11 min read

On this page

- + The True Cost of Driving in the Keystone State

- + The Pennsylvania Pain Points: Why You Are Overpaying

- • The Sales Tax Hit (6% to 8%)

- • The Annual Inspection Nightmare

- • Emissions Testing

- • PennDOT Bureaucracy

- + The Montana Solution: A Loophole for the Smart Buyer

- + The Financial Breakdown: PA vs. Montana

- + Real World Scenarios: Who Benefits Most?

- + The Zero Tax Tags Advantage

- + Frequently Asked Questions

The True Cost of Pennsylvania Vehicle Tax in the Keystone State

If you live in Pennsylvania, you know the routine. You spend months researching the perfect vehicle. You negotiate the price, check the history, and finally shake hands on the deal. The excitement is palpable—until you sit down with the finance manager and see the “out-the-door” price.

Suddenly, that reasonable price tag has ballooned. Why? Because the Commonwealth of Pennsylvania has arrived to take its cut. The Pennsylvania vehicle tax burden is among the most frustrating in the nation.

Between the flat 6% state sales tax (which jumps to 7% in Allegheny County and a staggering 8% in Philadelphia), the annual registration fees that seem to creep up every year, and the dreaded annual safety and emissions inspections, your wallet is constantly under attack.

But what if there was a completely legal, smarter way to title and register your vehicle? What if you could bypass the Pennsylvania Department of Transportation (PennDOT) entirely?

At Zero Tax Tags, we help Pennsylvania residents take back control of their finances and their vehicles. By registering your car, truck, or RV through a Montana LLC, you can legally pay 0% sales tax, avoid annual inspections, and say goodbye to the bureaucracy of PennDOT.

The Pennsylvania Pain Points: Why You Are Overpaying

To understand the value of the Montana solution, we first have to look at the financial bleeding caused by the Pennsylvania system. Most PA residents are so used to these costs that they accept them as inevitable. They are not.

1. The Sales Tax Hit (6% to 8%)

Pennsylvania imposes a 6% sales tax on the purchase price of vehicles. This is not a small fee; it is a major financial event.

- The State Baseline: On a standard $50,000 vehicle, the 6% tax is $3,000. That is money that vanishes instantly. It adds no value to the car. It does not go toward your loan principal. It is just gone.

- The City Surcharges: If you live in Pittsburgh (Allegheny County), you pay 7%. That same $50,000 car now costs you $3,500 in tax. If you are in Philadelphia, the rate is 8%, costing you $4,000 in taxes alone.

2. The Annual Inspection Nightmare

Pennsylvania is one of the few remaining states that requires a rigorous annual safety inspection for passenger vehicles. While safety is important, the PA inspection system is often viewed as a “license to upsell” for mechanics.

- The Cost: You pay $30–$50 just for the sticker.

- The Hassle: You must schedule an appointment, drop off your car, and wait.

- The “Upsell”: How many times have you been told your car “needs” new windshield wipers, brake pads, or tires just to pass inspection, even when you know they have life left in them?

3. Emissions Testing

If you live in Philadelphia, Pittsburgh, Allentown, Erie, Reading, or the suburban counties like Bucks, Montgomery, Chester, Delaware, or Washington, you are also subject to emissions testing. This is another fee, another layer of bureaucracy, and another reason for a “Check Engine” light to turn your car into a paperweight that you legally cannot drive.

4. PennDOT Bureaucracy

PennDOT is legendary for its inefficiency. Whether you are in Harrisburg, Scranton, or the suburbs of Philly, dealing with the DMV is a test of patience. Wait times are long, forms are confusing, and processing titles can take weeks.

5. The Rust Belt Reality

Let us be honest about Pennsylvania winters. The road crews do a great job clearing snow, but they do it using tons of salt and brine. These chemicals eat away at your vehicle. In PA, you are paying premium taxes on an asset that is actively dissolving beneath you.

The Montana Solution: A Loophole for the Smart Buyer

You might be asking, “I live in Pennsylvania. How can I register my car in Montana?”

The answer lies in the Montana LLC.

Montana has no state sales tax on vehicles. Zero. Zilch. To take advantage of this, you do not need to move to Big Sky Country. You simply need to form a Limited Liability Company (LLC) in Montana.

How It Works

- Formation: Zero Tax Tags sets up a legal LLC for you in Montana. This is a legitimate business entity.

- Ownership: You purchase your vehicle (or transfer your current one) in the name of your LLC. Technically, you do not own the car; your Montana company owns the car.

- Registration: Since the vehicle is owned by a Montana resident (your LLC), it is titled and registered in Montana.

- Driving: You, as the owner of the LLC, have the authorization to drive the company vehicle wherever you like—including right at home in Pennsylvania.

This is a well-established legal structure used by luxury car owners, RV full-timers, and smart consumers for decades. It is similar to strategies used by residents in Arizona avoiding VLT and Nevada escaping the 8.25% tax.

The Financial Breakdown: PA vs. Montana

Let us look at the numbers. We will compare the cost of ownership over 5 years for three different vehicle price points.

Scenario A: The Daily Driver ($40,000 Vehicle)

Estimated Savings: Over $2,000

Scenario B: The Heavy Duty Truck ($60,000 Vehicle)

Estimated Savings: Over $3,000

Scenario C: The Luxury Performance Car ($80,000 Vehicle)

Estimated Savings: Over $4,500

Real World Scenarios: Who Benefits Most?

We serve clients from all over the Commonwealth. Here is how the Montana LLC strategy helps different types of Pennsylvanians.

1. The Pittsburgh Truck Owner

Location: Allegheny County

Vehicle: Ford F-250 Super Duty ($75,000)

The Problem: Allegheny County charges a 7% sales tax. That is $5,250 in taxes immediately. Plus, heavy trucks often have higher registration fees in PA based on weight class.

The Solution: By using Zero Tax Tags, this owner saves the full $5,250. Furthermore, Montana registration fees are flat and affordable, unlike PA’s weight-based system which penalizes heavy-duty truck owners.

2. The Philadelphia Luxury Driver

Location: Philadelphia

Vehicle: Porsche 911 ($130,000)

The Problem: Philadelphia’s 8% sales tax is brutal. That is a $10,400 tax bill. Additionally, the potholes in Philly are notorious, and the owner is terrified of failing emissions tests due to aftermarket exhaust modifications.

The Solution: The Montana LLC saves this driver over $10,000 instantly. Because Montana has no emissions testing, the owner can modify the exhaust system for performance without worrying about failing a computer test.

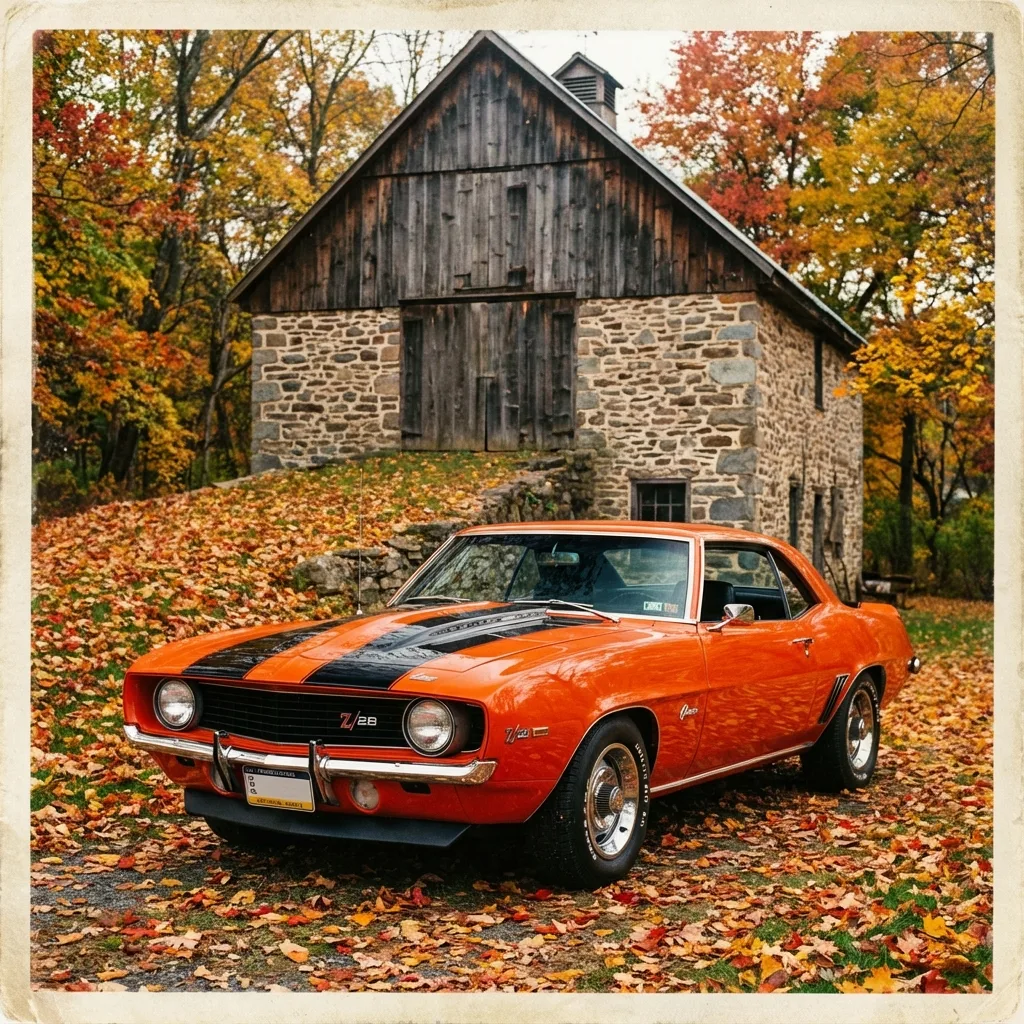

3. The Harrisburg Classic Car Collector

Location: Central PA

Vehicle: 1969 Chevrolet Camaro

The Problem: Pennsylvania has “Antique” plates, but they come with driving restrictions (cannot be a daily driver, limited use). Standard registration requires annual safety inspections, which can be a nightmare for vintage cars with old-school technology.

The Solution: Montana offers Permanent Registration for vehicles 11 years or older. This collector pays the registration fee once, and never has to renew it again. No annual fees. No annual inspections. Just drive.

4. The Erie Multi-Vehicle Family

Location: Erie County

Vehicles: 3 Cars, 1 Motorcycle

The Problem: The annual ritual of taking four different vehicles to the shop for inspections is a massive waste of time. The inspection stickers clutter the windshields, and the salt damage from Lake Erie winters makes passing inspection difficult as vehicles age.

The Solution: By moving the fleet to a Montana LLC, the family eliminates the annual inspection requirement entirely. They maintain their vehicles on their own schedule, not the state’s schedule.

The “Zero Tax Tags” Advantage: Why Choose Us?

There are other services out there, but Zero Tax Tags is the premier choice for Pennsylvania residents. We understand the specific frustrations of PennDOT and have streamlined our process to be as fast and painless as possible.

Speed: 3-5 Day Turnaround

PennDOT can take weeks to mail a title. If you make a mistake on a form, it can take months. At Zero Tax Tags, we operate at the speed of business. We can often have your LLC formed and your registration process moving within 3 to 5 days.

Remote Process: No Travel Required

You do not need to fly to Billings or Helena. You do not need to drive your car across the country. The entire process is handled remotely. You stay in PA, keep your car in PA, and we handle the paperwork in Montana.

Permanent Plates for Older Vehicles

If your car is 11 years old or older, Montana allows for permanent registration. Imagine paying your registration fee one time and never receiving a renewal bill again.

Our Process Timeline

| Day 1: | You order online and submit your documents |

| Day 2: | We form your Montana LLC and obtain your EIN |

| Day 3-4: | We process your vehicle registration with Montana DMV |

| Day 5: | Your plates and registration ship to your Pennsylvania address |

Frequently Asked Questions for PA Residents

Is this legal in Pennsylvania?

Yes, owning a Montana LLC is 100% legal. The LLC is a distinct legal entity that has the right to own property, including vehicles. Because the vehicle is owned by a Montana resident (the LLC), it is properly registered in Montana.

What about insurance?

You can insure a vehicle owned by a Montana LLC. Most major insurance carriers (Progressive, Geico, State Farm, etc.) can write policies for LLC-owned vehicles. You simply list the LLC as the owner and yourself as the primary driver.

Does Montana require a safety inspection?

No. Montana does not require annual safety inspections. You are responsible for keeping your vehicle safe, but you do not need to pay a mechanic annually to prove it.

Does Montana require emissions testing?

No. Montana does not have emissions testing. This is a huge benefit for residents of Philadelphia, Pittsburgh, and the collar counties who are tired of dealing with “Check Engine” lights and failed tests.

Can I do this for a car I already own?

Absolutely. You can transfer a vehicle you currently own into your Montana LLC to take advantage of the permanent registration (if applicable) or to stop paying annual renewal fees and dealing with inspections.

For more details on how this works, check out our guide on Virginia’s personal property tax which explains similar strategies.

Stop Funding the Bureaucracy. Start Saving Today.

Every day you drive a Pennsylvania-registered vehicle, you are participating in a system designed to extract maximum revenue from you through taxes, fees, and mandatory inspections.

The 6% (or 8%) sales tax is money you will never see again. The annual safety inspection is a yearly tax on your time and patience. The PennDOT lines are a punishment you do not deserve.

There is a better way.

Whether you are buying an $80,000 luxury SUV in the Main Line, a heavy-duty work truck in Pittsburgh, or a classic muscle car in Harrisburg, a Montana LLC is the key to unlocking massive savings and freedom from the Pennsylvania vehicle tax burden.

Do not write that check to the Pennsylvania Department of Revenue.

Join the thousands of smart car owners who have switched to Zero Tax Tags.

Ready to Stop Overpaying Pennsylvania Taxes?

Pennsylvania vehicle owners have saved millions with Montana LLC registration. You’re next.