12 min read

On this page

California registration penalties can crush you. You know the feeling. It sits in the pit of your stomach every time you turn the key.

You check your rearview mirror constantly—not for safety, but out of fear. You avoid the freeways. You take the side streets. You park your car in the garage or back into driveways so the license plate isn’t visible to passing patrol cars. You only drive at night if you can help it.

You are driving on expired tags.

If this sounds familiar, you aren’t a criminal. You aren’t irresponsible. You are likely one of the millions of Californians caught in the DMV Penalty Spiral.

Maybe it started small. You missed the renewal deadline by a few weeks because rent was due. Then the first penalty hit. Then the second. Maybe your Check Engine light came on, and you couldn’t pass the smog check required to renew. Suddenly, a $300 registration fee ballooned into $500. Then $800.

Now, a year or two later, you are staring at a bill for $1,500 or more. You can’t afford to pay it, but you can’t afford not to drive. You need your car to get to work to earn the money to pay the fees—but driving the car puts you at risk of losing it entirely. You feel trapped.

At Zero Tax Tags, we want you to know one thing: It is not your fault, and there is a way out.

Registration Penalties: The California DMV Spiral Designed to Fail

The California DMV penalty system is unforgiving. Unlike a credit card bill or a utility payment where you might negotiate a payment plan or ask for a hardship extension, the DMV operates on a rigid, automated system of exponential punishment.

The “Immediate Hit”

In California, there is no grace period. The second your registration expires, you are technically delinquent.

The “VLF” Multiplier

California registration is expensive because of the Vehicle License Fee (VLF), which is essentially a property tax on your car based on its value. When the penalties kick in, they aren’t just flat fees ($30 here, $50 there). They are percentages of that high VLF.

If you drive a newer truck or SUV, your base registration might be $600. Once the late penalties max out, you aren’t just owing $600. You owe the $600 for this year, plus the $600 for last year, plus nearly $1,000 in penalties.

The Smog Check Deadlock

This is the most common trap we see. You go to renew your tags. The DMV says, “Smog Check Required.” Your car fails the smog check because of a catalytic converter issue or a sensor error. The mechanic says it will cost $1,200 to fix the car to pass smog.

You don’t have $1,200. So you can’t renew the registration. Because you can’t renew, the late penalties start accruing. Six months later, you finally save enough to fix the car—but now the DMV bill has doubled because of late fees.

It is a vicious cycle that keeps good people off the road or driving in fear.

The Real Cost of “Waiting It Out”

Many people think, “I’ll just wait until I have the money.” But the California system is aggressive. It doesn’t just wait for you to come to the counter. It comes after you.

1. The Risk of Impound (CVC 22651(o))

This is the nightmare scenario. Under California Vehicle Code 22651(o), if your registration is expired by more than six months, police have the authority to tow and impound your vehicle immediately upon pulling you over.

If this happens, the costs become catastrophic:

- Towing Fee: $250 – $400

- Storage Fee: $80 – $120 per day

- Release Fee: $100+

- Back Registration: You cannot get the car out until you pay every cent owed to the DMV

If you owe $1,500 to the DMV and your car gets towed, you will likely need $2,500+ in cash within 48 hours to get your car back. If you can’t pay, the tow yard keeps your car, sells it at a lien sale, and you are left with no car and a debt that goes to collections.

2. The Franchise Tax Board (FTB)

The DMV doesn’t handle its own collections for long. They hand your debt over to the Franchise Tax Board. The FTB has the power to garnish your wages or seize money directly from your bank account to pay for expired tags.

3. The “Unsellable” Car

You decide to just get rid of the headache. You list the car on Craigslist or Facebook Marketplace. A buyer shows up, looks at the expired tags, and asks, “How much back registration is owed?” When you tell them it’s $1,800 in back fees, they walk away.

In California, the debt follows the car, not the driver. You cannot sell a car with back registration unless the buyer agrees to pay your debt (which they won’t), or you pay it off before the transfer. You are stuck.

Real Stories: You Are Not Alone

We hear stories every day from people drowning in this system. Do any of these sound like you?

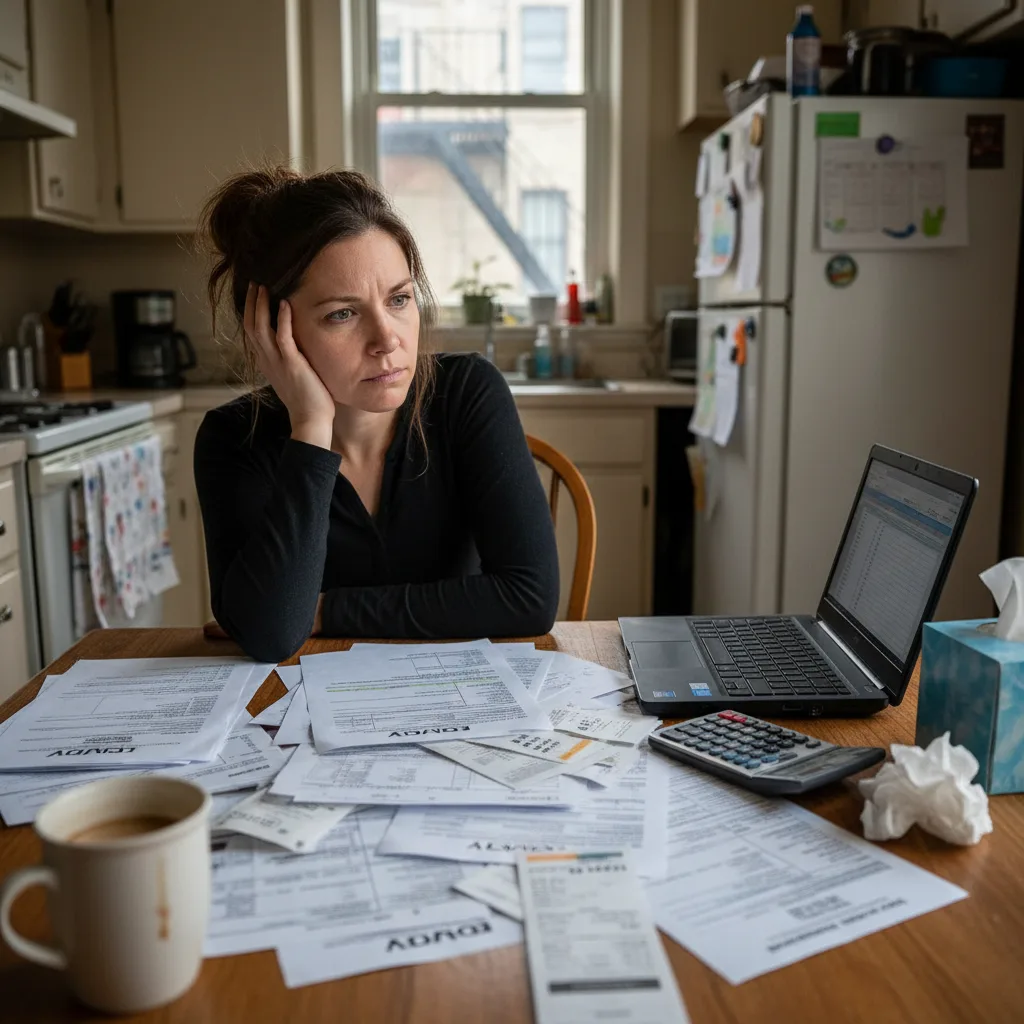

The Single Mom with the 2013 Honda

Sarah’s tags expired in 2022. She had to choose between new tires to get to work safely or paying the DMV. She chose tires. Then, her check engine light came on. She couldn’t pass smog. Now, the DMV says she owes $1,800. The car is only worth $4,000. She drives her kids to school using back roads, terrified of being pulled over.

The Contractor with the Work Truck

Mike has a heavy-duty Ford F-250 for his contracting business. During the COVID slowdowns, work dried up, and he let the registration lapse on his truck. Because it’s a commercial vehicle, the weight fees are massive. He now owes $2,400 in back fees and penalties. The truck has been sitting in his driveway for a year.

The College Student

Jason bought a used car from a “friend of a friend.” He didn’t realize the tags were two years expired when he bought it. When he went to the DMV to transfer the title, they handed him a bill for $1,200—more than he paid for the car.

The Solution: A Fresh Start in Montana

If you are reading this and feeling your heart rate spike, take a deep breath. There is a legal, effective solution that stops the bleeding instantly.

You do not have to pay the California penalties. You do not have to pass a California smog check. You do not have to hide your car anymore.

The solution is registering your vehicle in Montana with a Limited Liability Company (LLC) through Zero Tax Tags.

How It Works: The “Bankruptcy” for Your Car Tags

Think of this process like declaring bankruptcy on your vehicle’s registration debt. When you file for bankruptcy, you wipe the slate clean to get a fresh start. Registering in Montana does the same thing for your car.

- We Form a Montana LLC for You: You don’t have to live in Montana. We create a legal entity that you own 100%.

- The LLC Buys Your Car: On paper, you transfer the ownership of your vehicle to your new Montana LLC.

- Fresh Registration: Since the LLC is a Montana resident, the vehicle is registered in Montana.

- No Debt Transfer: Montana does not care about your California debt. You are starting over from $0.

Why This Saves You

1. Escape the Penalty Spiral

The moment your car is registered in Montana, you are done with the California DMV for that vehicle. That $2,000 bill? You don’t pay it to register in Montana. You get a clean slate.

2. No Smog Checks—Ever

Montana does not require emissions testing. If your car has a pesky “Check Engine” light that prevents renewal in California, it doesn’t matter in Montana.

3. Permanent Plates (The Golden Ticket)

If your vehicle is 11 years or older, Montana offers Permanent Registration. You pay the registration fee once. You get a license plate sticker that says “PERM.” You never have to renew again.

4. Significantly Lower Costs

Even for newer cars, Montana registration fees are generally lower than California’s. Plus, Montana has 0% sales tax on vehicles.

Let’s Do The Math: California vs. Montana

Scenario: You own a 2012 Chevy Tahoe. Your tags have been expired for 18 months. You also need a smog check, but the sensor is broken ($400 repair).

With the Montana route, you aren’t just saving money today; you are saving money forever. You are breaking the cycle of annual payments that keep you broke.

Is This Legal? (Addressing the Elephant in the Room)

This is the most common question we get. “Is this a scam?” “Is this legal?”

It is 100% legal to form an LLC in Montana. It is 100% legal for a Montana LLC to own a vehicle. It is 100% legal for that vehicle to be registered in Montana.

Thousands of Americans—from RV owners to classic car collectors to everyday drivers—use Montana LLCs to manage their assets. It is a recognized legal structure.

The “California Resident” Nuance: California has strict laws (CVC 4000.4) stating that if you are a resident, vehicles you own should be registered there. However, the LLC owns the vehicle, and the LLC is a resident of Montana. For many people, this is a matter of survival—the choice isn’t between “California Plates vs. Montana Plates.” The choice is between “Driving a car with Montana plates vs. Having no car at all because it was impounded.”

How to Get Started (It’s Easier Than You Think)

You might be thinking, “I don’t know how to start a company. That sounds complicated.” That is why Zero Tax Tags exists. We handle the paperwork. We deal with the Montana DMV. You just provide the information.

| Step 1: | Place Your Order – Visit our website. Choose the package that fits your needs. |

| Step 2: | Send Us Your Title – We need the title to transfer ownership to your new LLC. |

| Step 3: | We Do The Heavy Lifting – We file the LLC, obtain the Tax ID (EIN), and handle the Montana DMV. |

| Step 4: | Receive Your Plates – Montana license plates and registration arrive in your mailbox. |

| Step 5: | Drive with Confidence – Screw on the new plates. Drive past a police officer. You are legal. |

Frequently Asked Questions

Q: Can I get insurance with Montana plates?

A: Yes. Most major insurance carriers will insure a vehicle registered to a Montana LLC. You simply list the LLC as the owner and yourself as the primary driver.

Q: Does this clear my debt with California?

A: Registering in Montana stops the debt from growing and allows you to drive legally. The old debt with California is technically still associated with your file, but California cannot impound a car with valid Montana registration for California back taxes. You have separated the debt from your ability to drive.

Q: My car is a 2005. Can I really get Permanent Plates?

A: Yes! Any vehicle 11 years or older qualifies. You will pay for registration one time with us, and never pay a renewal fee again as long as the LLC owns the car.

Q: Can I do this if I have a lien/loan on my car?

A: It is more difficult if you have a loan because the bank holds the title. This service works best for vehicles that are paid off. If you have a loan, contact us to discuss your specific situation.

Conclusion: Escape Registration Penalties – Take Your Freedom Back

Registration penalties from the California DMV feel like a shakedown. The system punishes those who are struggling the most. It turns a temporary financial hardship into a permanent roadblock.

But you do not have to accept that reality. You do not have to park your car around the corner. You do not have to sweat every time you see flashing lights.

By forming a Montana LLC with Zero Tax Tags, you are taking control of your situation. You are choosing a legal, affordable path to get back on the road.

Imagine checking your mailbox and finding a set of shiny, valid license plates. Imagine the relief of knowing you won’t be towed. Imagine keeping that $2,000 in penalties in your own pocket for groceries, rent, or your family.

Don’t let the DMV crush you. Break the spiral.

Visit ZeroTaxTags.com today and start your fresh registration.

Disclaimer: Zero Tax Tags provides Montana LLC formation and vehicle registration services. We are not tax attorneys or legal advisors. We recommend consulting with a legal professional to ensure this strategy aligns with your specific situation and complies with all applicable laws.