11 min read

On this page

The DMV is a special kind of purgatory, but at least with cars, the rules are generally consistent. You have a title, you pay your taxes, you get a plate. But when you roll up to the window with paperwork for a trailer CO, a boat, or—heaven forbid—both at the same time, you are entering a world of hurt.

Trailers and boats exist in a bureaucratic gray area where weight ratings, federal maritime law, and state-specific loopholes collide. One of the most critical documents in this process is the Manufacturer’s Certificate of Origin (MCO) or Manufacturer’s Statement of Origin (MSO). These terms are interchangeable and refer to the vehicle’s “birth certificate.”

But transferring an MSO for a boat or a trailer is not the same as transferring one for a Honda Civic. From Gross Vehicle Weight (GVW) pitfalls to the black hole of “homemade” titles, here is everything you need to know about navigating the CO transfer process for toys that don’t have engines or wheels.

Trailer COs vs. Vehicle COs: Same Paper, Different Rules

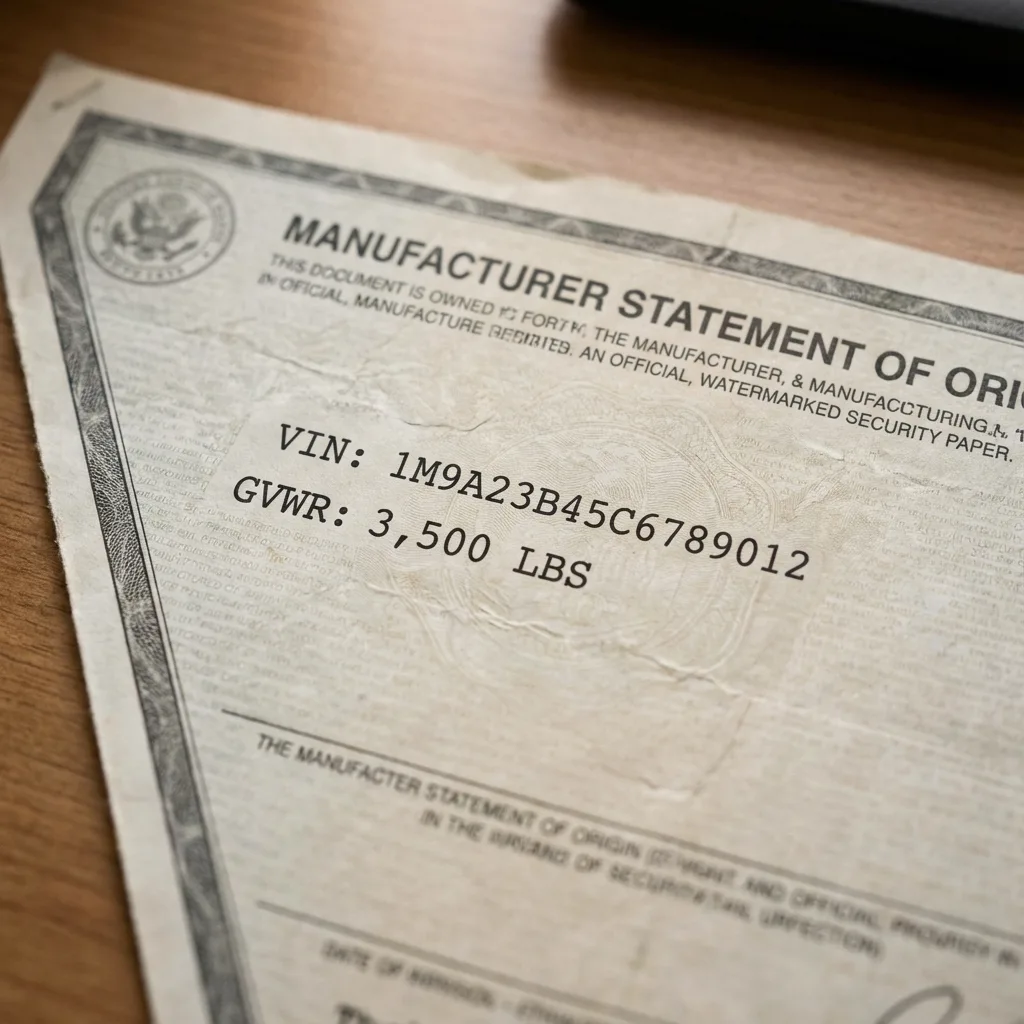

At first glance, a trailer CO (MSO) looks exactly like a car MSO. It’s on watermarked security paper, it lists a VIN, a year, and a manufacturer. However, the data on that paper carries different weight (literally) at the DMV.

With a standard passenger vehicle, the MSO is a direct ticket to a title. With a trailer, the MSO is often just the opening bid in a negotiation.

The Weight Factor

For cars, the DMV rarely questions the classification. A car is a car. For trailers, the MSO must clearly state the Gross Vehicle Weight Rating (GVWR) and the Unladen (Empty) Weight.

- Light Duty: In many states, if the MSO shows a GVWR under 3,000 lbs, you might not even get a title. You’ll just get a registration/Bill of Sale.

- Heavy Duty: If that MSO lists a high GVWR, you might accidentally wander into commercial registration territory, requiring higher fees or safety inspections.

The “Vehicle” Definition

An MSO for a car proves it meets federal safety standards (FMVSS). An MSO for a trailer proves it meets basic construction standards, but it doesn’t guarantee it’s road-legal in every state without an inspection. If you bought a trailer kit online, the MSO might be for “parts” rather than a “vehicle,” which is a distinction that can stop your registration dead in its tracks.

The “Homemade” Trailer CO Myth

Let’s rip the Band-Aid off: There is no such thing as a Manufacturer’s Certificate of Origin for a homemade trailer.

We see this constantly. A guy welds some scrap steel into a utility trailer, buys an axle from Tractor Supply, and then asks, “How do I write an MSO for this?”

You don’t. You are not a manufacturer. You do not have a Manufacturer’s Identification Code (MIC) registered with the NHTSA. You cannot issue an MSO.

The “Homebuilt” Process

If you built the trailer, you don’t transfer a CO. Instead, you apply for a unique VIN assignment.

- Police Inspection: An officer verifies it’s not stolen parts.

- Safety Inspection: A state inspector ensures the welds won’t snap on the highway.

- VIN Assignment: The state issues a VIN plate you must rivet to the frame.

Real Scenario: The “Homemade” Trailer Needs a Bonded Title

The Situation: You buy a flatbed trailer on Craigslist. The seller says, “I built it myself,” and hands you a Bill of Sale written on a napkin. No VIN, no title, no MSO.

The Problem: You go to the DMV, and they ask for the previous registration. You don’t have it. They ask for the MSO. You don’t have it.

The Fix: You likely need a Bonded Title. This involves buying a surety bond that protects the state if it turns out the trailer was stolen. You essentially pay to guarantee your ownership claim.

Boat MSOs vs. Trailer MSOs

If you buy a new boat package, you are actually buying two distinct assets: the Vessel (Boat) and the Vehicle (Trailer).

- The Boat MSO: Lists the Hull Identification Number (HIN). This acts like a VIN but for watercraft.

- The Trailer MSO: Lists the VIN (17 digits, usually).

The Trap: Dealerships will often staple these together. If you lose one, you lose both. Furthermore, the DMV handles the trailer, but in many states, a separate agency (like the Department of Natural Resources or Parks & Wildlife) handles the boat. You cannot use the trailer MSO to register the boat, or vice versa. They are legally divorced the moment they leave the factory.

Additionally, boat manufacturers must obtain a MIC (Manufacturer’s Identification Code) from the US Coast Guard to issue valid HINs. If you buy a boat from a small, boutique builder who didn’t file their paperwork with the USCG, that MSO might be worthless at the DMV.

USCG Documentation vs. State Titling

When transferring ownership of a boat, you have a choice that you don’t have with cars: Federal vs. State.

State Titling

Most small boats operate under state titles. You take the MSO to the local agency, pay sales tax, and get a state title and registration numbers (e.g., TX 1234 AB) to stick on the bow.

USCG Documentation

For larger vessels (usually 5 net tons or more), you can opt for US Coast Guard Documentation. This is a federal form of registration.

- The MSO Role: You send the MSO directly to the National Vessel Documentation Center (NVDC), not the state DMV.

- The Benefit: A documented vessel typically does not display state numbers on the bow (though some states still require a registration sticker). It makes financing easier and international travel smoother.

- The Exemption: In states like Texas, USCG documented vessels are exempt from state titling, though they still require registration.

Real Scenario: Boat with Hull Number but No MSO

The Situation: You bought a 1990s Bass Tracker. It has a HIN stamped on the transom, but the seller lost the title and the MSO decades ago.

The Problem: The state requires a chain of ownership. You can’t just show up with the boat.

The Fix:

1. Check USCG Abstracts: See if the boat was ever federally documented. If so, the chain of title is there.

2. Bonded Title/MCO Replacement: If it was never documented, you may need to contact the manufacturer for a duplicate MSO (if they still exist) or proceed with a bonded title process for the vessel.

Utility vs. Travel vs. Horse Trailers

Not all trailers are created equal in the eyes of the taxman. The MSO will specify the body type, and this dictates your insurance and registration costs.

Utility Trailers

The MSO usually lists these as “UT” or “Utility.” These are often the easiest to register. In states like Maine, you can register these via mail for cheap without ever visiting a DMV, provided they are for personal use.

Travel Trailers (RVs)

The MSO will list “Travel Trailer,” “Camper,” or “RV.”

- The Difference: These are considered luxury items in many jurisdictions. The transfer fees and annual taxes (ad valorem) can be astronomical compared to a utility trailer of the same weight.

- Surplus Military Trailers: Sometimes people convert military trailers into campers. The MSO (or SF97) for these usually says “Cargo,” which is great for registration until you try to insure it as an RV.

Horse/Livestock Trailers

These often fall under agricultural exemptions if you have a farm tax ID. However, if the MSO says “Livestock” and you are pulling it with a non-commercial SUV to a rodeo, you might face scrutiny regarding commercial driver’s license (CDL) requirements depending on the weight.

GVW Issues Affecting Registration

The Gross Vehicle Weight (GVW) listed on the MSO is the most dangerous number on the page.

If you transfer a trailer CO that lists a GVWR of 10,001 lbs or more, you have just entered the danger zone.

- Commercial Territory: Many states flag trailers over 10k lbs as commercial equipment.

- Class A License: If your truck and trailer combined GVWR exceeds 26,001 lbs, and the trailer is over 10k lbs, you may need a CDL.

The MSO Trap: Some manufacturers rate trailers at exactly 9,990 lbs to keep them under the CDL/commercial radar. If your MSO says 10,000 lbs, you might be forced to stop at weigh stations or carry commercial insurance. Always check the GVW on the MSO before you sign the check.

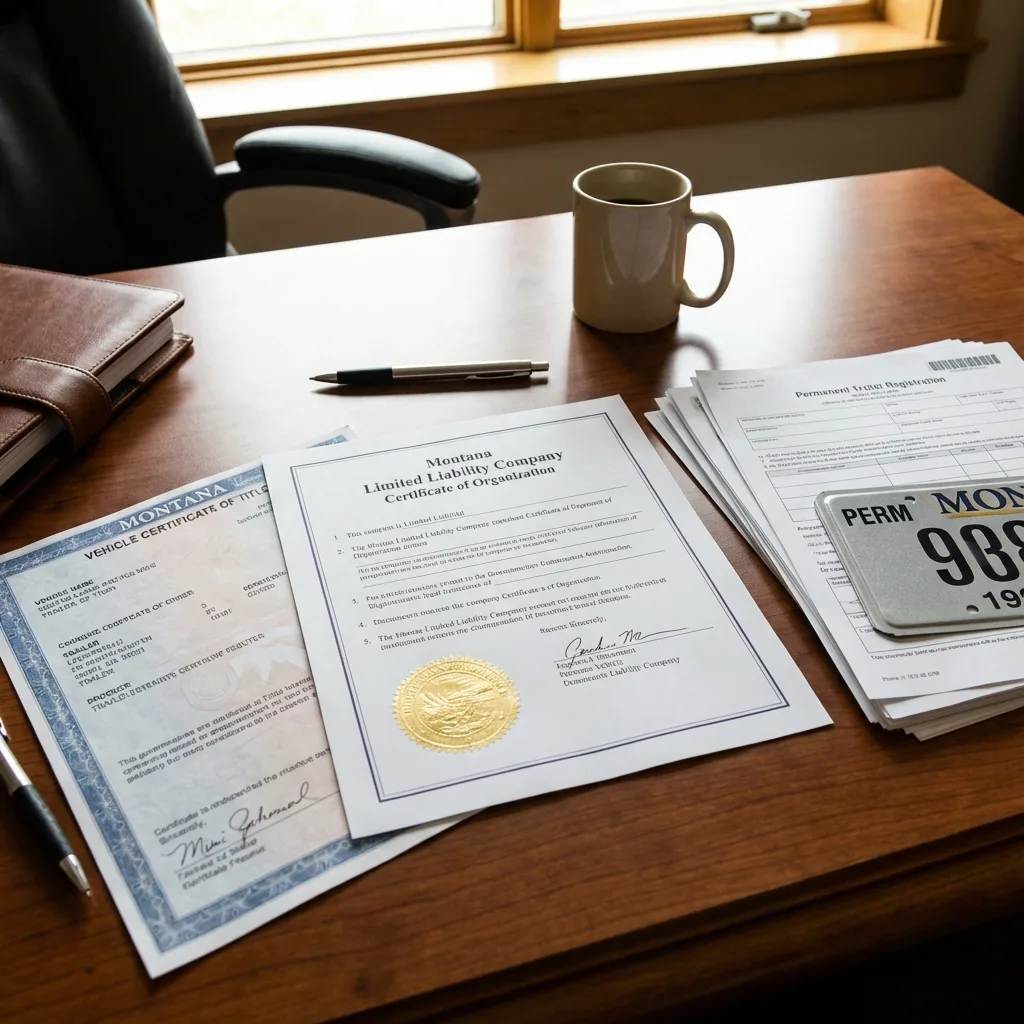

The Montana LLC Strategy for High-Value Trailers

If you are buying a high-value boat trailer, a massive fifth-wheel RV, or a stacker trailer for your race cars, the MSO transfer is the moment you get hit with sales tax. In states like California or New York, that can be 8% to 10% of the purchase price.

The Solution: Transfer the MSO to a Montana LLC.

- Zero Sales Tax: Montana has 0% sales tax on vehicles and trailers.

- Permanent Plates: Montana offers permanent registration for trailers. You pay once, and you never renew it again.

- Asset Protection: The trailer is owned by the company, not you personally.

This is entirely legal. You form an LLC in Montana, the LLC buys the trailer (or boat), and the MSO is signed over to the LLC. The title is issued in the LLC’s name.

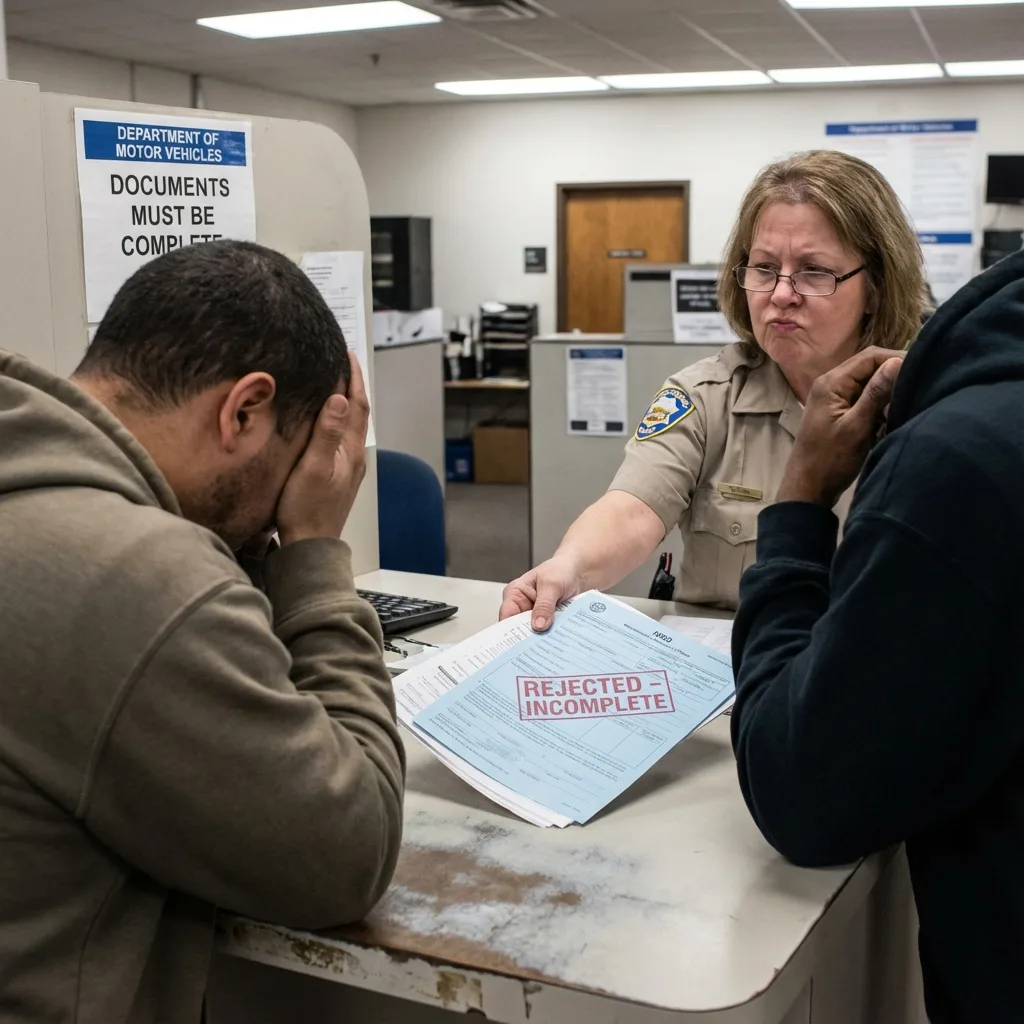

Common Rejections

You’ve waited in line for three hours. You finally get to the counter. The clerk looks at your boat or trailer CO and slides it back to you. “Next!”

Here is why your MSO transfer got rejected:

1. The “Skipped” Title

The MSO was signed by the manufacturer to a dealer. The dealer sold it to Guy A. Guy A never titled it (to save taxes) and sold it to You.

The Rejection: The DMV sees a break in the chain. The MSO is signed to the dealer, but you are holding it. Unless the dealer reassigned it directly to you on the back, this is a dead document. You cannot “skip” owners.

2. Notarization Missing

Many states require the MSO assignment to be notarized. If the dealer signed it but didn’t stamp it, you are out of luck.

3. VIN/HIN Typos

Trailer VINs are often hand-stamped or printed on cheap stickers. If the MSO says “1M9…” and the trailer frame looks like “1M8…”, the inspector will fail you.

4. Erasures or White-Out

Never use white-out on an MSO. It voids the document immediately. If a mistake is made, you usually need a specific affidavit of correction or a duplicate MSO from the factory.

See how we help with other MCO/CO transfer issues:

- How to Transfer a Certificate of Origin (Step-by-Step Legal Guide 2026)

- Blank MCO 2026: What to Do When Your Certificate of Origin Is Incomplete or Botched

- Title Transfer with Lienholder 2026: The Financed Freedom Ride and Bank Navigation Guide

Conclusion

Transferring a Certificate of Origin for a boat or trailer isn’t just “car paperwork but smaller.” It involves a unique web of weight ratings, hull numbers, and federal vs. state jurisdiction. Whether you are trying to title a military surplus trailer for off-road use or trying to avoid paying $5,000 in sales tax on a new wake boat, the paperwork matters.

Don’t let a missing signature or a GVW technicality turn your new toy into a lawn ornament.

Zero Tax Tags specializes in untangling the mess the DMV creates. From Montana LLCs for tax-free RV registration to obtaining titles for trailers that have lost their way, we handle the bureaucracy so you can handle the road (or the water).

Ready to Register Your Trailer or Boat?

Stop fighting with the DMV. We handle trailer and boat CO transfers, Montana LLC formations, and permanent registration.