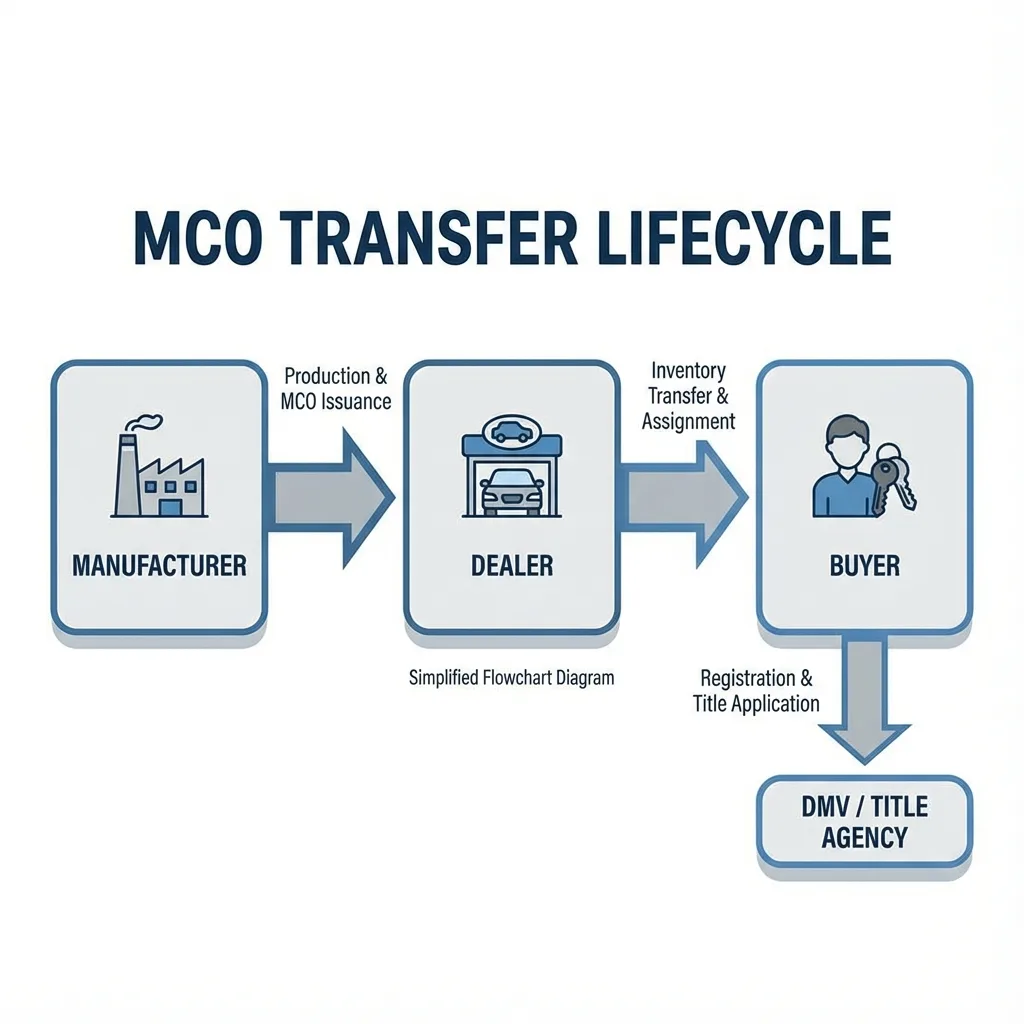

The Manufacturer’s Certificate of Origin (MCO) is the proof that a vehicle was built. It transfers ownership from the Manufacturer → Dealer → You.

Here is the catch: The MCO is a “die-on-use” document.

You cannot keep an MCO forever. You cannot “transfer” an MCO to a second buyer. The moment you want to put a license plate on the vehicle, the MCO must be surrendered to a DMV (or a processing service like ours). The DMV takes the MCO, files it away permanently, and issues a State Certificate of Title in its place.

Think of it like cashing a check. Once the bank takes the check, they give you cash (the Title). You don’t get the check back.

The Golden Rule: The MCO must be assigned to the exact entity that will hold the title. If you assign it to “John Doe,” the title will be issued to “John Doe.” If you want the title in your Montana LLC name, the MCO must be assigned to the LLC.

Step 1: Verify You Have the Right Document

Dealers are human. They make mistakes. Before you leave the dealership or accept delivery of the paperwork, you need to audit the document. Once you write on an MCO, correcting it is a nightmare that often requires the dealer to order a duplicate from the factory (which can take weeks).

Check the Security Features:

A real MCO feels like money. It has intaglio borders, watermarks, and visible fibers. If it looks like a photocopy on standard printer paper, question it immediately.

Verify the VIN:

Walk over to the vehicle. Look at the VIN plate on the dashboard or the stamped VIN on the frame (for trailers/UTVs). Read the VIN on the MCO character by character.

Real-World Scenario: We had a client buy a $40,000 UTV. The dealer swapped two digits on the MCO. The client mailed it to us, and we had to send it back. The client couldn’t ride for 6 weeks while the dealer scrambled to get a corrected document from Polaris.

Check the Dealer Assignment:

On the back of the MCO, there is a section called “First Assignment.” The dealer must sign this. If the dealer hasn’t signed it, the chain of ownership is broken. You cannot sign for the dealer.

Step 2: Complete the Assignment Section

This is the “make or break” step. Flip the MCO over. You will see a section labeled “Assignment of Manufacturer’s Certificate of Origin” or “First Assignment.”

1. Buyer Information:

This must match your ID or your LLC documents exactly.

- If personal: Write your full legal name as it appears on your driver’s license.

- If Montana LLC: Write the full name of the LLC. Do not write your personal name here. If you write your name, you will have to pay sales tax in your home state to title it to yourself, then transfer it to the LLC later (paying fees twice).

2. Odometer Disclosure:

Federal law requires the mileage to be disclosed for motor vehicles.

- The Rule: The mileage must be accurate at the time of sale.

- The Trap: Even if the vehicle is “new,” it rarely has 0 miles. It usually has 5, 12, or 50 test miles. If you leave this blank, the DMV will reject it.

3. Purchase Price:

Some states require this on the back of the MCO; others rely on the Bill of Sale. If there is a blank for it, fill it in. This figure is what the DMV uses to calculate sales tax (unless you are using a Montana LLC, in which case the tax is $0, but the value is still required for registration fees).

4. Signatures:

- Buyer Signature: You sign here.

- Printed Name: Print your name clearly.

- Capacity: If signing for an LLC, you must indicate why you have the right to sign. You would sign: “John Doe, Member” or “John Doe, Manager.”

Step 3: Gather Supporting Documents

You cannot just mail an MCO to the DMV and hope for the best. It must be accompanied by a “registration package.”

1. Bill of Sale:

The MCO proves the vehicle exists; the Bill of Sale proves you paid for it.

Pro Tip: Get the Bill of Sale notarized. While not every state requires this, Montana and several others strictly enforce it. It prevents fraud and speeds up processing.

2. Proof of Insurance:

You cannot register a vehicle without active insurance. The insurance card must match the name on the MCO. If the MCO is assigned to “Smith Logistics LLC,” the insurance policy must list “Smith Logistics LLC” as the insured.

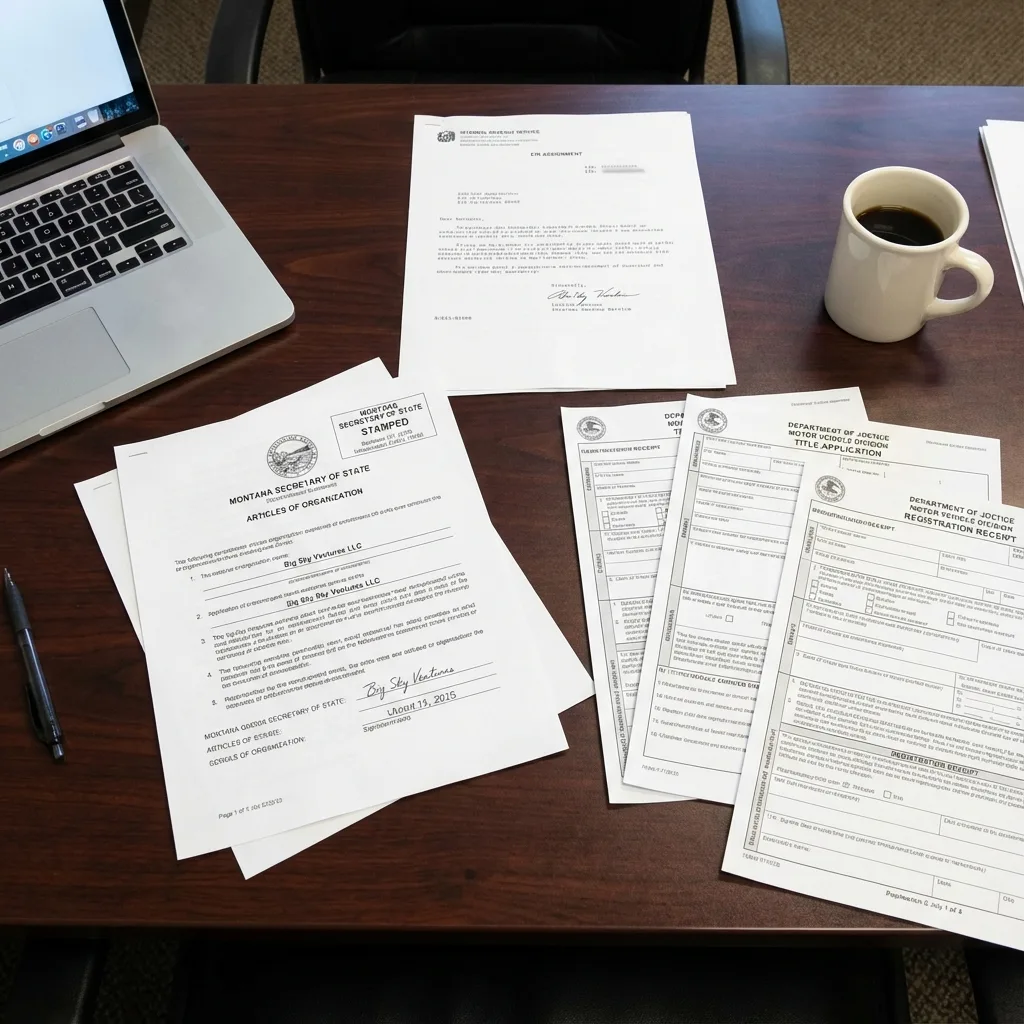

3. Identification:

- Personal: Copy of your Driver’s License.

- LLC: Articles of Organization and an EIN letter (if required by the state).

4. Sales Tax Proof:

If you are registering in your home state, you need a check for the sales tax (often 6-10% of the purchase price). If you are registering via a Montana LLC through Zero Tax Tags, you do not pay sales tax, but you will pay the flat Montana registration fees.

See how Montana LLC registration helps owners avoid other vehicle ownership headaches:

- Unsigned MCO: What to Do (and What NOT to Do)

- Certificate of Origin vs Title: The Definitive Legal Guide

Step 4: State-Specific Requirements

Every state DMV operates like its own little fiefdom. The requirements in California are vastly different from the requirements in Montana or Florida.

VIN Inspections:

Many states (like California, Florida, and Colorado) require a physical VIN inspection (or VIN verification) for out-of-state vehicles or first-time titles. This usually involves a police officer or DMV official looking at your VIN plate and signing a form (like the MV20 form in Montana).

Note: If you are buying a vehicle remotely and registering it in Montana through us, we can often handle the paperwork without the vehicle needing to be physically in Montana, provided the paperwork is perfect.

Emission Standards:

If you are in a CARB (California Air Resources Board) state, verify the MCO states “50-State Emissions Legal.” If it says “49-State” or “Federal Emissions Only,” you may be barred from titling that vehicle in California or New York.

Weight Certificates:

For trucks, trailers, and commercial vehicles, the DMV needs to know the empty weight (tare weight) and the Gross Vehicle Weight Rating (GVWR). If this isn’t printed on the MCO, you will need to go to a certified scale, weigh the vehicle, and provide a weight slip.

Step 5: Submit to the DMV

Once the MCO is assigned and the packet is built, you have to submit it.

The In-Person Route:

If you are doing this locally, prepare for a wait. Bring your checkbook (DMVs often charge credit card fees), a black pen, and patience. If you make a mistake on the forms in front of the clerk, they may make you go to the back of the line or get a new notarized document.

The Mail-In Route:

If you are mailing your MCO (which you will do if using Zero Tax Tags), never use standard mail.

The MCO is the only proof of ownership you have. If the post office loses it, you are in a world of hurt. Always use FedEx, UPS, or USPS Priority/Express with tracking.

Processing Timeframes:

- Local DMV: You might walk out with plates, but the title will be mailed in 2-4 weeks.

- Montana LLC Service: We typically turn around registration and plates quickly, with the physical title following the state’s processing timeline (currently roughly 4-8 weeks depending on MVD volume).

The Montana LLC Specific Process

If you are using Zero Tax Tags to register your vehicle in Montana (to legally avoid sales tax on your RV, exotic car, or UTV), the MCO transfer process is slightly different but much easier for you.

1. The Assignment:

The dealer must assign the MCO to your Montana LLC.

- Correct: “Mountain View Holdings LLC”

- Incorrect: “John Smith”

- Fatal Error: “John Smith AND Mountain View Holdings LLC”

2. Power of Attorney:

We will provide you with a Limited Power of Attorney form. This allows our agents in Montana to sign the title application and registration documents on behalf of your LLC. This saves you from flying to Montana to sign paperwork.

3. We Catch the Errors:

When you send your MCO to Zero Tax Tags, our experts audit it before it goes to the state. If the dealer missed a signature or the odometer reading is blank, we catch it. We work with you (and the dealer) to fix it before it enters the DMV black hole.

4. EIN Requirement:

Since the owner is a business (your LLC), the DMV requires the Federal Employer Identification Number (FEIN/EIN). Ensure you have this number handy when filling out our intake forms.

See how others have successfully registered through Montana LLCs:

Common Mistakes That Cause Rejections

We see hundreds of MCOs a month. Here are the most common reasons they get rejected.

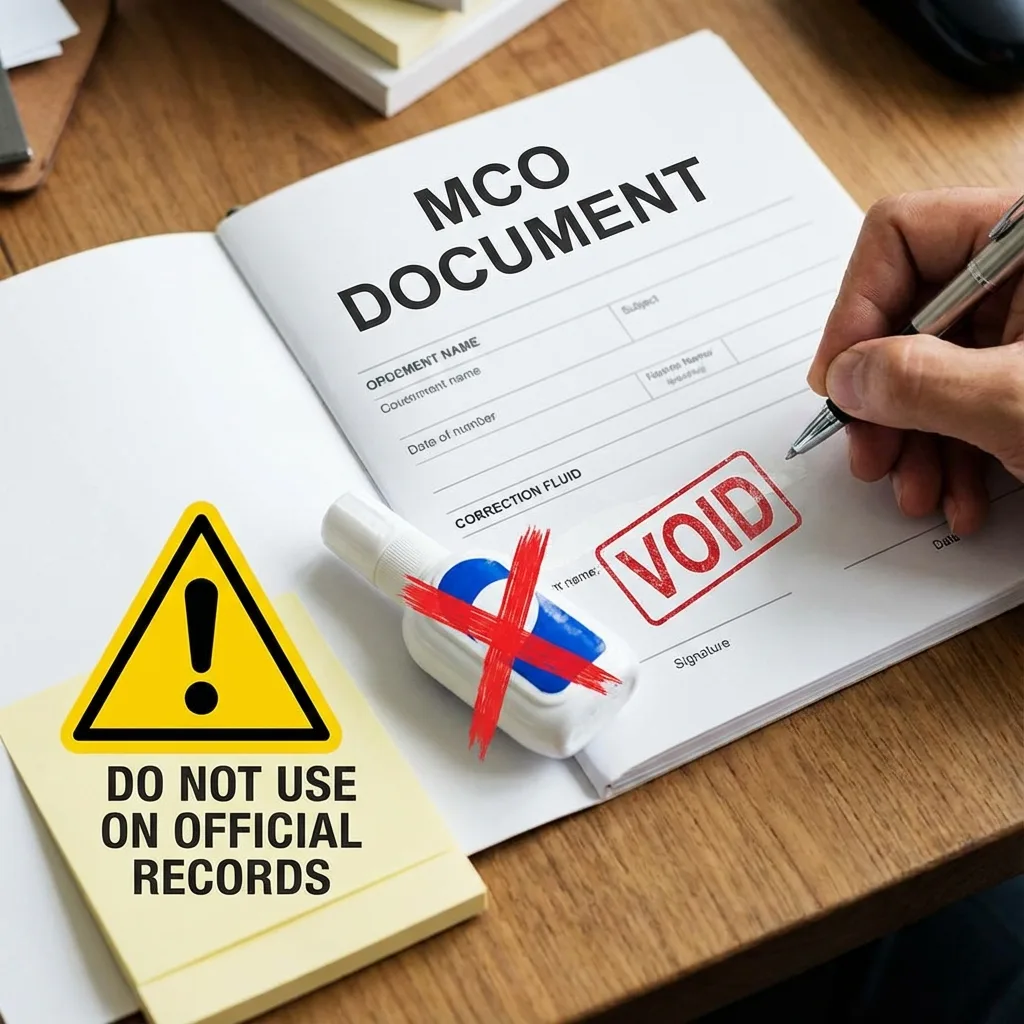

1. The “White-Out” Disaster

Never, ever use correction fluid (White-Out) on an MCO.

If you write the wrong name or date, do not scratch it out. Do not paint over it. A defaced MCO is void. You will have to go back to the manufacturer for a duplicate.

Solution: If you make a mistake, stop. Call us. There are specific affidavits (Statement of Fact) that can sometimes correct a minor error, but let the experts handle it.

2. Name Mismatch

- Scenario: Your driver’s license says “Robert J. Downey” but you write “Bob Downey” on the MCO.

- Result: Rejection. The names must match the ID or LLC documents character-for-character.

3. The “Skipped” Dealer

Sometimes a dealer trades a vehicle to another dealer before selling it to you.

- Dealer A transfers to Dealer B.

- Dealer B sells to You.

- The Error: Dealer A assigns the MCO directly to You, skipping Dealer B. Or, the chain of assignments on the back is incomplete.

- The Fix: All transfers must be documented. If there is a gap in the chain of ownership, the DMV will reject it.

4. Missing Odometer Disclosure

We mentioned this before, but it bears repeating. If the odometer section is blank, the MVD assumes the vehicle has an unknown history or a broken odometer. This can lead to a “Not Actual Mileage” brand on your title, killing your resale value.

What Happens After Submission?

Once the MVD accepts the MCO, the magic happens.

- Surrender: The MVD keeps the MCO. It is archived and effectively “destroyed” as an active ownership document.

- Title Issuance: The state prints a Certificate of Title. This is your new “Pink Slip.” It will list your LLC as the owner.

- Registration: You receive your license plates and registration card.

If you financed the vehicle, the Title will be mailed directly to your lender (the lienholder). You will receive the registration and plates, but you won’t see the title until the loan is paid off.

Ready to Transfer Your Certificate of Origin Correctly?

Vehicle owners have saved thousands with Montana LLC registration. Skip the DMV nightmares and let our experts handle your MCO transfer perfectly the first time.

Conclusion

Transferring a certificate of origin isn’t rocket science, but it is strict legal bureaucracy. It requires precision. You are converting a manufacturer’s promise into a government-recognized legal asset.

If you are buying a high-value vehicle, an RV, or a trailer, doing this process through a Montana LLC can save you thousands in taxes and headaches. But it only works if the paperwork is perfect.

Don’t guess. Don’t use white-out. And definitely don’t let a sloppy dealer assignment cost you weeks of riding time.

Ready to register your new vehicle tax-free? Zero Tax Tags handles the entire MCO-to-Title process for you. We catch the errors, handle the DMV, and get your plates delivered to your door.