13 min read

On this page

- + The Sticker Shock at the Garden State Parkway

- + The Anatomy of the New Jersey Vehicle Tax Shakedown

- • The Property Tax Crush

- • The 6.625% Sales Tax: The Silent Killer

- • The “Luxury” Penalty Surcharge

- + A Tale of Two Buyers

- + Why Montana is the American Tax Haven

- + Is This Legal for New Jersey Residents?

- + The ZeroTaxTags Advantage

- + Let’s Run the Numbers

- + Frequently Asked Questions

- + Stop the Bleeding

The Sticker Shock at the Garden State Parkway

Picture this. You’ve worked hard all year. Maybe ten years. You’ve saved, you’ve sacrificed, and you’ve finally walked onto the lot to buy that Ford F-250 King Ranch, or perhaps that Porsche 911 you’ve had on your vision board since college. The New Jersey vehicle tax is about to hit you like a freight train.

You negotiate the price. You feel good. You shake hands with the dealer. And then, you sit down in the fluorescent-lit finance office. The finance manager turns the monitor around, and your stomach drops.

The “Out the Door” price isn’t what you agreed to. It’s bloated. It’s heavy. It’s thousands of dollars higher.

“What is this?” you ask, pointing to a line item that costs as much as a family vacation to Disney World.

“That’s just the tax and tags, boss,” the manager says with a shrug. “Welcome to New Jersey.”

If you live in New Jersey, you know this pain. You breathe this pain. The state motto might as well be “Give us your money, then give us some more.” From the tolls on the Turnpike to the property taxes that rival mortgage payments in other states, New Jersey treats its residents like an endless ATM.

But here is the secret that wealthy collectors, savvy business owners, and financial insiders have known for years: You do not have to pay it.

There is a legal, safe, and incredibly effective “escape hatch” located about 2,000 miles west in the Big Sky Country. It’s called a Montana LLC, and for New Jersey residents drowning in taxes, it isn’t just a loophole; it’s a life raft.

At ZeroTaxTags.com, we specialize in one thing: liberation. We liberate your assets from the grip of the New Jersey Motor Vehicle Commission and help you keep your hard-earned wealth where it belongs—in your pocket.

Part 1: The Anatomy of the New Jersey Vehicle Tax Shakedown

To understand the solution, we first have to look at the problem without flinching. New Jersey is consistently ranked as one of the worst states in the nation for business tax climate and individual tax burden.

It’s not just one tax. It’s the cumulative weight of all of them.

The Property Tax Crush

New Jersey has the highest effective property tax rate in the United States. Period. In many counties, you are paying $10,000, $15,000, or even $25,000 a year just for the privilege of sleeping in a house you already bought. This drains your disposable income. It means that when you finally do have enough cash to buy a luxury item or a work truck, you are already operating at a deficit compared to the rest of the country.

The 6.625% Sales Tax: The Silent Killer

Then comes the sales tax. New Jersey charges a state sales tax of 6.625%.

On a cup of coffee, that’s pennies. On a new pair of jeans, it’s a couple of bucks. But when you are buying high-value assets—vehicles, RVs, heavy equipment—that percentage turns into a devastating number.

Let’s do the math on a standard heavy-duty truck purchase:

That is nearly six thousand dollars that vanishes into thin air. You get nothing for it. The truck doesn’t drive better. The roads aren’t smoother (we all know the potholes on Route 17). That money is simply confiscated wealth.

The “Luxury” Penalty Surcharge

But wait, it gets worse. New Jersey legislators decided that 6.625% wasn’t enough. If you buy a vehicle costing more than $45,000 (which, in today’s economy, is a standard Honda Odyssey), you might be hit with a supplemental 0.4% surcharge. They literally penalize you for buying a nice car.

The Registration Nightmare: Have you been to a New Jersey MVC regarding registration lately? It is a test of human endurance. High fees, long lines, inspection stickers that mar your windshield, and the constant threat of fines for minor administrative lapses.

New Jersey has created a system where ownership feels like a burden rather than a joy.

Part 2: A Tale of Two Buyers (The Real World Impact)

Let’s move away from percentages and talk about real people. Let’s look at two hypothetical New Jersey residents, Tony and Mark.

Tony: The “Play by the Rules” Victim

Tony owns a landscaping company in Maplewood. He’s had a good year. He lands a few commercial contracts and decides it’s time to upgrade his rig. He buys a brand new diesel truck for towing his equipment and a new Fifth Wheel RV for weekend getaways with the family.

- Vehicle 1: Ford F-350 Platinum ($95,000)

- Vehicle 2: Luxury Fifth Wheel RV ($110,000)

- Total Purchase Price: $205,000

Tony registers the paperwork in New Jersey:

Tony just wrote a check for fourteen thousand dollars. That money could have bought a new bad-boy mower. It could have maxed out his Roth IRA for two years. It could have paid for a semester of his daughter’s college. Instead, it’s gone. Poof.

Mark: The ZeroTaxTags Strategist

Mark lives two streets over in Princeton. He buys the exact same setup. A $95k truck and a $110k RV.

But Mark didn’t walk into the dealership blind. Before he signed the papers, he contacted ZeroTaxTags.com. We set up a Montana LLC for him.

Mark pays a small flat fee to set up his LLC and handle the registration. He saves roughly $13,000+ compared to Tony.

Who is the smarter businessman? The guy who lit $14,000 on fire to support the bureaucracy in Trenton, or the guy who kept that capital in his business?

Part 3: Why Montana is the American Tax Haven

You might be asking, “Why Montana? Why not Delaware or Oregon?”

Montana is unique. It is one of the few states with 0% sales tax. But more importantly, Montana has a very specific set of laws regarding vehicle registration.

Montana allows non-residents to form a Limited Liability Company (LLC) in the state. Once that LLC is formed, the LLC is considered a Montana resident—a legal “person” in the eyes of the law.

Because an LLC is a legal entity, it has the right to own property. If your Montana LLC buys a Ferrari, a Freightliner, or a Winnebago, that vehicle is owned by a Montana resident (the LLC). Therefore, it is subject to Montana tax laws (0%) and Montana registration rules.

It’s Not Just About the Zero Tax

Yes, the 0% tax is the headline. But the benefits go deeper:

- No Inspections: Montana does not require vehicle inspections. No more scraping stickers off your windshield or waiting in line at the inspection station in Lodi.

- Permanent Plates: For vehicles over 11 years old, Montana offers permanent registration. You pay once, and you never pay again. No annual renewals.

- Privacy: An LLC offers a layer of asset protection and privacy that personal registration does not.

- Simplicity: You deal with us. We deal with the DMV. You never have to stand in a line again.

Part 4: Is This Legal for New Jersey Residents?

This is the most common question we get, and it’s the most important one. The short answer is: Yes, owning a Montana LLC is 100% legal.

Under US law, you have the right to form a business entity in any state you choose. You can live in New Jersey and own a corporation in Delaware, a partnership in Wyoming, or an LLC in Montana. That is your right as an American citizen.

Furthermore, a business entity has the right to own assets. If your business (the LLC) owns a truck, that truck is legally domiciled where the business is domiciled.

The Nuance of “Garaging”

Now, here is where we have to be honest and clear. New Jersey, like many high-tax states, hates this. They want your money. They have laws that say if you personally live in NJ, your personal car must be registered there.

However, the car isn’t yours. It belongs to the LLC.

While you must be careful and aware of local ordinances regarding garaging (especially for daily commuter cars), this structure is widely used for:

- High-end Luxury Cars: Vehicles that aren’t driven daily.

- RVs and Motorhomes: Which spend much of their time on the road or stored in various locations.

- Classic Cars: Which are rarely driven.

- Commercial/Business Vehicles: Trucks used for work.

The burden of proof is on the state to prove that you are evading taxes illegally. But when you have a legitimate Montana LLC, properly formed, with a Registered Agent (that’s us), you have a robust legal structure protecting you. You aren’t “faking” a residency; you are operating a legitimate holding company.

Thousands of exotic car owners, full-time RVers, and shrewd business owners use this strategy every single day. See how other states compare: Arizona VLT, Virginia Car Tax, and Nevada’s 8.25% Tax.

Part 5: The ZeroTaxTags Advantage

The internet is full of “cheap” LLC formation services. You can go on a discount site and form an LLC for pennies. Do not do this.

Registering a vehicle through an LLC requires precision. If you mess up the articles of organization, if you fail to file the annual report, or if you don’t have a physical address in Montana that can accept legal mail, your LLC can be dissolved. If your LLC is dissolved, your registration is void, and your asset is exposed.

ZeroTaxTags.com is the premium solution. We are not just filing paperwork; we are your partners in asset protection.

What We Handle for You:

| 1. | LLC Formation: We draft and file the Articles of Organization with the Montana Secretary of State specifically tailored for asset holding. |

| 2. | Registered Agent Service: We provide the physical Montana address required by law. |

| 3. | DMV Liaison: We physically go to the county treasurer’s office. We stand in line so you don’t have to. We handle the title work, the plating, and the registration. |

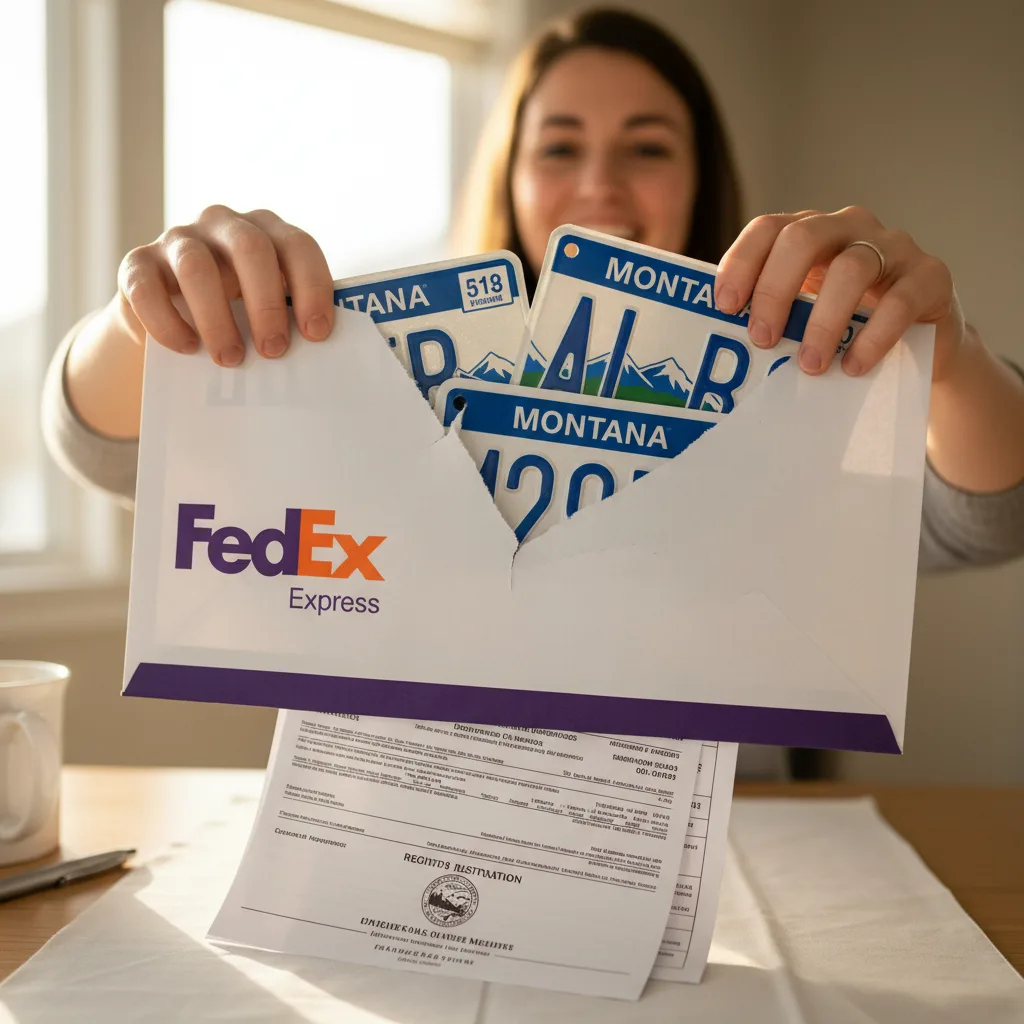

| 4. | License Plates: We ship your Montana plates and registration directly to your doorstep in New Jersey (or wherever you are). |

You upload the documents (Bill of Sale, Title/MSO). We do the rest.

Part 6: Let’s Run the Numbers (The “Why” You Can’t Ignore)

Let’s look at three specific scenarios where sticking with the New Jersey system is financial suicide, and where ZeroTaxTags provides the rescue.

Scenario 1: The Diesel Pusher (RV Life)

You’re buying a Newmar Dutch Star.

With ZeroTaxTags: LLC setup & registration is a fraction of the tax cost. Tax Saved: $29,812.50. ROI: Infinite. You just saved enough to pay for diesel fuel for the next five years of cross-country trips.

Scenario 2: The Exotic (McLaren 720S)

You’re buying a used supercar.

That is almost $20k simply for the right to own the car. With a Montana LLC, that $20k stays in your bank account.

Scenario 3: The Fleet Upgrade (Small Business)

You own a construction firm and need to buy two heavy dump trucks.

- Total Cost: $180,000

- NJ Tax: $11,925

Why give the state nearly $12,000 that could be used for payroll, marketing, or repairs? It makes zero business sense.

Part 7: Frequently Asked Questions (FAQ)

We know you have questions. Here are the answers to the concerns keeping you up at night.

Q: Do I need a Montana Driver’s License?

A: No. Your driver’s license is personal; it belongs to you and must match your primary residence (NJ). The vehicle registration belongs to the LLC, which is a Montana resident. You drive the LLC’s car with your NJ license. This is exactly like renting a car from Hertz—the car has Florida plates, but you have an NJ license. It is perfectly legal.

Q: What about insurance?

A: This is crucial. You must insure the vehicle. You should inform your insurance carrier that the vehicle is owned by an LLC in Montana but is garaged/used in New Jersey. Most major carriers (Progressive, Geico, State Farm, Hagerty) can write a commercial policy or a specific policy for this arrangement. Never lie to your insurance company. Be transparent about the ownership structure.

Q: Can I finance the vehicle?

A: Yes, but it requires a lender who understands LLCs. Many traditional auto loans are personal. You may need a commercial loan or a lender who allows you to put the title in the LLC’s name while you act as the personal guarantor. ZeroTaxTags can often point you toward lenders who are “Montana friendly.”

Q: Will I get pulled over for out-of-state plates?

A: Driving with out-of-state plates is not a crime. People drive rental cars, corporate cars, and borrowed cars across state lines every second of the day. As long as your registration is valid, your insurance is current, and you are obeying traffic laws, you have nothing to fear.

Q: Does the LLC need to do business in Montana?

A: No. Your LLC is a “holding company.” Its only business activity is owning assets. This is a legitimate business purpose.

Q: How fast is the process?

A: We are the fastest in the industry. Once we have your paperwork, we can often have the LLC formed in 24-48 hours and the registration process started immediately after. The DMV processing times vary, but we expedite everything we can.

Conclusion: It’s Time to Stop the Bleeding

New Jersey relies on your compliance. They rely on you assuming that there is no other way. They rely on you sighing, pulling out your checkbook, and paying that 6.625% plus fees without a fight.

Stop complying with a system that penalizes your success.

The difference between being wealthy and being “tax-poor” often comes down to strategy. The wealthy do not pay maximum retail price on taxes. They structure their lives to minimize liability.

With ZeroTaxTags.com, you have access to the same strategies used by the ultra-rich to escape the New Jersey vehicle tax burden legally.

Imagine your next vehicle purchase. Imagine looking at the invoice and seeing: Tax: $0.00.

Imagine taking that $5,000, $10,000, or $20,000 you saved and investing it, upgrading your home, or taking your family on a trip they will never forget.

The choice is stark. You can continue to feed the New Jersey treasury, or you can take control of your financial destiny.

Do not let New Jersey vehicle tax drain your wealth.

Break the cycle.

(Disclaimer: ZeroTaxTags.com provides vehicle registration services. We are not tax attorneys or financial advisors. You should consult with your own tax professional regarding your specific tax liabilities and compliance with your local state laws.)